This question is asked within the context of the present financial system. To answer this question, we must think in terms of Social Credit. Social Credit requires us to reason in terms of reality rather than in terms of money. Once the answer reflects reality, then finance can be adapted to it. This is true of every aspect of the Social Credit economy.

This question is asked within the context of the present financial system. To answer this question, we must think in terms of Social Credit. Social Credit requires us to reason in terms of reality rather than in terms of money. Once the answer reflects reality, then finance can be adapted to it. This is true of every aspect of the Social Credit economy.

The present taxation method is corrupt, as is the present financial system. It contradicts economic reality. It steals from the people and is a tool of centralization by both the financial empire and the state. Speaking on this topic, Douglas said in a lecture at Westminster in February, 1926:

“Modern taxation is legalized robbery, and it is none the less robbery because it is effected through the medium of a political democracy which is made an accessory by giving it an insignificant share in the loot. But I do not think robbery is its primary object. I think policy is, much more than mere gain, its objective. I think it is most significant that every effort is made by economists of the type turned out by the London School of Economics to instill into the Labour Party that it is possible to obtain some sort of a millennium by accelerating the process of stealing.” (“Warning Democracy”, 1934 page 61)

Douglas later wrote:

“Present-day finance and taxation is merely an ingenious system for concentrating financial power.” (“Social Credit”, 1937 page 105)

Again in the same book:

“The main tendency of the process [of taxation] is to concentrate the control of credit in a potential form in great organizations, and notably in the hands of the great banks and insurance companies.”

Douglas strongly condemns the present tax system. He states:

“It is well understood that taxation in its present form is an unnecessary, inefficient and vexatious method of attaining the ends for which it is ostensibly designed. But while this is so, there is, of course, a sense in which, while private enterprise and public services exist side by side, taxation is inevitable. Public services require a provision both of goods and human service, and the mechanism by which these are transferred from private enterprise to the public service must in its essence be a form of taxation.” (“Warning Democracy”).

Not at all. Douglas is speaking in terms of reality regarding finance. If one considers his arguments, what Douglas describes as “legalized robbery” is the present taxation system, which takes money from individuals to satisfy the demands and aims of the financial system. Whereas, the form of taxation which Douglas considers under Social Credit, does not take money from individuals, but rather transfers from the private sector to the public sector the necessary supplies and labour to satisfy community needs.

When the government builds a road does this decrease to any extent the production of milk, butter, vegetables, clothing, shoes or other consumer goods? On the contrary won’t workers have more money to spend on consumer goods?

But in today’s system, the government requires the taxpayer to pay workers’ salaries. It takes money away from the purchase of consumer goods to pay for the building of a road.

This system does not reflect reality. If the country is capable of producing both private and public goods, then the financial system must supply the money to pay for both.

Under a Social Credit system money would be issued automatically to finance all production that is physically possible and required by the population, whether it be private or public production. This was explained previously with the building of the bridge.

Only madness could excuse such theft. Following is an excerpt taken from the Michael Journal published in 1964: “When the country’s population is capable of supplying both private and public goods simultaneously, one would have to be an idiot or a thief to take away from individuals their claims upon private production under the pretext of allowing public production to be made.”

There are other situations where taxation represents an unjustifiable but legal plundering, such as when all the purchasing power is taken from individuals through taxes while products are waiting to be purchased.

Another instance is when responsibilities that belong to individuals, families and intermediate institutions are taken over by the government using tax dollars. As the government’s intrusions multiply the theft is increasing. The reason given by the government is always the same: individuals, families and local public administrations do not have the necessary financial means. The government’s actions should be directed at correcting this financial incapacity as would occur under a Social Credit system. The costs of collecting taxes is another feature of the legalized robbery that is the tax system. No services are rendered to the community when taxes are collected.

It must first be seen in terms of reality, and its financial expression can take different forms.

Let me explain. The decision to build the bridge was made by the government representatives of the population. This decision would constitute a transfer of part of the country’s productive capacity to the public sector. The effect this will have on the quantity of consumer goods being made could influence the population’s standard of living.

The population can only enjoy that which is produced. If too many public work projects are requested then production of private goods could suffer. The personal standard of living would be lowered while the enjoyment of public works increased. It has nothing to do with finance; it is a matter of real wealth.

