We note that Federal Minister of Finance, the Hon. Walter Harris, estimated the gross national product of Canada for 1955 at more than $26 billion. There being some 15 million people in Canada, this works out at between 1700 and 1800 dollars, worth of goods and services for every mạn, woman and child in Canada.

An "average" family of five might therefore expect an income or purchasing power of nearly $9,000 last year. How many "average" families got it? And that is precisely why unsaleable surpluses glut the market in everything from wheat to TV sets — there is a vast gap between total prices and effective demand or purchasing power.

The orthodox approach to this problem is to just do nothing. After all, eventually programs of restricted production or destruction, or war, look after the surpluses!

The socialist approach is to nationalize (confiscate) the productive machine which created the surplus, and impose an economy based on governmental controls, regulations and restrictions. This, in practice, weakens initiative and enterprise, and kills the goose that laid the golden egg, as it were. More controls, and less production, in other words.

The Social Credit approach is to welcome abundance, and, instead of restricting or destroying, balancing purchasing power with production so that the Consumer may be in a position to claim and enjoy all desired goods and services capable of being produced. And private, competitive enterprise seems best equipped to produce abundance. By guaranteeing full consumption, not only the consumer, but also the producer and business man, will benefit.

∗ ∗ ∗

"Concerning these little things we dignify with the name of pound notes, dollar bills, marks, francs, and so forth, we hypnotise ourselves into believing they are something marvellous and have a great many mystical properties, and that they are the medium of exchange and the storehouse of value and all sorts of wonderful things, in books on money and economics.

"They are none of these things at all. They are little bits of paper printed with ink. When you go into a railway station and you exchange a thin, and, if it is clean, a crackly bit of paper, for a thicker and not so neatly printed bit of paper; you call it buying a railway ticket with money. You are exchanging a bank ticket for a railway ticket, that is all.

"It is in that power to issue bank tickets, those crackly little things which we have all become hypnotised about and which we regard as being so wonderful, that we accept as a reasonable statement when we see thousands out of work and hundreds of machines idle and bad roads and many things of that kind, when we say: 'Oh yes, it is a pity, but we cannot do it because there is no money.' In other words, there are not any bits of paper with ink on them."

C. H. Douglas.

∗ ∗ ∗

Western Business and Industry, in its July '55 issue, carries a lengthy article on "Social Credit." Included under the heading "What A Real Social Credit Government Would Do" are these items:

"In short," concludes the article, "true Social Credit philosophy requires a completely controlled economy."

So now we know what "Social Credit" would do! We pity those who are so unfamiliar with the subject that they might have taken these pronouncements of the author, Mr. L. J. Thompson, seriously. Those acquainted with Social Credit policy will recognize this article as not only inaccurate in many respects, but saturated with absurd falsehoods. For instance:

We should not even comment on this absurd article carried by Western Business and Industry, were it not that this publication carries weight in business circles. We feel it our duty at least to keep the record straight.

∗ ∗ ∗

This continent enjoys unprecedented 'prosperity'. Now, if we cannot pay our way during the most prosperous time, what about the others!

U. S. News & World Report (Jan. 13) gives these revealing figures on U.S. debt:

During 1955 alone installment Credit (Debt) rose 5 BILLION dollars in the US. In the last ten years this type of debt has risen from less than 3 billion to 27 billions.

During 1955 mortgage debt rose 10 BILLION dollars in a ten-month period.

In the first 10 months of 1955 the public borrowed 15 billion dollars to buy cars — 45 per cent more than in the same period of 1954.

Average debt on a new car is now $2,200

In short, during a year of unprecedented 'prosperity' Americans are unable, financially to make ends meet. As a matter of fact, this period of unprecedented 'prosperity' is a period of unprecedented debt-contracting. The more they produce, the more they go into debt. The greater the production, the larger the gap between purchasing-power and prices.

Rather powerful confirmation of the Social Credit contention, isn't it!

Well, Americans are now 27 billion in debt on installment buying alone (buying this year production with next year's income). That comes to about $170 for every man, woman and child in the US — or nearly $680 a family of four. And while they try to pay it off next year, with compound interest, next year's production piles up and further complicates matters.

