More and more, leading economists are forced to recognize that what C.H. Douglas and Louis Even wrote over the years is true: Progress leads ineluctably to jobs being eliminated. Another source of income must be found to make up for the loss of salaries and wages. The following article, written by Jeremy Rifkin, was published in the March 2, 2004 issue of the UK newspaper The Guardian. Rifkin is the founder of the Foundation on Economic Trends in Washington:

We are losing jobs all over the world. It has reached crisis proportions. In 1995, 800 million people were unemployed or underemployed. Today, more than a billion fall into one of these categories.

Even in America and Europe, millions of workers find themselves under-employed or without jobs and with little hope of obtaining full-time employment. The US has lost 12% of its factory jobs since 1998, while the UK shed 14% of its manufacturing jobs in the same period. Manufacturing jobs continue to disappear in the UK, even though the sector is growing at its fastest pace in four years.

Where have all the factory jobs gone? It has become fashionable, of late, to blame the high unemployment on companies relocating their production facilities to China. It is true that China is producing and exporting a far greater percentage of manufacturing goods, but a new study by Alliance Capital Management has found that manufacturing jobs are being eliminated even faster in China than in any other country. Between 1995 and 2002, China lost more than 15 million factory jobs, 15% of its total manufacturing workforce.

There's more bad news. According to Alliance Capital, 31 million manufacturing jobs were eliminated between 1995 and 2002 in the world's 20 largest economies. Manufacturing employment has declined every year in the past seven years and in every region of the world. The employment decline occurred during a period when global industrial production rose by more than 30%.

If the current rate of decline continues — and it is more than likely to accelerate — manufacturing employment will dwindle from the current 164 million jobs to just a few million by 2040, virtually ending the era of mass factory labour.

Now the white-collar and services industries are experiencing similar job losses, as intelligent technologies replace more and more workers. Banking, insurance, and the wholesale and retail sectors are introducing smart technologies into every aspect of their business operations, fast eliminating support personnel in the process. The US internet banking company Netbank has $2.4 billion in deposits. A typical bank that size employs 2,000 people. Netbank runs its entire operation with just 180 workers.

The UK and US jobs being lost to call centres in India, while important, pale in significance compared with jobs lost every day to voice recognition technology. Consider the US phone company Sprint, which has been steadily replacing human operators with this technology. In the year 2002, Sprint's productivity jumped 15% and revenue increased by 4.3%, while the company reduced its payroll by 11,500.

As far back as the late 1980s, industry analysts were warning that automation would eliminate more and more jobs. Because their forecasts proved somewhat premature, the public was lulled into believing that automation was not a problem. Now, however, the software, computer and telecom revolutions, and the proliferation of smart technologies, are finally wreaking havoc on jobs in every country.

Industry observers expect the decline in white-collar jobs to shadow the decline in manufacturing jobs during the next four decades, as companies, whole industries, and the world economy become connected in a global neural network.

The old logic that technology gains and advances in productivity destroy old jobs, but create as many new ones, is no longer true. The US is enjoying its steepest rise in productivity since 1950. In the third quarter of 2003, productivity soared by a staggering 9.5%, yet the ranks of the unemployed remain high.

Economists have long argued that productivity allows firms to produce more goods and services at cheaper costs. Cheaper goods and services, in turn, stimulate demand. The increase in demand leads to more production and services and greater productivity, which, in turn, increases demand even more, in a never-ending cycle. So even if technological innovations throw some people out of work in the short term, the spike in demand for the cheaper products and services will assure additional hiring down the line to meet expanded production runs.

The problem is that this theory appears to be no longer applicable. The US steel industry is typical of the transition taking place. In the past 20 years, steel production rose from 75 million tonnes to 102 million tonnes. In the same period, from 1982 to 2002, the number of steelworkers in the US declined from 289,000 to 74,000. "Even if manufacturing holds on to its share of GDP," says University of Michigan economist Donald Grimes, "we are likely to continue to lose jobs because of productivity growth." He laments that there is little we can do about it. "It's like fighting a huge headwind."

Herein lies the problem. If dramatic advances in productivity can replace more and more human labour, resulting in more workers being let go from the workforce, where will the consumer demand come from to buy all the potential new products and services? We are being forced to face up to an inherent contradiction at the heart of our market economy that has been present since the very beginning, but is only now becoming irreconcilable.

A shrinking workforce, however, means diminished income, reduced consumer demand, and an economy unable to grow. This is the new structural reality that government and business leaders and so many economists are reluctant to acknowledge.

