The linking function of finance is so important that it is worth getting as clear a picture of it as possible. A conception at once graphic and true is that of a bridge spanning a ravine, and let the ravine be wide and deep so that nothing can cross it, except by the bridge, without courting disaster.

Some of the characteristics of such a bridge are as follows. (We assume it to be well built and well managed.

Are these ramifications and elaborations of the simile fantastic? We shall see. First, however, let us identify our material.

The two sides of the ravine are of course Production and Consumption, the bridge, Finance; the traffic, goods; and the few unfortunates who try to jump across, thieves and the like. This completes the picture, though in one respect it needs qualification. In economies, John Smith lives two lives, one in the land of Production and the other in the land of Consumption. This only means, of course, that a farmer not only produces wheat but also consumes tractors; etc., and that a pillmaker, not only produces pills but also consumes bread etc., including perhaps even some of his own pills. John Smith, in short has an office in Production and a Home in Consumption.

So if we can visualize millions of people in the land of consumption all thronging towards the bridge with arms outstretched and crying out. "We want.", and in the land of Production those same millions shouting across the ravine (through their Advertising Departments): "It's all right — we've got the very things you want?" and pouring goods to the bridgehead, then we shall have some idea of the basic relations between the members of the great economic trinity.

Now for a few of the curious, not to say alarming, things that are happening on the bridge of Finance. We can compare them paragraph by paragraph with what we have just seen should not be done on any properly conducted bridge.

Money has itself become a commodity traded in like any other.

2. The bridge is assumed to be, if not God built, at least so beyond our powers of comprehension or alteration that instead of widening it to meet an increase in traffic the latter is deliberately and even with pride curtailed to fit the existing width.

The amount of money varies, not with the amount of producible and wanted goods, though what else, we may ask, should money represent? — but with the amount of gold in bank vaults.

The bridge is regarded as an immovable natural phenomenon, sacrosanct and inexorable.

A Cabinet Minister, no exception to his kind, explaining why promises made at a general election had not been kept; said: "The grim goddess of Finance exercised as she always must, an inexorable power."

3. The bridge does not belong to its users.

The Bank of England and the "Big Five" Joint Stock Banks (Barclays, Lloyds, Midland, National Provincial, Westminster) are privately owned institutions.

4. The bridge's officials are not appointed. by the users, therefore and consequently, are neither paid by them nor responsible to them.

The officials achieve power and profit through administering the bridge as their own perquisite.

∗ ∗ ∗

Finally, when the general maladministration very naturally throws the traffic into turmoil, the people on either side of the ravines are told that only by taking steps which will confirm the officials in their usurped powers can the bridge be saved from falling in utter collapse into the torrent below. In other words, any discussion of Finance itself (apart from its present creaking machinery), any affirmation of its true function, or any search for a possible basic flaw — these things are taboo.

Yet, who can blame the officials for regarding the bridge as a 'pons asinorum' (a bridge of asses) when the asses on it appear to have forgotten even how to bray? The patience of asses, when it is derived from ignorance, is not a virtue, nor their silence brave.

Maurice COLBOURNE

(The above is an abridgement of a section of chapter 4 of Maurice Colbourne's book: The Meaning of Social Credit, a book heartily to be recommanded to all beginning a study of Social Credit.

