At the root of Social Credit was a man of genius, a Scot, Clifford Hugh Douglas. Born in 1879, he was the son of Hugh Douglas and Louisa Hordern. He graduated from Cambridge University with an honours degree in mathematics.

Douglas had a fruitful career in engineering. He worked on projects in India, South America, and England. As an expert in cost-price accounting, in 1916 the British Government asked him to go to Farnborough to sort out “a certain amount of muddle” in the Royal Aircraft Establishments’ accounts. It was not long before he identified that, each week, the cost-prices of the goods produced were greater than the incomes distributed to workers in the forms of wages and salaries. He concluded that prices were not in accordance with purchasing power.

His attention was captured. A study of the ledgers of many companies showed him that it was so in every case. Given this, how could money distributed to consumers ever be sufficient to buy the goods produced? Douglas also noted that when World War I started, there was no longer the dilemma of a lack of purchasing power. Clearly, there was nothing sacred about money. If money could appear all of a sudden, as was the case during the war, then all that was physically possible could be made financially possible.

Douglas went from these initial observations to identify and enumerate the various defects of the financial system. He then sought to discover the solution, formulating the principles that would make the financial system conform to reality. Douglas’ ideas have been called ‘Social Credit’ since then.

Douglas was not an economist, and it is likely he would have thought it an insult to make any such claim, given the monumental errors made by the profession. University classes in economics were certainly based on false understandings. We can, however, consider Douglas to be greatest economist of all times because of his diagnosis of the major flaws in today’s economic system and the proposals he formulated to solve them..

Douglas first published his conclusions in an article in the English Review in December of 1918 in an article titled, The Delusion of Super-Production, and then in a series of articles in A. R. Orage’s weekly review, The New Age. Those articles were reprinted in his first book, published in 1920, Economic Democracy. The same year, Credit–Power and Democracy was also published, and in 1923 he wrote the book, Social Credit. Two more titles were published in 1931: Control and Distribution of Production, and The Monopoly of Credit. Two final books were published in 1937: Warning Democracy and The Alberta Experiment.

Apart from writing, Douglas delivered lectures on Social Credit in Canada, Australia, New Zealand, Japan, and Norway. In 1923, he gave evidence before the Canadian Select Standing Committee on Banking, and in 1930 before the MacMillan Committee on Finance and Industry, in England.

Douglas died at his home in Fearnan, Scotland on September 29, 1952, on the Feast day of Saint Michael the Archangel, at the age of 73.