US News reports: "As Government moved to check the credit boom, auto sales are slowing." In other words, under the present financial system which bases everything on debt, any restriction placed upon 'deficit financing' or debt-contracting would immediately result in aggravating the shortage of purchasing power and slowing demand and consumption — which in turn would mean lay-offs, and further reduced purchasing power. Ultimately, this chain reaction leads to depression.

So, the only other course under the present system is to go further into debt. All of which means more interest charges and trouble in the future.

In our July, 1955, issue we gave the corresponding figures for Canada, which showed the average Canadian to be in about the same squeeze as his U. S. counterpart.

This present system of finance is based upon debt. And debt today means interest and taxation tomorrow — and more trouble the day after. The physical facts of this country, the statistics and financial statements, all attest to the ugly truth that our present system of debt finance does not distribute adequately the full product of this power age.

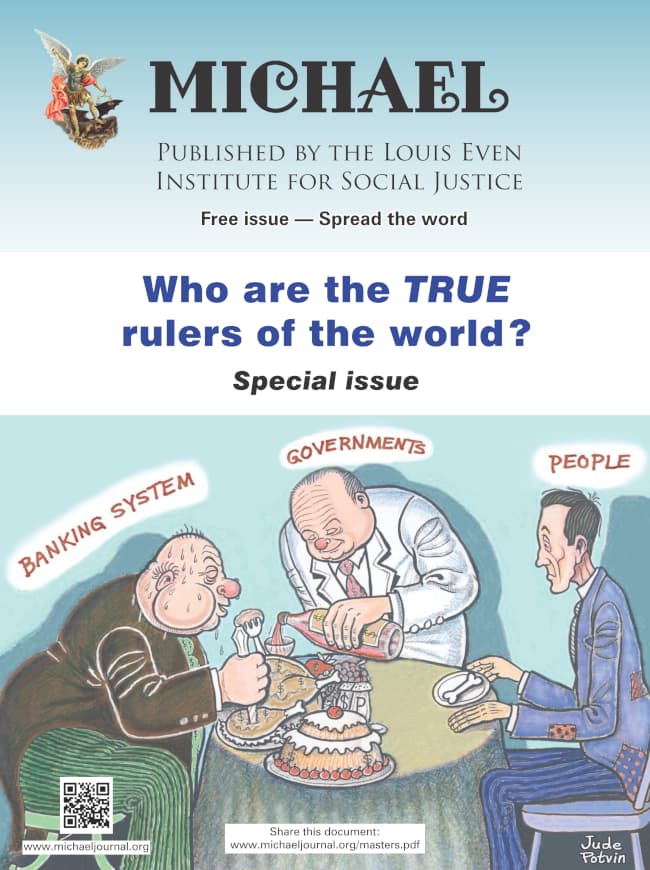

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

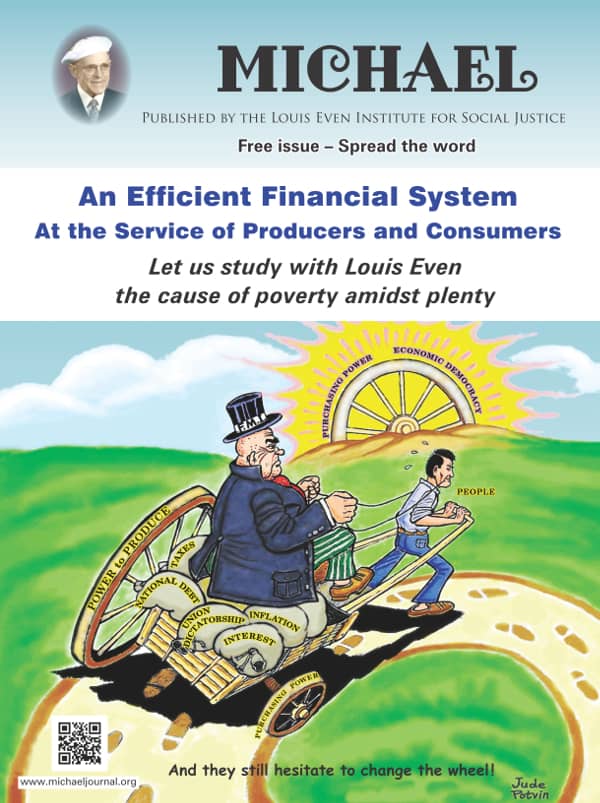

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

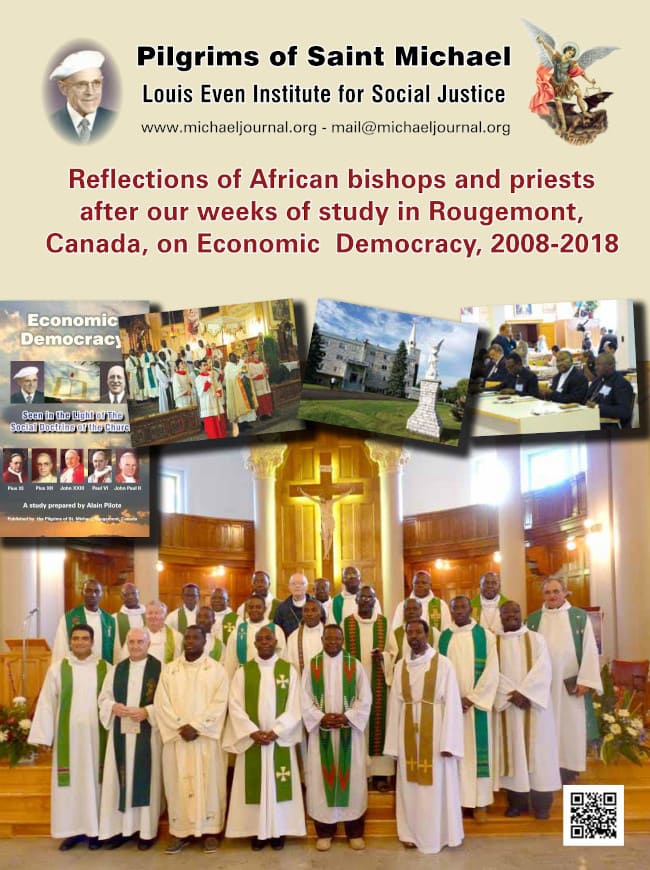

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

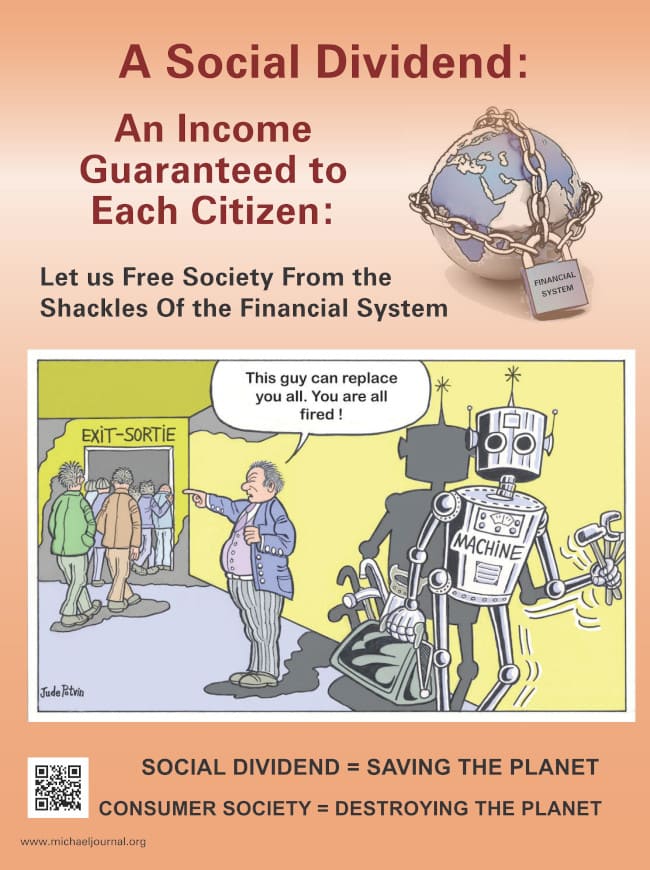

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.