Mr. Member,

All the municipalities of the province are in the throes of increasing financial difficulties. Nobody will deny it. The Hon. Antoine Rivard, a Quebec minister, representing the Premier of his Province at the Congress of the Union of Municipalities at Pointe-au-Pic, on the 2nd of last July, stated that the situation was grave and troublesome:

The cities and municipalities of the province are facing a serious and troublesome problem which, at times, is paralysing.

It is an undeniable fact in every Province. Every time that a municipality is paralyzed when faced with an urgent public project, it is always a question of being unable to pay, never of not being able to carry out the work.

Municipal councils see only two issues: taxing or borrowing. Increasing taxes on real estate by raising the assessment or by increasing the rate. Or borrowing, which adds to the indebtedness of the people and which necessarily brings about increased taxes to reimburse the loan as well as the interest that it bears.

Property owners object, and with good reason, because they do not wish to lose their property nor see their assets changed to liabilities. The same minister, the Hon. Rivard, admitted the reasonableness of this resistance when he added:

Real estate give you no more revenue that it actually is supplying. To force it to give more would mean endangering the status of small properties, even endangering the existence of these properties which are the basis of stability and security. There must be some other way. The core of the problem must be attacked.

This is why, Mr. Member, an increasing number of citizens, of an increasing number of cities and municipalities want to see the government attack the core of the problem effectively and efficaciously, and devise a way to remove definitely the mere financial obstacle in the development of municipalities.

For this reason, Mr. Member, they want you to present (or if it has already been presented to support), at this 1956 session of Parliament, a motion, proposing:

That, in the opinion of this house, the Government should consider the appropriateness of establishing without delay a provincial credit organization, which would make financially possible, in the Province, all that which, in the Province, is possible and that concerns the needs of the population.

We cannot say that the financial system — of human and not of divine origin — was instituted to prevent those living in society from utilizing the possibilities of production that are within their reach, for the satisfaction of the legitimate needs of the public as well as of the private order. There is undoubtedly, here, a perversion of an institution originally designed to serve. In our modern world, where the use of cheques is widespread, and where a great many payments are made by simple transfers of credit, it is not impossible, for a provincial organization established for this purpose, to design and achieve an accounting system which would reflect productive capacity and permit of its utilization in serving the needs of the people of the Province.

The above motion does not enter into the domain of techniques. It remains the expression of a policy, of a line of action, of an end to be pursued and realized. Once the objective is accepted, the technique is referred to experts — in this case, accountants.

A current objection raised to excuse the refusal to do something in this direction, is that everything concerning credit is a Federal matter. This must be challenged.

It could not have been the intention of the Fathers of Confederation to prevent the provinces from utilizing their natural resources and their productive capacities for the satisfaction of the needs of their people.

Neither has the credit of the provinces been alienated by the constitution. Provinces frequently borrow on their own credit, without asking anyone or rendering account to anyone except to the provincial parliament, reprensenting the people. Provinces, then, have credit.

If I can get a loan on my farm or my industry, it is because my farm or industry is mine; and instead of borrowing on what I own I can certainly dispose of it otherwise, I can utilize it for myself and mine.

Similarly, if the Province borrows on its credit it is because it owns this credit. The Province can certainly utilize what belongs to it, its credit, without changing it into a liability; into a debt toward private institutions.

An autonomous government should not allow itself to be interfered with in the pursuit of the common good of its people, as long as its actions do not interfere with other governments. It is here a matter of utilizing the physical possibilities, the materials and man-power available in the province. This wouldn't take anything away from other provinces. And who could complain of the utilization of productive resources which are not actually utilized?