Earl Massecar

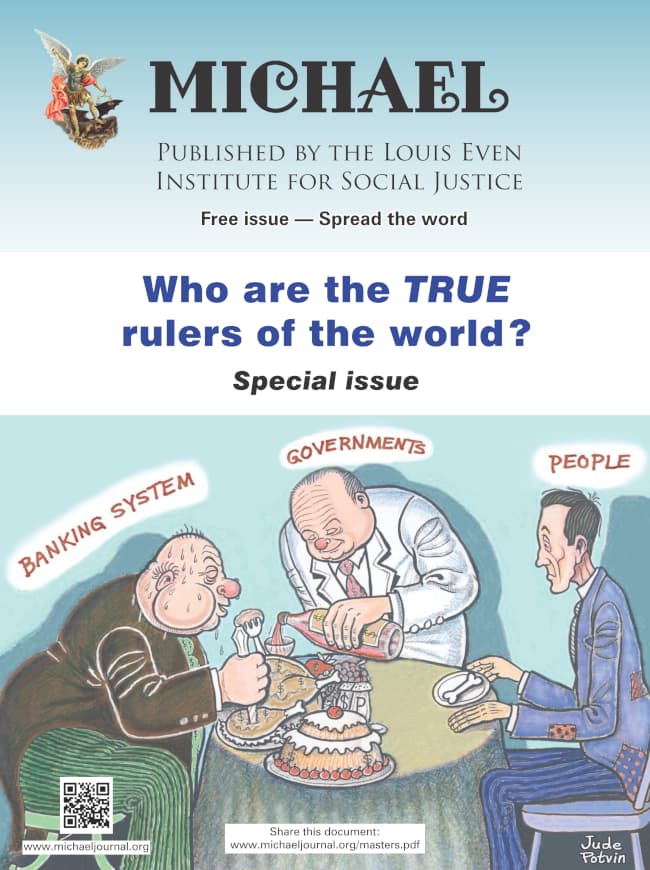

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

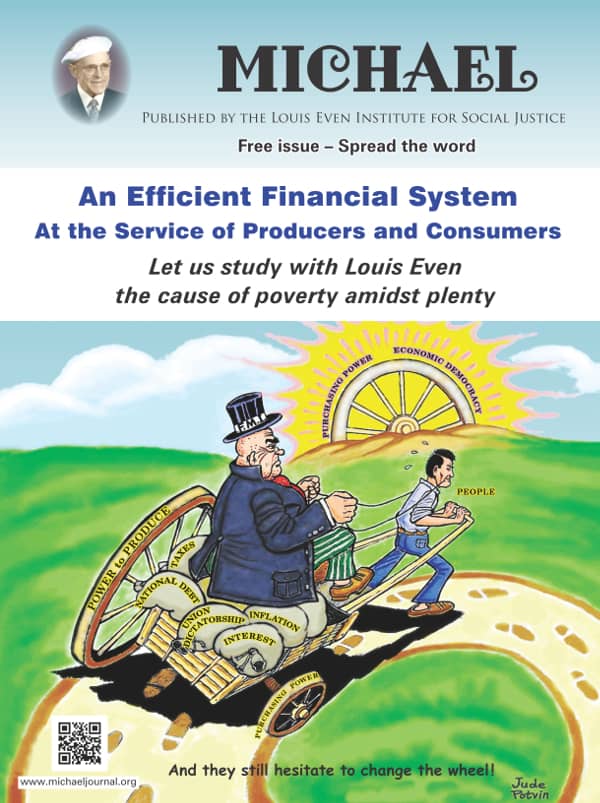

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

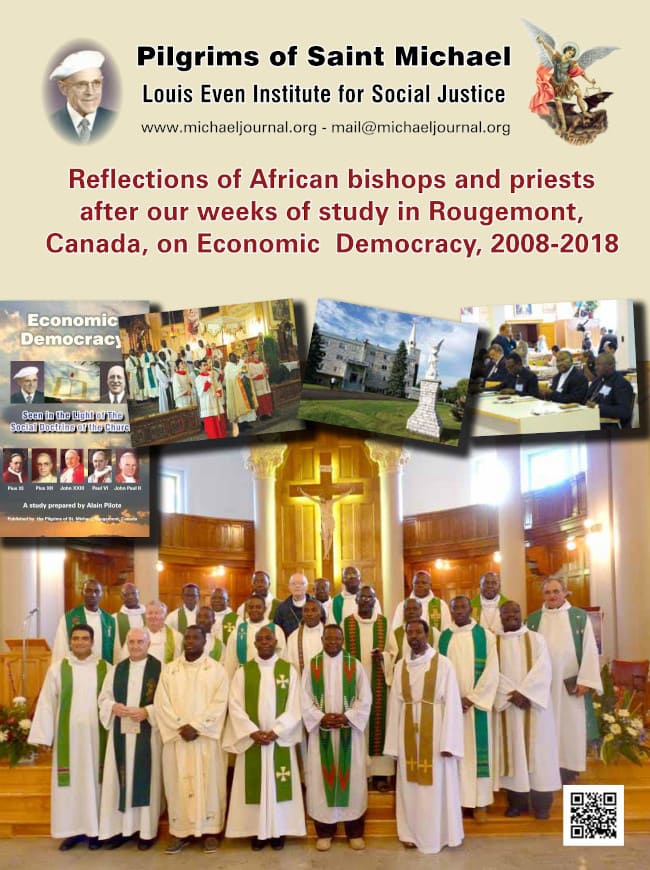

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

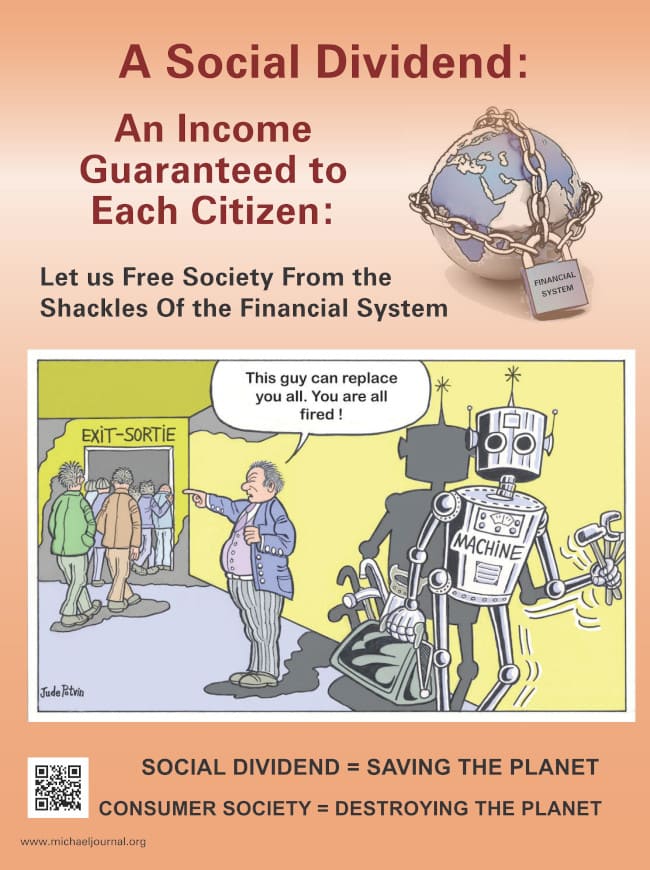

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.