by Yves Jacques

December 23rd, 2013 marks the 100th Anniversary of the Federal Reserve Act; the forming of the greatest financial power and control authority ever in the hands of an oligarchy of a few international banking families. The deception is that most people believe that the Federal Reserve is part of the government and that it has reserves somewhere. The truth is that the United States Federal Reserve is not federal and it has no reserves.

Though the American people like to believe that we are a democratic nation, the Federal Reserve System itself is far from being democratic. The Federal Reserve Board is unelected and is not accountable to anyone. It controls and claims ownership of, what should be, the nation's money supply, at the service of the people for the common good. Instead, there are private owners of the central bank (the Federal Reserve), managing the economy of the nation and running the financial system to their benefit.

According to Article 1 of the Constitution, adopted in 1787, our Founding Fathers stated: "Congress shall have the Power To Coin Money and Regulate the Value Thereof."

It was the intent of the Founding Fathers that the power to create and control the money be in the hands of the Federal Congress, not in the hands of private bankers, who could charge enormous amounts of interest, and then actually control the country by controlling its currency. It was the European banker, Mayer Anselm Rothschild (1744 -1812), who once said: "Permit me to issue and control the money of a nation, and I care not who makes its laws..." Our founding fathers understood the tricks of the bankers. It was their belief that the national government must be the only creator of money for the good of the public.

We should also clarify the term "create". When we use this term, we refer to the process used when bringing money into existence. Money is nothing but numbers, be it numbers in a ledger book, on checks, or dollar bills. Using this process most banks are legally allowed to lend out up to 50 times what they have on deposit, creating the money out of nothing and then charging interest on it. Banks create the principal but do not create the interest to service these loans. The bankers create money out of nothing by simply writing numbers in their ledger books and then giving this money to the American people in the form of loans.

This allows us to write checks based on the numbers written in our accounts, but then requires payment with interest. The result of this is a shortage of money in circulation, leading to a continuous need for borrowing more money and causing the continual increase in the National Debt.

The United States has plunged itself terribly into debt since the Federal Reserve Act was passed in 1913. Before this, the federal debt was $1 billion, or $12.40 per citizen. State and local debts were practically non-existent.

The people of America have become tenants and debt slaves to the bankers and their agents. Our children and the future generations will be paying this debt forever. We are now coming to the point where, eventually, the Government will own nothing. The people will own nothing. But the bankers will own everything.

President Woodrow Wilson had this to say about the Federal Reserve: "A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated Governments in the world – no longer a Government of free opinion, no longer a Government by conviction and vote of the majority, but a Government by the opinion and duress of small groups of dominant men."

Just before he died, Wilson is reported to have stated to friends that he had been "deceived" and that "I have betrayed my country." He was referring to the Federal Reserve Act passed during his Presidency.

The financial institutions of the nation are enslaving us. No one dares to say anything. Economic professors in universities, politicians, the mainstream media… all seem to avoid the topic of money creation, treating it as "taboo". During the October 2013 dept ceiling debate, very little was mentioned in congress about the problem of debt money creation, by either of the political parties.

The truth is, that the Federal Reserve has deceived us with their moneymaking schemes, veiling them in secrecy. Bankers pull numbers from their computers, like a magician pulling a rabbit from his hat, creating money out of nothing and claiming it as their own. They then lend this money as credit to the nation and to individuals, and then charge interest. And it is this interest (money) that has never actually been created, thus, making it impossible to ever pay it back.

As it is explained in Lesson 3 of the book Social Credit Explained in 10 Lessons: "The public debt is made up of money that does not exist, that has never been created, but that governments nevertheless have committed themselves to paying back. An impossible contract, represented by the bankers as a'sacrosanct contract', to be abided by, even though human beings die because of it."

In the Church's Catholic Social Teaching Pope Pius XI in 1931 wrote in his Encyclical letter Quadragesimo Anno, "This power becomes particularly irresistible when exercised by those who, because they hold and control money, are able also to govern credit and determine its allotment, for that reason supplying, so to speak, the lifeblood to the entire economic body, and grasping, as it were, in their hands the very soul of production, so that no one dare breathe against their will."

