In Part I of this series taken from J. Crate Larkin's booklet, "From Debt to Prosperity" (Sept.-Oct. 2008 issue), we saw how money is created as a debt by private banks in the form of loans, which brings about disastrous consequences for society. The first conclusion was that a money system built on debt and interest can function in the long run only to create more debt. And this is precisely what has happened.

In Part II (Nov.-Dec. 2008 issue), we saw that under the present financial system a shortage of money is inevitable, making it increasingly difficult to buy goods.

In this article (Part III), we will learn how money can accomplish its true function and be made a true reflection of physical realities, a true bookkeeping system:

by J. Crate Larkin

If we want money to work for us instead of against us we must use credit-money instead of debt-money. We can only enable the economic system to deliver wanted goods and services by closing the gap between buying power and prices. As more debt-financed relief programs fail to bridge this gap the necessity for action becomes increasingly plain. Equally obvious should be the fact that the most effective method to close the gap is to raise buying power and lower prices at the same time.

But how can this be done in a practical operation? It is self-evident that any lasting and general prosperity depends upon maintaining a constant balance between a high rate of production and an equally high level of consumption. This balance results from continuously satisfying the vital needs of consumers with the actual physical goods of producers. To make their demand for goods, effective consumers must have sufficient money to buy the goods. Demand, without money to implement it, is impotent, ineffective. The only actual limit to the satisfaction of the shopping nation's need for goods is the limit of our productive capacity, of which we are now utilizing only a small fraction.

Therefore sufficient money must be available to express accurately the demand for wanted goods. Money, being the bridge between desire and goods, must depend upon our Real Credit; that is to say, the rate at which we as a nation can deliver the goods and services we require to live.

In other words, money must reflect the true facts of our Real Wealth. Since money is the accepted means to express the effective demand for available goods, the balance between our ability to produce and our ability to buy and consume what is produced must be accomplished by money.

The present financial system is not the true reflection of realities, it is a flawed mirror: new developments (real wealth) are represented as a financial debt, even though they are the physical enrichment of the nation.

Permanent business recovery requires then that we level up consumption to balance with production. The nation as shoppers and consumers of goods must be able to buy what we produce. If America as shopper is to buy the output of America-producer we must begin to raise consumption up to the level of productive capacity. This can be accomplished only by controlling the total amount of money in circulation so that it will be increased or expanded at exactly the same rate as production and consumption are increased. Only in this way can the balance between production and consumption be maintained, and the desires of consumers for goods be satisfied in permanent prosperity.

A money system that is sound, that delivers wanted goods to shoppers for consumption, must be a true expression of Real Credit. Furthermore, Financial Credit must be fully equal to this Real Credit. Otherwise money cannot reflect the true facts of our Real Wealth. "The re-identification of Real Credit with Financial Credit is the vital issue."

Two things are necessary to make the money system reflect our Real Credit. Both must be done by the government of the nation, acting as the representative of the people. Both can easily be done by existing governmental agencies.

We have seen that the first necessity is to restore to the nation its Constitutional right to control our own money system. The government must exercise its sovereign power to control the money supply of the nation. This includes credit as well as currency. This action is the first requirement for permanent business recovery.

Second, the government must gather together the facts and figures of our ability to produce and deliver useful wanted goods for consumption. As we have seen, our Real Credit rests upon this solid foundation.

Once the nation regains constitutional control of its own money system, the immediate practical step proposed by Social Credit is to appoint a non-political Federal Credit Commission. As its primary duty this Commission would take a national inventory of our actual productive capacity for wanted goods. Based on this capacity to produce wealth a National Credit Account would be established, in the case of the U.S.A., for example, in the United States Treasury.

The National Credit Account is simply a business statement showing the known facts of our ability to produce wealth in goods compared with our ability to buy those goods, to consume them. This Account provides the practical means by which the government can monetize the nation's Real Wealth, that is, to express its value in money. The purpose of this Account is to keep the price-values created in the nation's workshop of wealth in constant balance with the money-tickets distributed for shopping. Its object is to provide a constant supply of credit correlated exactly with our supply of goods.

Social Credit proposes to supply the money necessary to level up the balance between production and consumption by means of the National Credit Account. This money will be created as credit by the Government, acting through the United States Treasury. The money itself will be sound money in every sense of the word, for its value will be based upon the Real Credit of the United States.

Monetizing our Real Wealth means the transformation of our present vast Real Credit into its financial equivalent. This is necessarily a bookkeeping operation, exactly like the present creation of money. But Social Credit requires that instead of the nation's money supply being created in the bookkeeping of the private banking system as debt, it would be created in the bookkeeping of the United States Treasury as credit.

