The distribution of new money through a national dividend is therefore a means of increasing the country's money supply when needed and of placing this money directly into the hands of consumers.

But, to be of benefit to the consumer, this distribution of money must represent a true increase of the consumer's purchasing power.

Purchasing power depends on two factors: the amount of money in the buyer's hands and the sale price of a product.

If the price of a product goes down, the consumer's purchasing power goes up, even if the amount of money is not increased. If I have $10.00 with which to purchase butter and if the price of butter is $2.50 a pound, I have in my hands the power to buy four pounds of butter; if the price of butter is lowered to $2.00 a pound, my purchasing power goes up and is equal to five pounds of butter.

On the other hand, if the price goes up, it negatively affects the consumer's purchasing power and, in that case, even an increase in money can lose its effect. Thus, the worker who earned $200 in 1967 and who earned $400 in 1987 will have lost out because the cost of living had more than doubled within those twenty years. In 1987, one needed at least $772 to buy what one could have purchased with $200 in 1967.

This explains why the increases in salary, so strongly advocated by workers, do not succeed in providing a lasting improvement, because the prices of products are increased accordingly. The employers do not create money, and if they have to spend more to pay their workers, they are compelled to sell their products at higher prices in order not to go bankrupt.

The national dividend is not included into prices since it is made up of new money which is distributed by a Government Agency, outside of work.

However, with more money in the hands of the public, retailers might be tempted to increase the prices of their products, even if these products did not cost them more to produce.

A monetary reform which does not prevent unjustifiable price increases would not be complete. It could even become a catastrophe by letting inflation run free.

The arbitrary setting of prices, by imposing a general upper limit on them, can also achieve a prejudicial effect by discouraging production; and lowering production is the surest way of pushing prices up. The legislator thus achieves the opposite of what was sought: inflation is let loose in trying to fight it. To escape legal sanctions, people then resort to the black market which also furthers inflation.

Social Credit offers a technique to prevent inflation: the “adjusted price” or "compensated discount" technique. This would be part of the process by which money is issued. Total purchasing power must be kept equal to the total production being offered.