Pope Francis wrote, in his new Apostolic Exhortation Evangelii Gaudium (The Joy of the Gospel) signed on November 24, 2013, for the conclusion of the Year of Faith: "We have created new idols. The worship of the ancient golden calf (cf. Ex 32:1-35) has returned in a new and ruthless guise in the idolatry of money and the dictatorship of an impersonal economy lacking a truly human purpose. The worldwide crisis affecting finance and the economy lays bare their imbalances and, above all, their lack of real concern for human beings; man is reduced to one of his needs alone: consumption."

And Pope Francis continues: "A new tyranny is thus born, invisible and often virtual, which unilaterally and relentlessly imposes its own laws and rules. Debt and the accumulation of interest also make it difficult for countries to realize the potential of their own economies and keep citizens from enjoying their real purchasing power." (n. 56)...

"Behind this attitude lurks a rejection of ethics and a rejection of God. Ethics has come to be viewed with a certain scornful derision. It is seen as counterproductive, too human, because it makes money and power relative. It is felt to be a threat, since it condemns the manipulation and debasement of the person. In effect, ethics leads to a God who calls for a committed response which is outside the categories of the marketplace. When these latter are absolutized, God can only be seen as uncontrollable, unmanageable, even dangerous, since he calls human beings to their full realization and to freedom from all forms of enslavement." (n. 57.)

For these bankers, money is their god; it is the "golden calf" that they worship. They are like agents of the, "…thief (who) comes only to steal and kill and destroy;"(John 10:10) But Jesus adds, "I came that they may have life, and have it abundantly." (John 10:10) "No one can serve two masters; for either he will hate the one and love the other, or he will be devoted to one and despise the other. You cannot serve God and mammon (money)". (Matthew 6:24)

So who owns the Federal Reserve Central Banks? Eight big banking dynasties, most of them from Europe:

Rothschild Bank of London

Warburg Bank of Hamburg

Rothschild Bank of Berlin

Kuhn Loeb Bank of New York

Israel Moses Self Banks of Italy

Goldman, Sachs of New York

Warburg Bank of Amsterdam

Chase Manhattan Bank of New York

Lazard Brothers Bank of Paris

Our intention of revealing these names is solely for the purpose of praying for their conversion. "…in the sight of God our Savior, who desires all men to be saved and to come to the knowledge of the truth." (Timothy 2:3,4)

According to an official government report, the Federal Reserve made 16.1 trillion dollars in secret loans to the big banks during the last financial crisis. The following is a list of loan recipients that was taken directly from page 131 of the report:

Citigroup - $2.513 trillion

Morgan Stanley - $2.041 trillion

Merrill Lynch - $1.949 trillion

Bank of America - $1.344 trillion

Barclays PLC - $868 billion

Bear Sterns - $853 billion

Goldman Sachs - $814 billion

Royal Bank of Scotland - $541 billion

JP Morgan Chase - $391 billion

Deutsche Bank - $354 billion

UBS - $287 billion

Credit Suisse - $262 billion

Lehman Brothers - $183 billion

Bank of Scotland - $181 billion

BNP Paribas - $175 billion

Wells Fargo - $159 billion

Dexia - $159 billion

Wachovia - $142 billion

Dresdner Bank - $135 billion

Societe Generale - $124 billion

"All Other Borrowers" - $2.639 trillion

Source: http://theeconomiccollapseblog.com/archives/25-fast-facts-about-the-federal-reserve-please-share-with-everyone-you-know

