Some of the most frank evidence on banking practices was given by Graham F. Towers, Governor of the Central Bank of Canada (from 1934 to 1955), before the Canadian Government's Committee on Banking and Commerce, in 1939. Its proceedings cover 850 pages. (Standing Committee on Banking and Commerce, Minutes of Proceedings and Evidence Respecting the Bank of Canada, Ottawa, J.O. Patenaude, I.S.O., Printer to the King's Most Excellent Majesty, 1939.) Most of the evidence quoted was the result of interrogation by Mr. “Gerry” McGeer, K.C., a former mayor of Vancouver, who clearly understood the essentials of central banking. Here are a few excerpts:

Q. But there is no question about it that banks create the medium of exchange?

Mr. Towers: That is right. That is what they are for... That is the Banking business, just in the same way that a steel plant makes steel. (p. 287)

The manufacturing process consists of making a pen-and-ink or typewriter entry on a card in a book. That is all. (pp. 76 and 238)

Each and every time a bank makes a loan (or purchases securities), new bank credit is created — new deposits — brand new money. (pp. 113 and 238)

Broadly speaking, all new money comes out of a Bank in the form of loans.

As loans are debts, then under the present system all money is debt. (p. 459)

Q. When $1,000,000 worth of bonds is presented (by the government) to the bank, a million dollars of new money or the equivalent is created?

Mr. Towers: Yes.

Q. Is it a fact that a million dollars of new money is created?

Mr. Towers: That is right.

Q. Now, the same thing holds true when the municipality or the province goes to the bank?

Mr. Towers: Or an individual borrower.

Q. Or when a private person goes to a bank?

Mr. Towers: Yes.

Q. When I borrow $100 from the bank as a private citizen, the bank makes a bookkeeping entry, and there is a $100 increase in the deposits of that bank, in the total deposits of that bank?

Mr. Towers: Yes. (p. 238)

Q. Mr. Towers, when you allow the merchant banking system to issue bank deposits which, with the practice of using the cheques as we have it in vogue today, constitutes the medium of exchange upon which I think 95 per cent of our public and private business is transacted, you virtually allow the banks to issue an effective substitute for money, do you not?

Mr. Towers: The bank deposits are actual money in that sense, yes.

Q. In that sense they are actual money, but, as a matter of fact, they are not actual money but credit, bookkeeping accounts, which are used as a substitute for money?

Mr. Towers: Yes.

Q. Then we authorize the banks to issue a substitute for money?

Mr. Towers: Yes, I think that is a very fair statement of banking. (p. 285)

Q. 12 per cent of the money in use in Canada is issued by the Government through the Mint and the Bank of Canada, and 88 per cent is issued by the merchant banks of Canada on the reserves issued by the Bank of Canada?

Mr. Towers: Yes.

Q. But if the issue of currency and money is a high prerogative of government, then that high prerogative has been transferred to the extent of 88 per cent from the Government to the merchant banking system?

Mr. Towers: Yes. (p. 286)

Q. Will you tell me why a government with power to create money, should give that power away to a private monopoly, and then borrow that which parliament can create itself, back at interest, to the point of national bankruptcy?

Mr. Towers: If parliament wants to change the form of operating the banking system, then certainly that is within the power of parliament. (p. 394)

Q. So far as war is concerned, to defend the integrity of the nation, there will be no difficulty in raising the means of financing, whatever those requirements may be?

Mr. Towers: The limit of the possibilities depends on men and materials.

Q. And where you have an abundance of men and materials, you have no difficulty, under our present banking system, in putting forth the medium of exchange that is necessary to put the men and materials to work in defence of the realm?

Mr. Towers: That is right. (p. 649)

Q. Would you admit that anything physically possible and desirable, can be made financially possible?

Mr. Towers: Certainly. (p. 771)