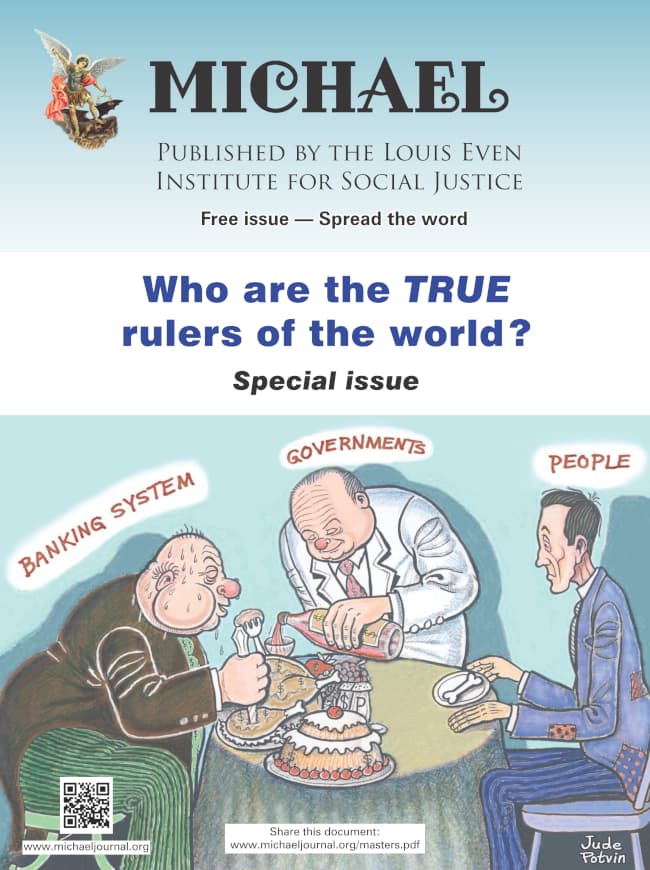

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

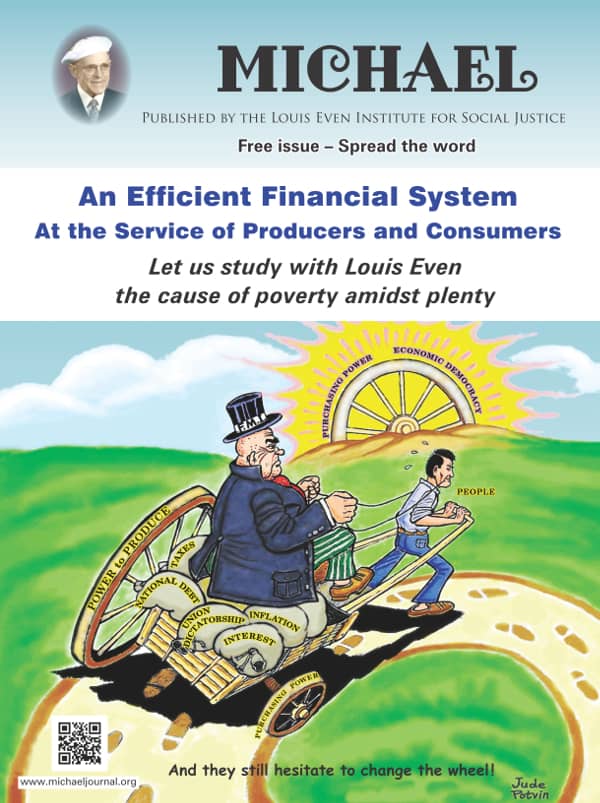

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

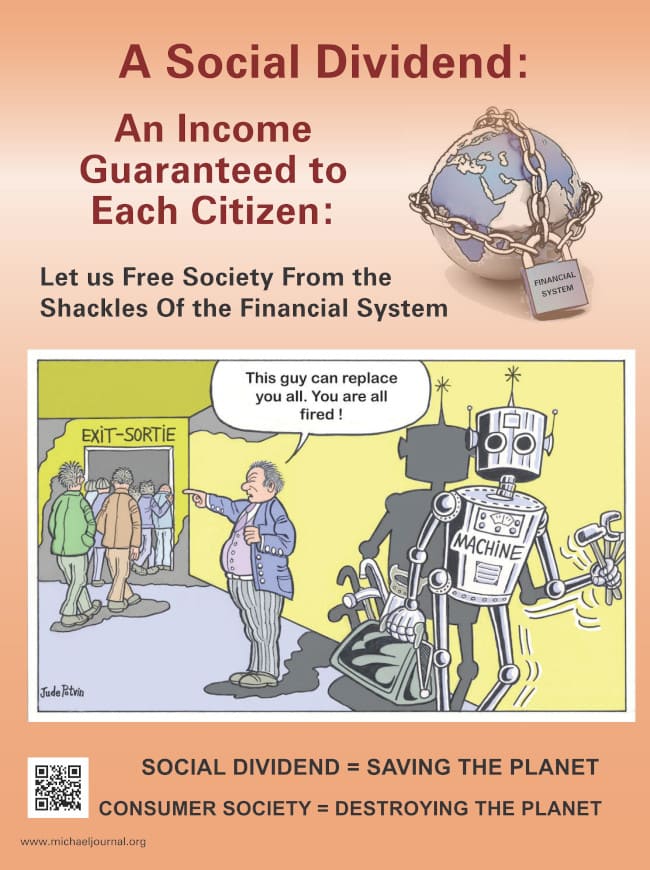

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.