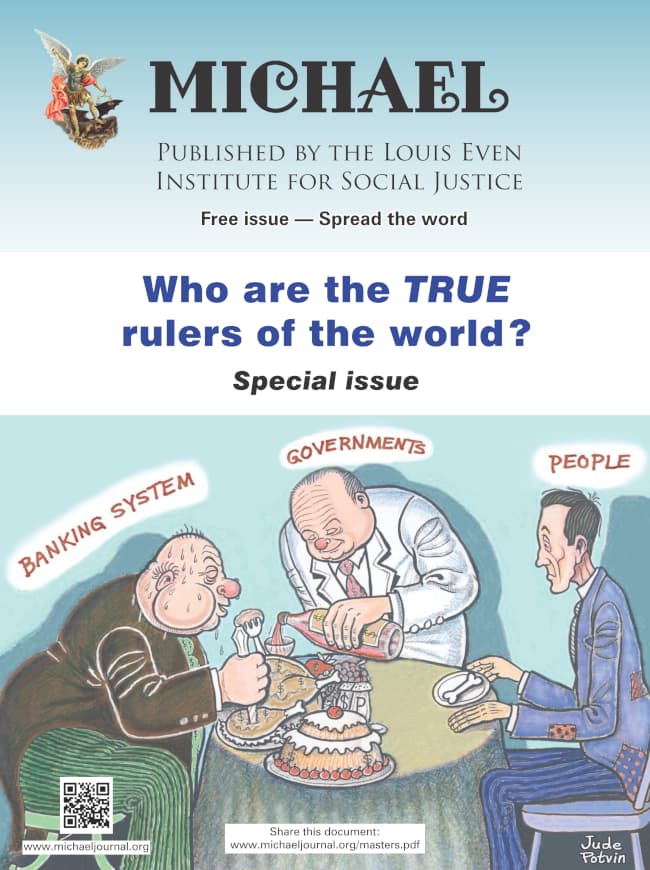

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

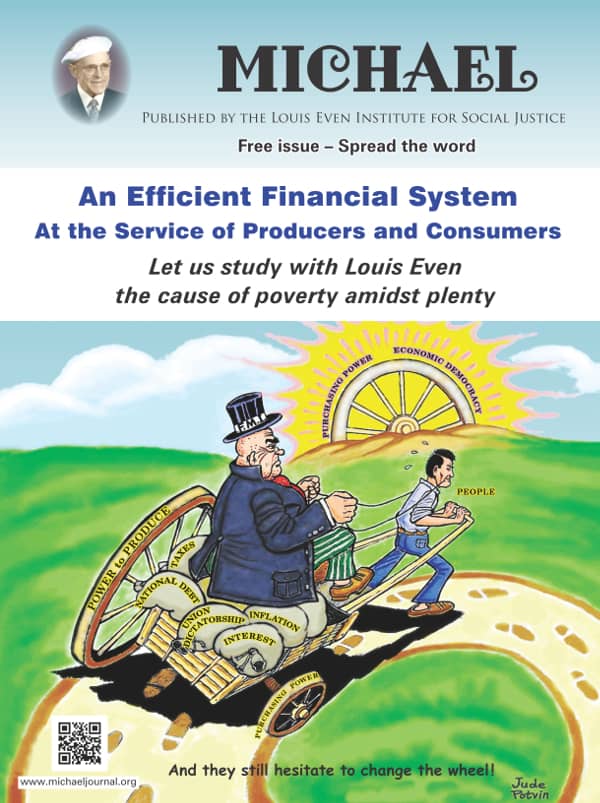

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

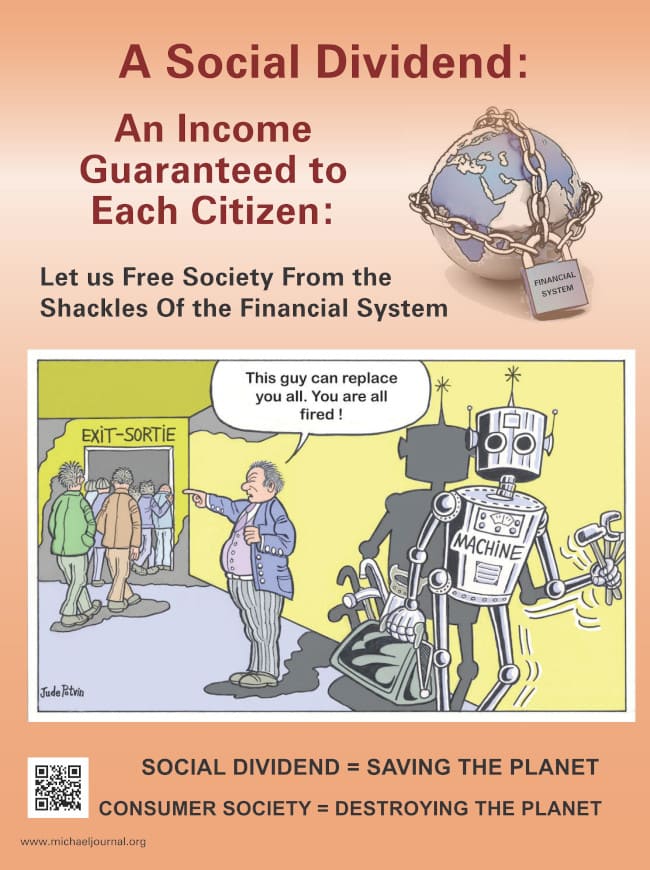

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.