The Institute of Political Action

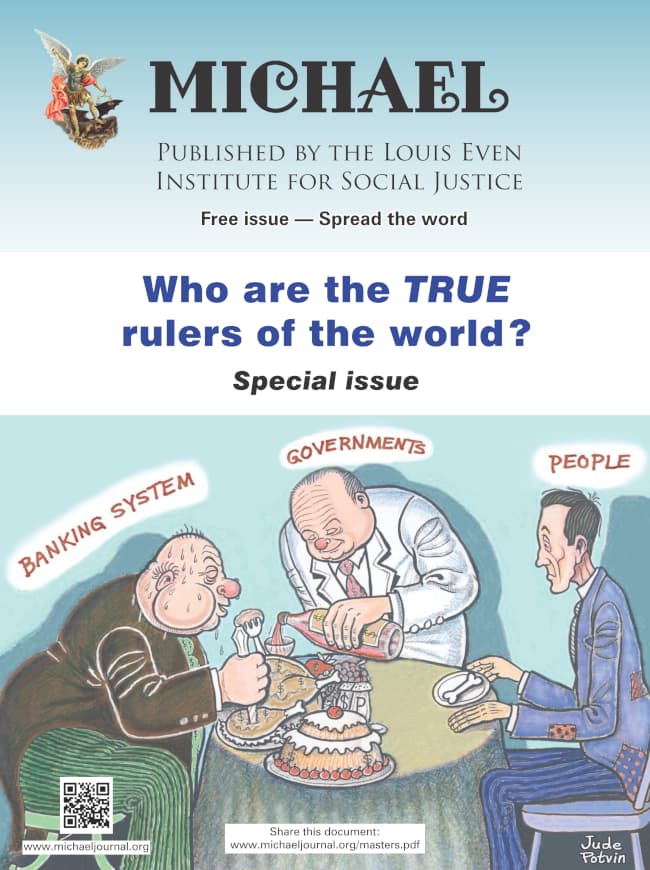

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

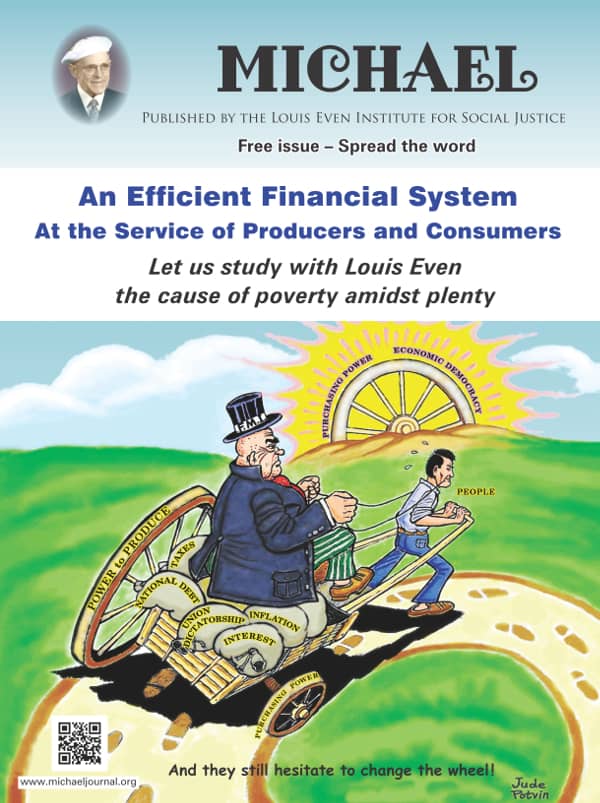

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

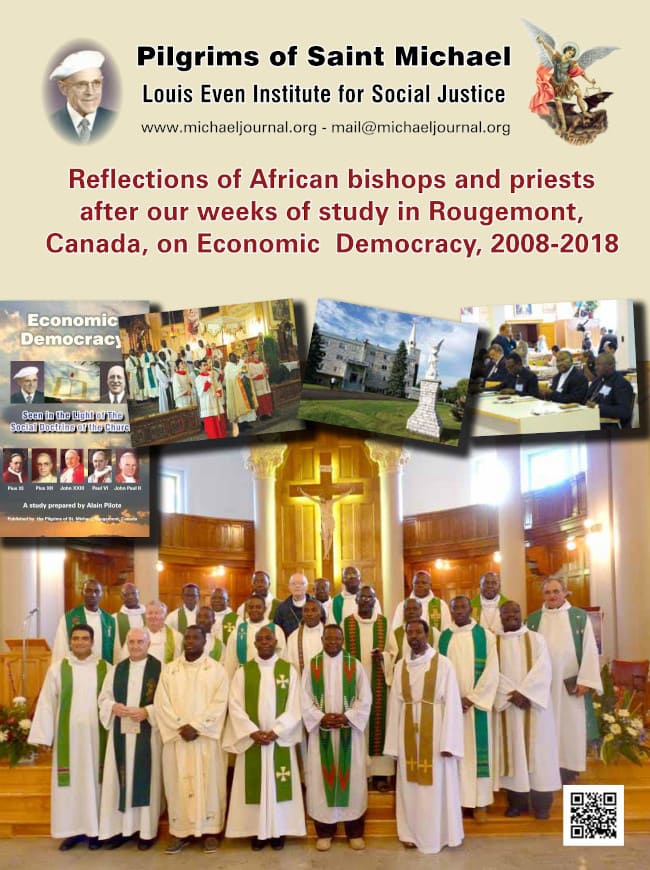

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

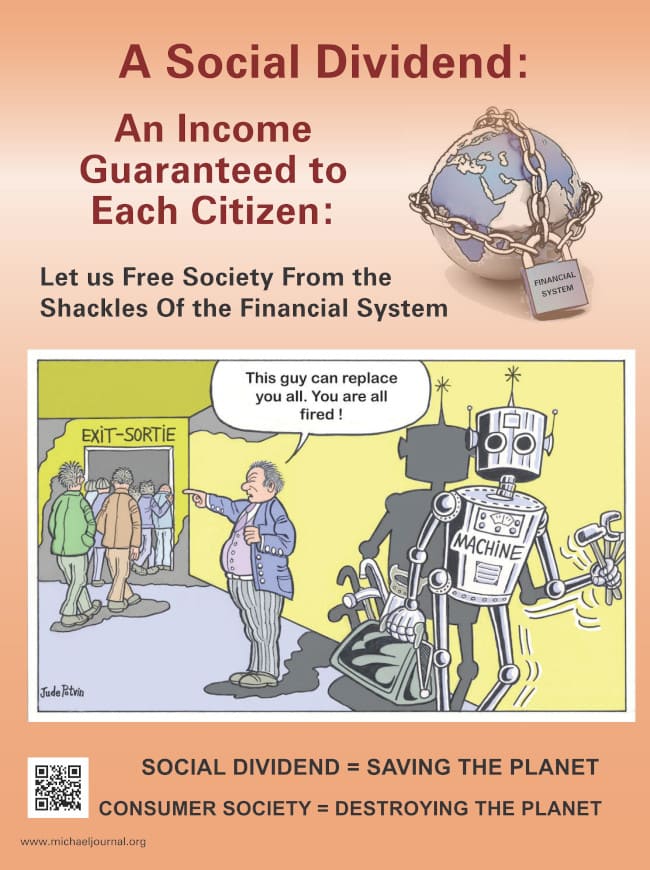

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.