The non-political Federal Credit Commission would gather together and show in a national balance sheet all the facts of our enormous productive capacity as compared with our present limited, restricted consumption of goods. The nation would be credited with its production of wealth and charged with its consumption. This balance sheet would show the real limit of the national Credit. By means of this business-like method the surplus of production over consumption would be made available as credit to increase consumption.

Sufficient money in the form of credit would then be issued by the Treasury direct to consumers to enable them to buy all the wanted goods produced. This credit-money will be exactly sufficient in quantity to enable our established productive capacity to deliver goods and services to shoppers for consumption. The amount of the money must therefore be based on the current relationship between production and consumption.

In essence the National Credit Account is simply a statement of the facts of the nation's business, of the production and consumption of Real Wealth over a given period, reflecting the truth of our Real Credit. This Real Credit is transformed into Financial Credit in the bookkeeping of the United States Treasury by the constitutional power of the Government.

The administration of the National Credit Account would be the duty of the Federal Credit Commission, a non-political body of commissioners comparable in authority in the realm of business to the Supreme Court in law. The members of this commission would be appointed by the President, by and with the consent of the Senate, to serve for a definite term of office. The membership of the commission would change in rotation as seven-year terms of office expire. The commission could not be politically influenced because its work would deal only with the facts of production and consumption.

But we must understand clearly the most important point to be grasped about this controlled issuance of credit-money based on the Real Credit of the nation. The money thus created is backed 100% by the Wealth of the nation, its ability to produce and deliver wanted goods and services. This wealth, created by the industries of the nation, is an Asset. Social Credit recognizes this wealth as an added national value, a true asset, not as a debt to the banking system.

A rough example in round numbers (see below NATIONAL CREDIT ACCOUNT OR "BALANCE SHEET") will illustrate in a general way how the National Credit Account provides the facts necessary to monetizing our Real Wealth:

In terms of this example, based on the Real Credit of the United States, the Treasury could issue 25 Billion dollars in CREDIT-money, thus transforming this Real Credit into Financial Credit available to consumers for shopping.

The institution and keeping of the National Credit Account does not require any "nationalization" of the banks. As a matter of fact, such nationalization would be a great mistake. "I am not myself, for instance, an advocate of the nationalization of banks. I believe this again to be one of those misapprehensions so common in regard to these matters, for the nationalization of banks is merely an administrative change: it does not mean a change in policy, and a mere administrative change cannot be expected to produce any result whatever in regard to this matter. A change in monetary policy can be made without interfering with the administration or ownership of a single bank in the world." (Speech by C.H. Douglas at Oslo, Norway, 1935.) Only monetary policy need be under national control. The present banking system could just as efficiently carry out a policy for the national benefit as today it carries out policies for its own private profit.

While Social Credit would do away with the monopoly over the supply of money as now maintained by the banking system, it would preserve banks and protect bankers. The government would assume, as its proper constitutional function, full authority for the supply of money. But this change does not imply any violence, nor does it contemplate putting the banks out of business. As proposed in the United States, Social Credit would save the banking system from private ownership. The banks would operate under the supervision of the Government as agencies of the Treasury. They would handle money, accept deposits and carry on the bookkeeping necessary to the use of cheques and the transaction of business. In fact "...the bank as repositories of the people's money and as efficient debt collectors, are most useful institutions, and banking is one of the fine arts of the modern world. The machinery of the banks should as far as possible be retained – perhaps extended – although monetary policy should be withdrawn from private control."

This simply means that the banks would no longer hold as a monopoly the power to create and destroy money as they do today. Business and individuals alike need the facilities of the banking system to carry on their activities. All the useful functions of banking must be preserved for the service and convenience of business. But the banking system would also be the means through which the government dispenses money and credit to consumers. Bank loans as a service to business would be backed by cash on hand, not created "out of nothing" as a debt. Fees for service rendered would be the bankers'recompense instead of interest on money created as debt.

The Social Credit proposals would require and reward the ability of every capable and public-spirited banker, "since their function as bookkeepers and agents of the National Credit Authority still requires to be carried on." The opportunities of bankers for rendering valuable and profitable service to the public would multiply as increasing prosperity is achieved.

The National Credit Account, reflecting our Real Wealth and equating Financial Credit with Real Credit, would provide sufficient circulating credit-money for business and consumers. The practical operation of the National Credit Account means the transfer of the control of credit from the banking system to the government as the representative of all its citizen-consumers.