It is expressed as a reduction in purchasing power, since it is impossible to buy things that do not exist. Under a Social Credit system, this reduction in purchasing power would be calculated and corrected by the Price Adjustment mechanism. This would be “a form of taxation” that would correspond to the transfer of a share of the country’s productive capacity from the private to the public sector.

Any price increase resulting from this Price Adjustment would be justified. It would not be speculative or exploitative since all prices would be adjusted according to the ratio of consumption to production. The increase in the production of public works might result in a reduction in the production of private goods. Being aware of this, if people thought the load was too burdensome they could instruct their government to curb public sector activities.

The “form of taxation” described above is not the only one possible. The main requirement is that its financial aspect be an exact reflection of reality. As for the choice of methods, it is a question of feasibility. Circumstances need to be considered and different methods allowed as long as principles are respected.

There are distinctions to be made. We said that new production must be financed by new Credits but we added that we must pay for these goods at the rate they are consumed. For example, if a school built with new Credits is estimated to last twenty years, the population that uses it must pay one-twentieth of its price each year.

This is not a tax that robs but rather it is a payment for what is consumed. This is as logical as paying the tailor for a suit or the baker for a loaf of bread.

The same applies to public services such as garbage removal and aqueducts. They were instituted to provide services to individuals and families in a more efficient manner. If each family had to obtain water at a lake or river or pay to have it delivered there would be a cost in time and energy. The same applies to the removal of garbage.

As for education, a mother seldom has the time, even though she may have the competence, to teach her own children. We can hardly expect every family to hire a private tutor. But if 20, 30, or 100 families decide to hire a teacher each family will spend less for the same service.

Must we call what each family will have to pay, taxes? Perhaps, because the term is commonly used. But in fact, it is no more a tax than the money paid to a doctor who treated a family member or to the shoemaker for a shoe repair.

There is a huge difference. First of all, the country’s projects would be financed by new Credits. Financially, we would only pay for their consumption, i.e., their wear and tear, rather than for their production. We would no longer be burdened by public debts and interest that cannot be paid. It is public debts that currently consume the greater part of tax revenue.

We would not pay taxes to support government employees who perform tasks that should be performed by individuals and families. The financial incapacity of individuals and families that requires governments to stand in their stead, would be a thing of the past.

Taxes would no longer maintain a burgeoning government run social security system. As co-heirs and co-owners of a common capital, all citizens would find their unconditional economic security in the social Dividend combined with the Price Adjustment mechanism.

Since all that is physically possible would be financially possible, the public could collectively pay for any public or private goods that the country can produce. The payment of public services would no longer be a burden and an obstacle to obtaining private goods, as it is today.

Under a Social Credit system all citizens would be shareholders entitled to a Dividend. As shareholders, they would also be kept periodically informed of the nation’s bookkeeping. Bookkeeping would be simpler and more transparent than the complexities of the present system. The public could more readily intervene with their elected representatives should they wish goods to be produced that answer the real needs of the people.

Moreover, the guaranteed income to each person, first at a level that ensures the satisfaction of basic needs and later increased to the level warranted by a civilized society, would be the means that allows people to give instructions to the production system.

To get a proper perspective on a Social Credit world, we must look at everything from the standpoint of reality. The standard of living would no longer depend on the financial system but rather on available or requested production. Finance would only intervene to lubricate the production system and to foster the consumer’s freedom of choice.

Different formulas will have to be determined according to the services offered and depending on whether they benefit the entire population or only a given geographical area. The formula chosen would be the one found to be the most practical. But we must avoid what might cause people harm under the pretext of being effective. No financial objective can justify causing harm.

Some public services can continue to be paid by those who use them such as with the postal service where users pay by purchasing stamps. The same applies to expressways although their financing under a Social Credit system would avoid lengthy repayment obligations.

Other public services are used by all citizens regardless of where one lives in the country. This is the case for most roads. This also applies to national security, such as the protection of the country against a possible threat of aggression. This requires the readiness of armed forces to carry out military operations. The same applies for a police force needed to maintain public order. All individuals benefit equally in these cases. The simplest way of paying for these services would be to use national credits that would be recovered from the public by the Adjusted Price mechanism.