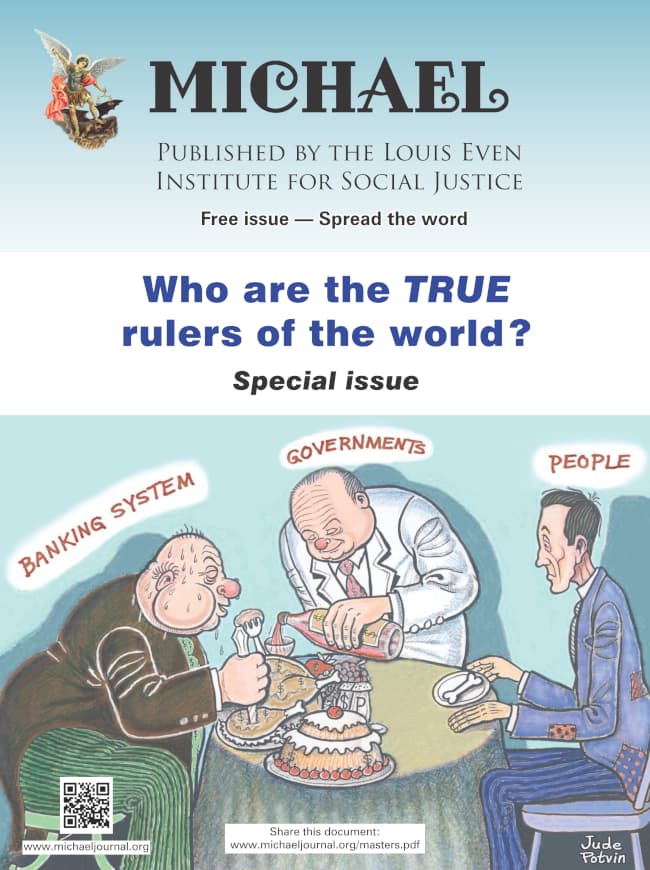

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

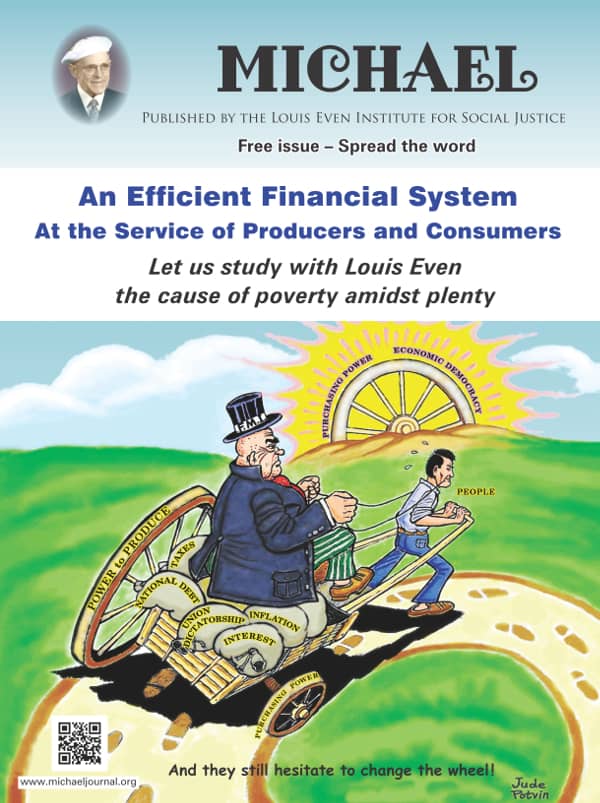

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

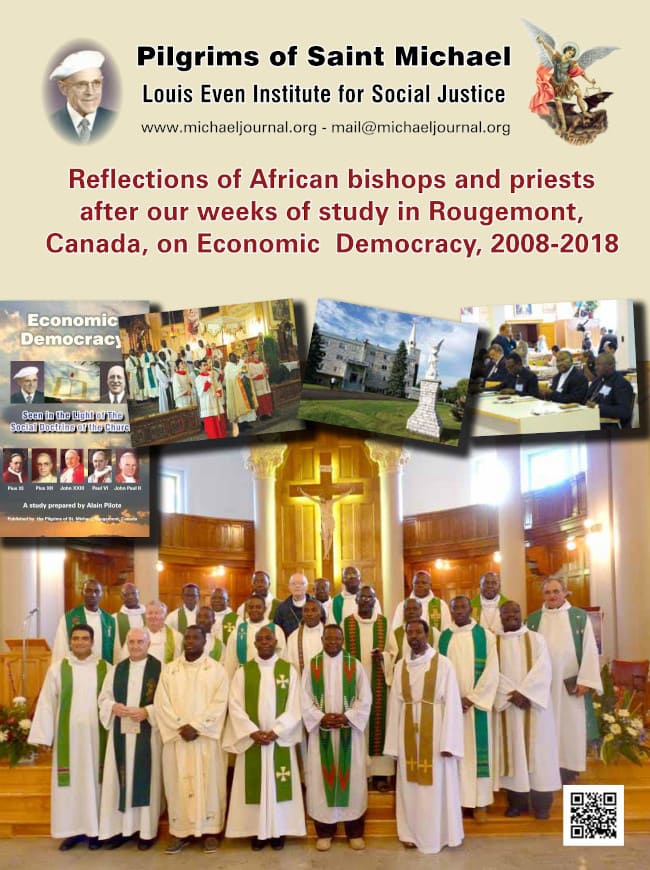

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

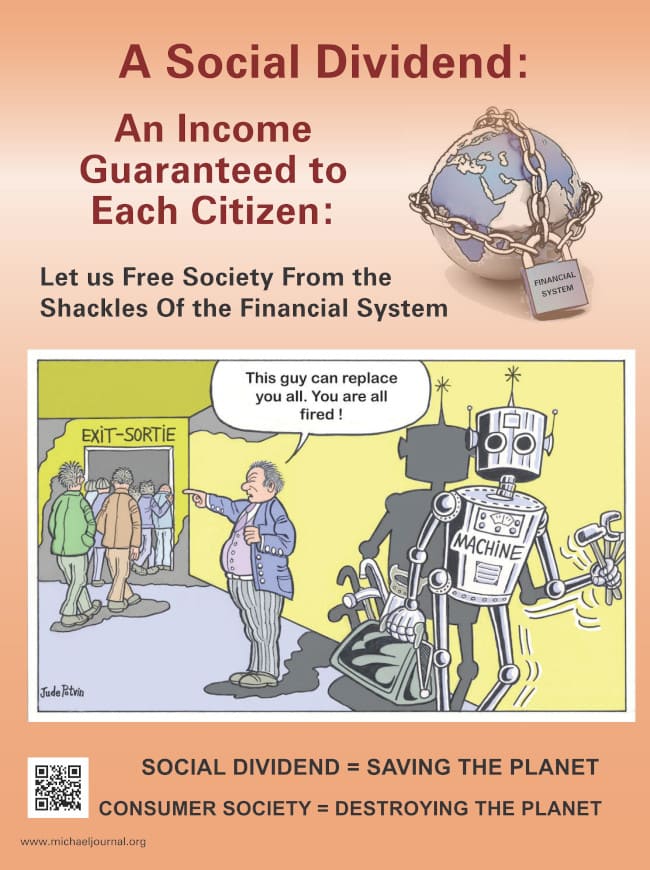

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.