No confusion or discarding of present business practice need attend the introduction of the National Credit Account. In fact the first steps in this direction have already been taken by the Government, through its purchase of bank stocks for the purpose of operating the Deposit Insurance Plan. The government has used its authority to determine the eligibility of banks for participation in this plan. This is in reality the beginning of widespread recognition of the necessity for Government control of monetary policy, even though, in a strange paradox, the Deposit Insurance Plan was necessary to bolster up public confidence in our present inadequate banking system.

Public opinion will bring pressure to bear when enough of us realize that artificial scarcity continues and the present shortage of buying power is increased because self-made methods of the banking system restrict our supply of money. When the facts are known public demand will change this situation. Is it not absurdly stupid that banks continue to monopolize money and credit only by our consent? The Government is empowered by the Constitution to issue and control the value of money. Why should it not exercise this right? Yet we not only allow the banking system to continue its monopoly, but even the government itself borrows its own credit, piling up an increasing burden of public debt to the banks!

The suggestion that the government create money to be issued as buying power to the nation's shoppers may cause some people to fear "inflation" as a result. "This word inflation is one which is always raised by bankers and those whose interests are with bankers, when any question of modification to the money system is raised... The first thing to realize is the true meaning of inflation. Inflation is not an increase of purchasing power, it is an increase in the number or amount of money tokens, whether paper or otherwise, accompanied by an increase in price, so that both the money-to-spend side is, in figures, raised and the price side is also, in figures, raised. That is true inflation." (Douglas in Oslo, Norway,1935.)

It is common knowledge that inflation is dangerous because it is characterized by rising prices, ruinous to the buying power of wage earners. But Social Credit would avoid and prevent inflation by automatically controlling the money supply, not only in its issuance but in relation to the wealth in goods against which it is issued. The amount of money issued through the National Credit Account would be so regulated as to avoid both inflation and deflation. The panics, crashes and depressions of the past would no longer threaten the security of our economic life. Social Credit would positively insure the direct control of money in relation to goods – a relative stability of prices and values – by means of the Just Price.

In the next issue: the Just Price and the National Dividend.