But some public services are offered to only a part of the community, such as water and sewage treatment. These services benefit city residents rather than country residents. It would be unfair to ask everyone to contribute to the same extent by a Price Adjustment applied to the entire population.

Generally speaking, the people who benefit from a given service should be the ones who bear its cost. As for the best method for doing this, Douglas wrote:

“Now, just as there are two methods in theory by which the unearned increment of association, which we call public credit, can be distributed, these two methods being either a grant of ‘money’ or a general reduction of prices, and the choice between these two methods is one of practicability and not of principles, so there are two methods by which this transfer of goods and services from private to public use can be obtained, the direct and the indirect method, and it is curious that we have such a tendency to insist on the direct method, with its crudities, complications, and iniquities. It would be both simple and practical to abolish every tax in Great Britain, substituting therefore a simple sales tax on every description of article, and, apart from other considerations, such a policy would result in an economy of administration far in excess of anything conceivable within the limits of the existing financial system.” (“Warning Democracy”, 1934 page 176)

Direct taxes are the amounts levied against individuals, like the income tax, poll tax, tax on succession, property taxes, etc.

Douglas prefers a sales tax on prices, the indirect method. In a Social Credit system this would combine with the Price Adjustment on consumer goods. This method is suited to the payment of public services that are offered to the whole community as we have pointed out above.

We need to remember that prices are also the same for the poor as for the rich in today’s system.

We must not forget that under a Social Credit system individuals regardless of age are guaranteed an income through the social Dividend linked to the individual and not to employment. Each member of a family thus receives a Dividend. This Dividend must be large enough, even when adding the prices of public services and consumer goods, to ensure everyone receives what is needed to obtain the bare necessities. In fact, the hierarchy of needs requires that the country’s productive capacity be used first for the necessities of life for each person. Of course, this country can provide much more than the bare necessities to all.

Usually the rich buy more than the poor. In the indirect method proposed by Douglas the rich would finance a greater share of the public service costs than the poor. It is only fair that the ones who benefit the most from national wealth should pay more.

A closer look will reveal that taxes on prices are less dictatorial in character than the income tax or the property tax. This is a point emphasized by Douglas. If one wishes to pay smaller taxes it is possible to choose to buy less and be satisfied with a lower standard of living. Whereas income and property taxes are harsh considering that one does not benefit from having either income or from having property.

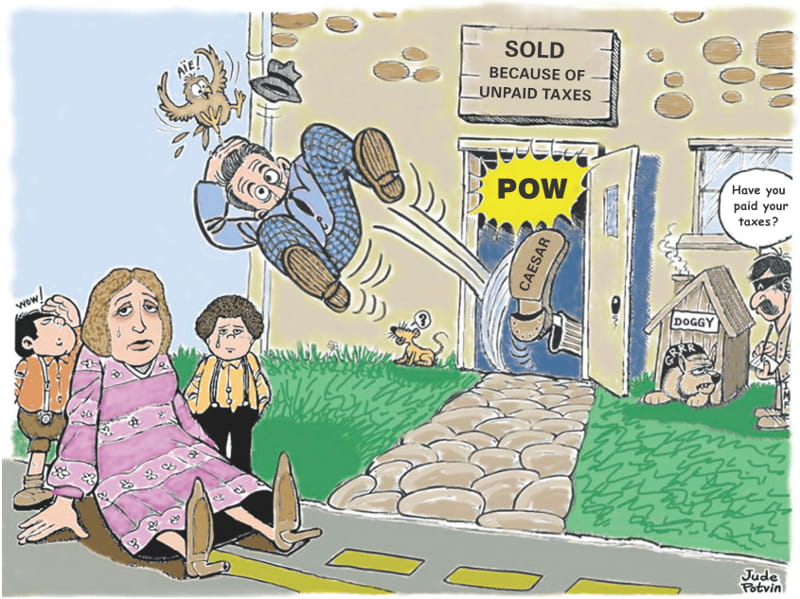

Here is an opportunity to say a word on property taxes levied on the family home. Property taxes are the source of a multitude of evils.