| Previous chapter - The National Dividend | Next chapter - Price Adjustment |

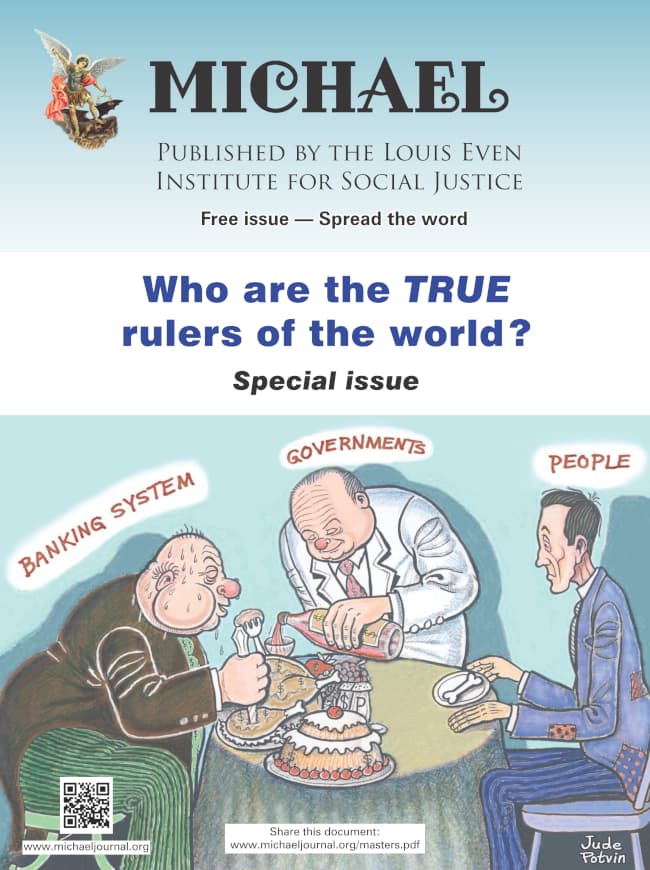

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

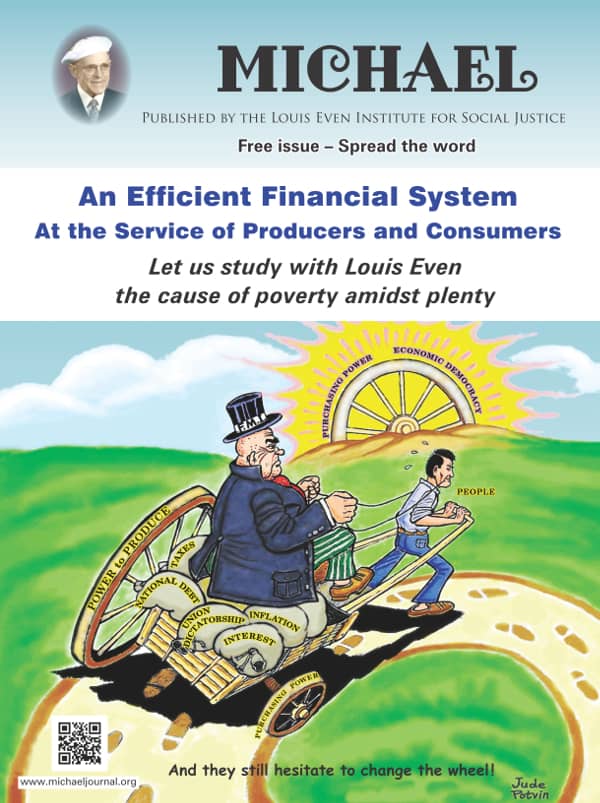

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

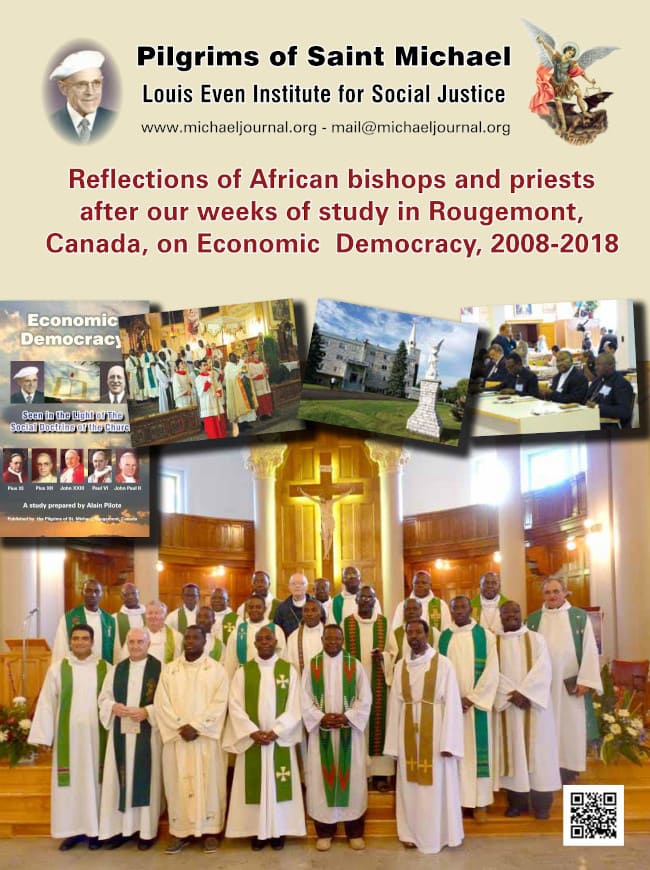

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

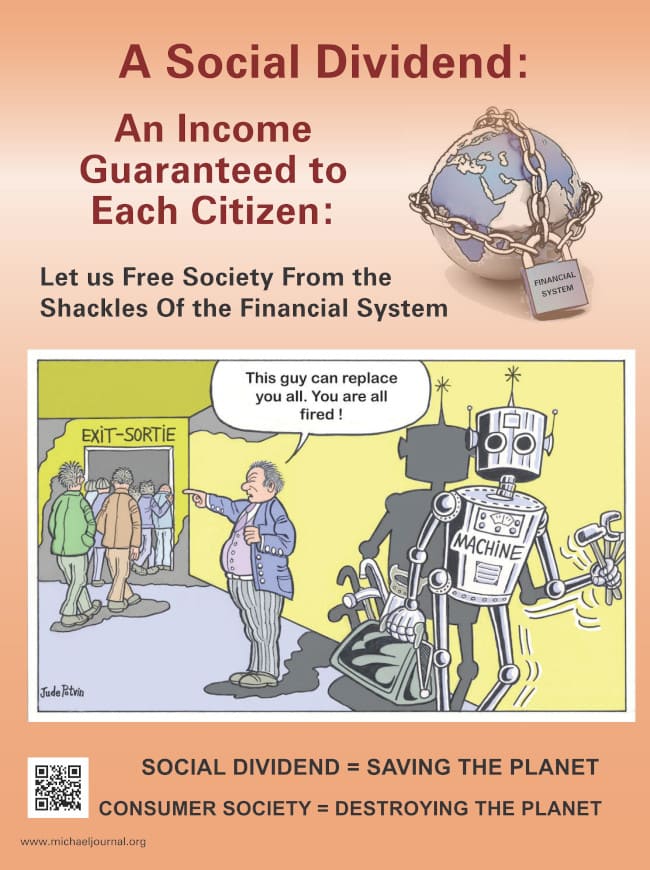

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.