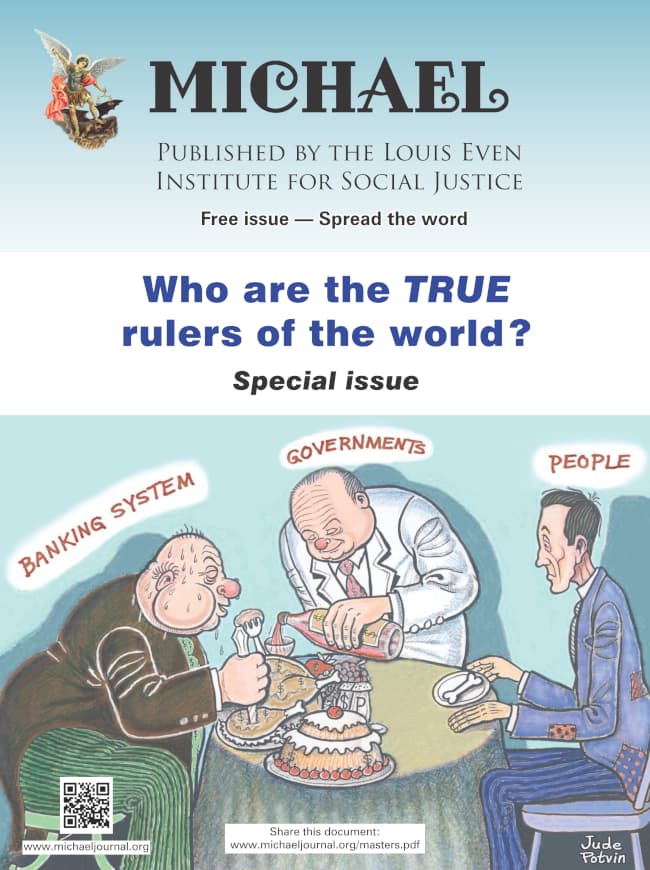

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

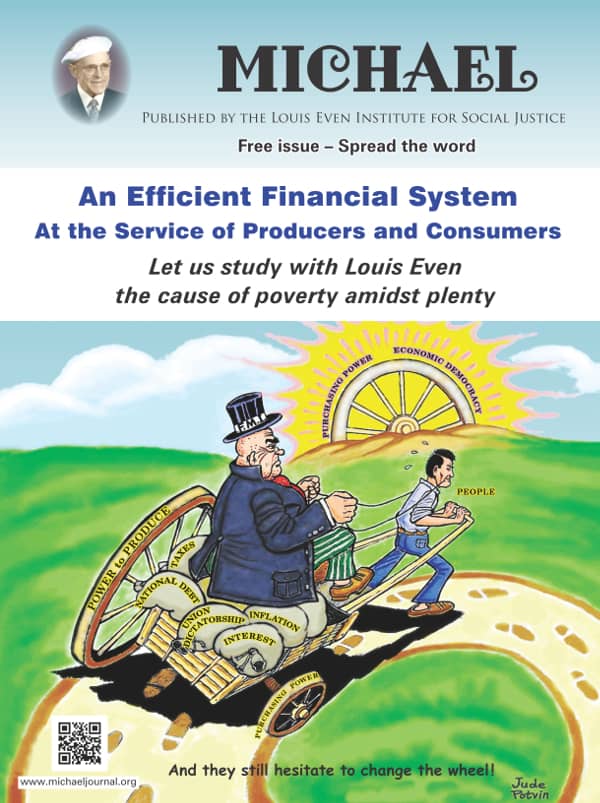

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

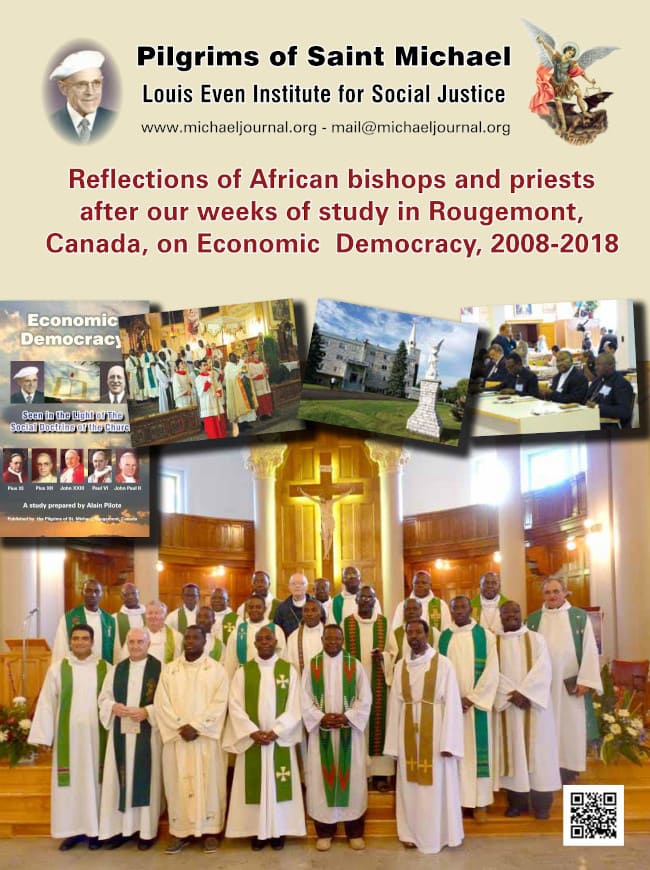

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

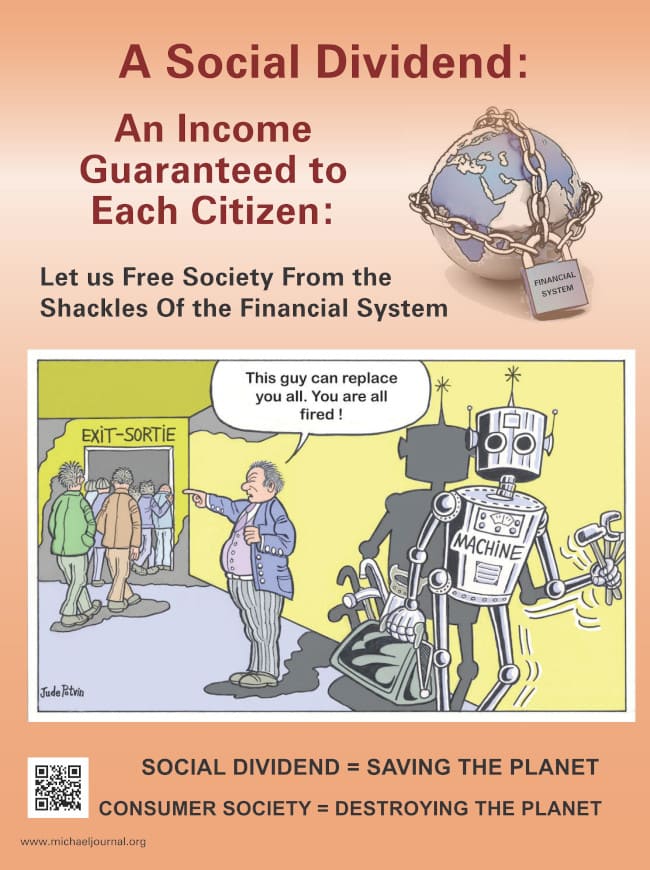

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.