The family dwelling is a home, not a money fountain. Why ask families for money that does not grow on their home’s walls or roof?

This discourages ownership and leads us closer to totalitarian regimes such as communism.

Property taxes that cannot be paid cause anguish to families and fears that the family could be thrown onto the street. This may be so even after the family has endured hardships over time, without successfully securing the amount required to pay their taxes.

This form of taxation is preferred over other forms because it allows the taxing authority to punish those who do not pay by putting their properties up for sale. This gives the collection of money more importance than is given to human beings.

It is our opinion that property tax is the most unfair tax ever established and that it should be eliminated. In closing, let us repeat that, under a Social Credit system, there are no taxes, so to speak. There are payments for public and private services rendered. In any case, the country’s population would be provided with the Means of Payment to purchase all that is offered to consumers to satisfy their public and private needs.

Previous chapter: A Dividend to All |

Next chapter: Conclusion |

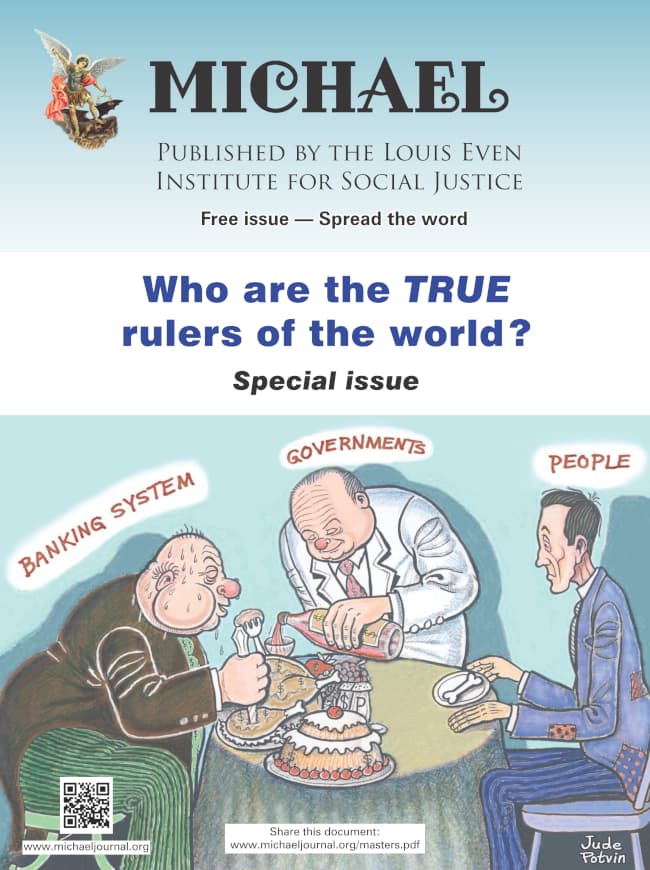

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

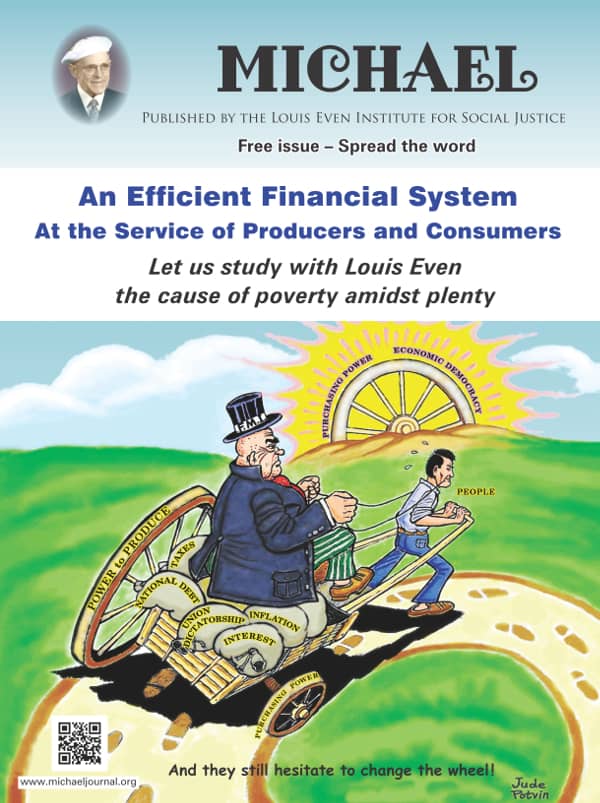

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

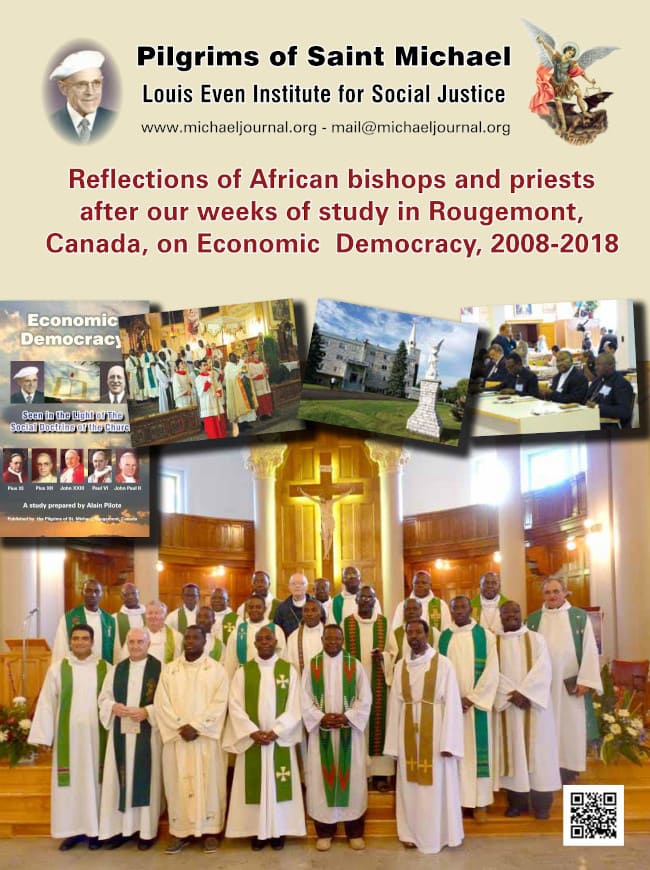

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

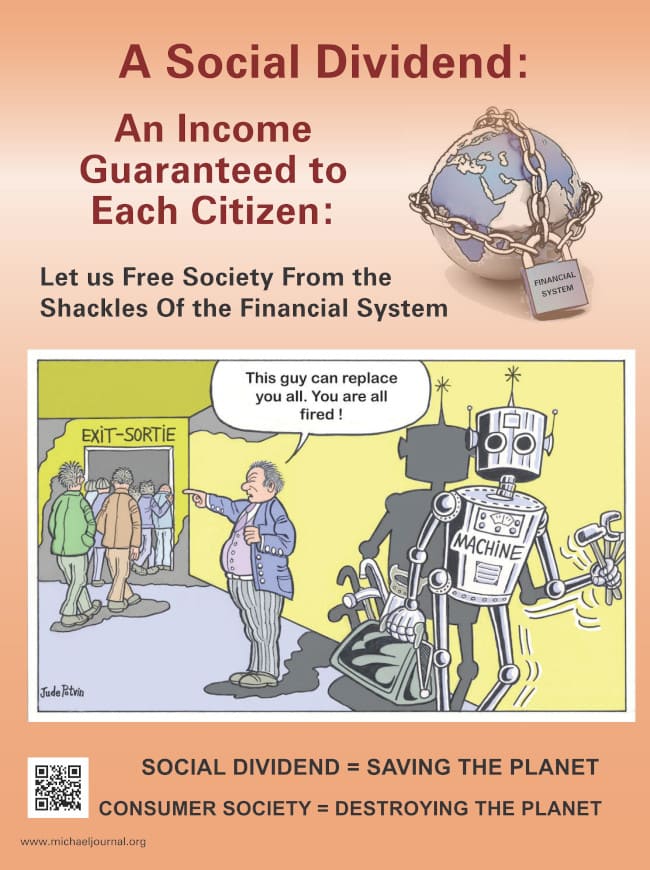

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.