Previous chapter - Words of Thomas Edison

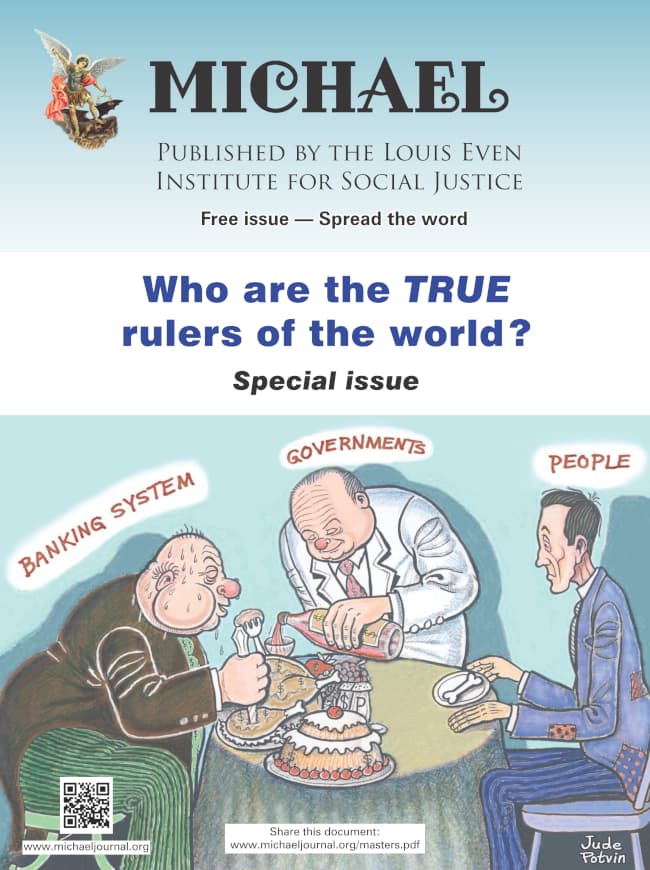

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

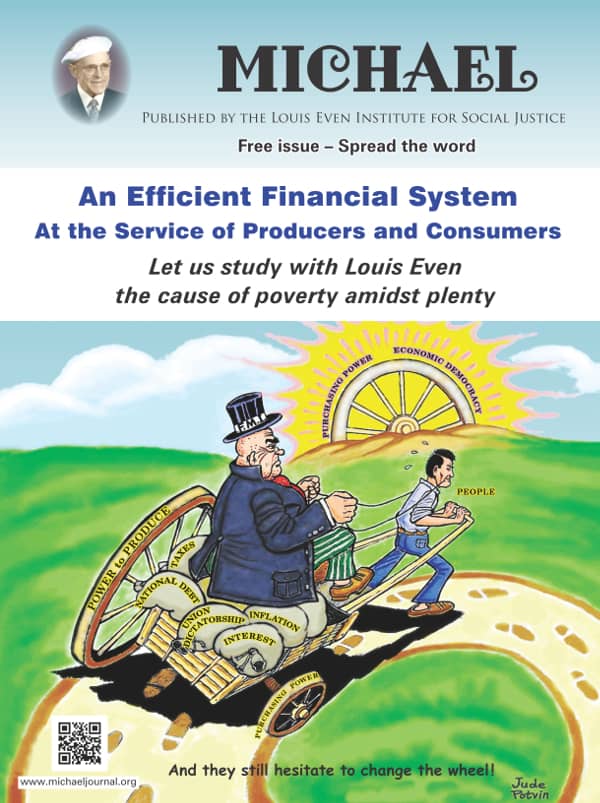

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

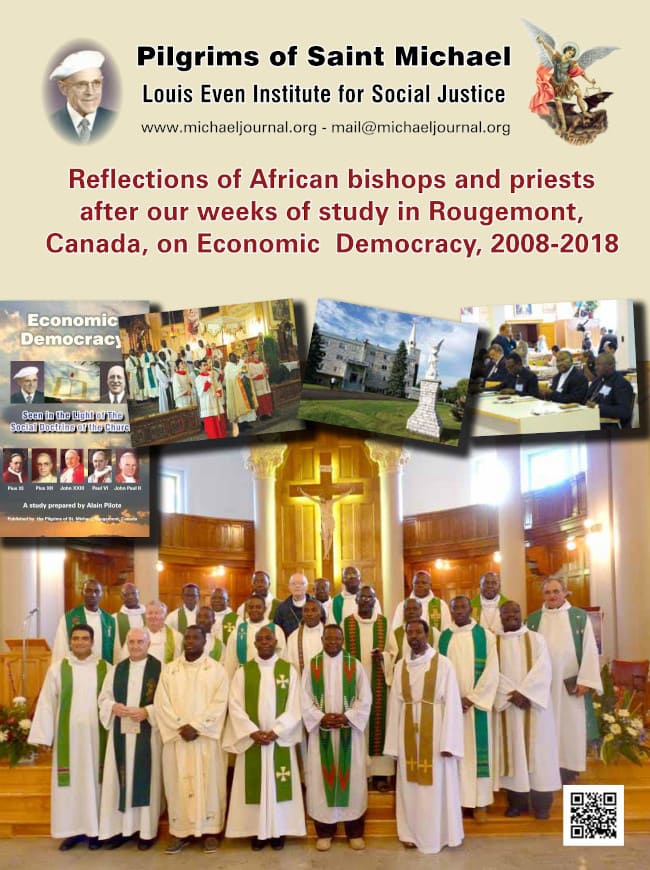

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

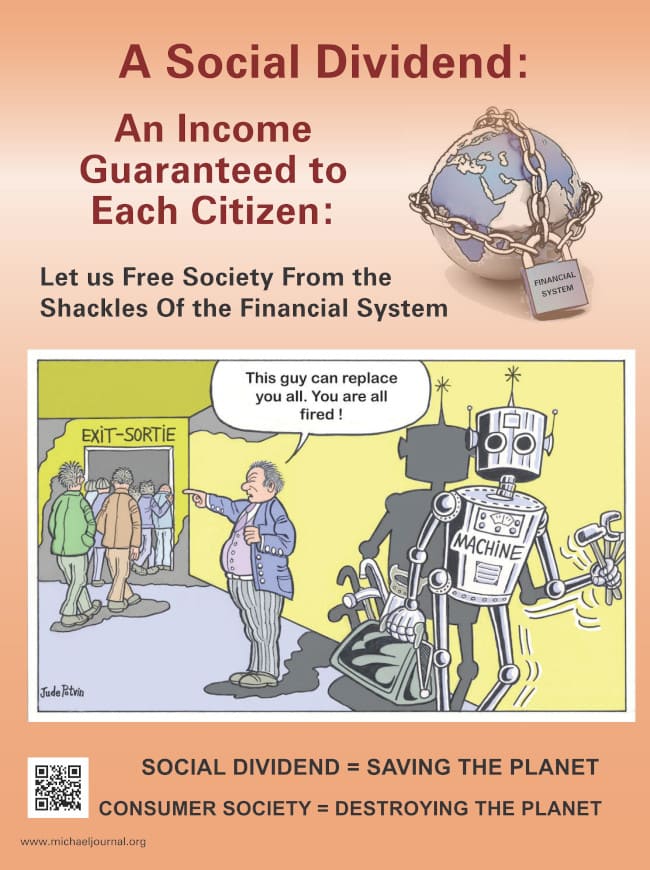

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.