The market

Cast a glance over all the objects that are in your home: a piano, ties, beds, forks; they have all been purchased. If they are a gift, the person who gave them to you had to buy them first.

Unless you are a farmer, all that is on your table or in the refrigerator has also been bought. Even farmers have on their tables things they had to buy — salt and pepper, to mention a few — and they also had to purchase the agricultural implements that allowed them to produce the food that is on their table or that they sell on the market.

Such is modern life. We work at making products, or parts of products, that are not meant for our homes. These goods are made to be sold on the open market, nation-wide.

Each person then goes to this community market and chooses what he wants. One can choose as long as one has the means to choose, since products are not given away, they are sold. They are marked with a price tag, in dollars and cents. To obtain a product, we must own an equivalent amount of money, in dollars and cents. The more money you have, the more freedom of choice you have. If you have no money whatsoever, you may choose absolutely nothing: you must live off the charity of others.

Prices and purchasing power

This means that our standard of living depends on the existence of two things: the existence of goods before us, and the existence of purchasing power in our pockets.

The existence of goods before us — whether in stores or warehouses — is no problem today. Goods are replaced as fast as they are purchased, except perhaps in wartime, when the production of life-giving goods is stopped intentionally in order to make death-giving production.

But if goods arrive on the market quickly and in plenty, the purchasing power in our pockets comes at a much slower rate. To prove it, wallets are often empty, but stores are never completely empty. New goods enter the stores faster than money does in our wallet.

Prices and money

On each product there is a price. What is this price? They are numbers, figures.

And what about the money in your pockets, when you do have some, what is it made of? They are pieces of paper, 6 inches by 2 inches, with figures printed on them. Nothing else. The 10 dollar note is worth twice as much as the 5 dollar note because one bears the number 10, and the other, the number 5.

If you have a bank account, you can say: “I have money in the bank.” What is this money in the bank made of? Look in the banker's ledger, or in your bankbook. You wll see nothing but figures.

When you write a cheque to pay someone, or when someone writes a cheque to pay you, what gives the cheque its value? The amount that is written on it.

Prices on goods are figures. Money to purchase goods is also figures.

If the figures that are prices and the figures that are money were the same, there would be no more problem in paying than there is to make things.

But this is not the case, and that is why goods pile up even though retailers would like to see them go. This is why products do not enter into many homes where they are sorely needed.

Lack of purchasing power

There is a lack of purchasing power, whereas goods are far from lacking.

Purchasing power is the ratio between the figures you have in your wallet and the figures found on goods.

When the figures found on goods increase, people say: “The cost of living is high.” And come what may, it remains high.

When the figures in our wallets diminish or disappear, people say: “Money is tight. We do not have enough money.” But say what you may, it will not make money come into your wallet.

When people have little money or when they are continuously short of money to satisfy their needs, they say: "We are poor." There are many people who say: “I am poor.”

There are some poor people who say: “I am poor because there are other people who are too rich.” We, Social Crediters, never say this. We know that we do not need to impoverish the wealthy in order to make the poor richer.

Let us suppose there is hardly any money in your wallet. Go to a store at the same time as a rich person does. What do you notice? The rich person easily buys everything he needs. He leaves the store with one or several bag full. Is the store empty because of this? If you cannot bring home what you need from the store, is it because this rich person took so much with him that there is nothing left for you? Of course not. The real reason is because your wallet is too thin. So, if money was put in your wallet without taking it from the rich person's wallet, would this not suit you? And suit the merchant as well?

And what is it that prevents more money from being put into the wallets when there are still unsold goods, and when there is a multitude of unemployed people who could make even more goods if the quantity of goods should threaten to diminish? If money is figures, what prevents the money-figures from being raised to the same level as the price-figures? The rich person did not lay hands on all of the figures in arithmetic. Figures are the most inexhaustible thing that can exist. It is very strange indeed that people should be left to suffer, not because production is lacking, but because figures are lacking.

Oh, I can imagine some distinguished economist saying with a shrug: “Money cannot be created just like that. What would be the use of money without goods to match it?”

It would certainly be of no use. But please tell us, distinguished gentleman, of what use are goods with no money in front of them? They can only cause people to be unemployed, deprived, and exasperated. But if you have goods in front of needs, and money on the same side as needs, then both goods and money will be useful.

Of course, money, even bookkeeping money, cannot be created at will. This must be done intelligently, so tha price figures and money figures match each other, and so that everyone might have money figures, at least enough of them to live decently in a country capable of feeding all of its population.

A dividend and lowering of prices

There are two ways to get price-figures to correspond to money-figures: prices can be lowered, or wallets fattened.

Social Credit would do both without doing anyone any harm, by accommodating everyone.

With the present financial system, it is impossible to lower the prices without harming the producers, and impossible to fatten the wallets without raising the prices.

You have seen, quite often, workers demanding pay raises. Why? Because their wages, which are made up of money-figures, are too small when compared to the price-figures marked on goods. They are right to complain since they have needs that remain unanswered in front of goods that accumulate.

But if workers get pay raises, these pay raises will be included in the prices, and the price-figures increased accordingly. The gap remains between the price-figures and the money-figures.

Money-figures must be increased without increasing the price-figures. For this, additional money must come from a source other than industry. This is what a Social Credit financial system would do. This is what the Social Crediters call “a dividend”: a dividend to all, since it is not a salary given as a reward for work.

On the other hand, Social Credit also proposes a monetary mechanism to lower prices, without harming the producers, because the retailers would be compensated for the amount the consumers would not have to pay.

The two mechanisms put together — the lowering of prices and the dividend — would be calculated so as to balance price-figures and money-figures.

Both are needed. If there was only the dividend, the prices might tend to rise, even if the actual cost price of goods remained the same. And if there was only the lowering of prices, without a dividend, this lowering of prices would be of little use for people who have no income whatsoever.

Progress at the service of the human person

Technological advances allow us to produce more with less human labor.

These technological advances, the many inventions, the scientific applications, the discovery of new sources of energy, are not the work of one man, nor the work of a few men, not even the work of the present generation of men alone. All this progress is a real capital that has been increased and transmitted from one generation to the next. It is a communal good that must not benefit a few men only. “The discoveries made by the human genius,” wrote Damien Jasmin, “must benefit all of mankind and not only a few fortunate and rich individuals.”

When a capitalist invests money in a company, if this company is profitable, the capitalist gets a dividend, even though he does not work personally in this company. Those who work in that company receive wages, but the capitalist who invested money in it receives a dividend; and if he also works in the company, he receives both a salary and a dividend.

Well, Social Credit considers that progress, the great capital we have just spoken of, a communal capital which is more and more productive, must bring in dividends to all, since all the members of society are the co-owners of this progress. Those who do not work still remain the co-owners of this communal capital, and are entitled to a dividend. Those who work are also entitled to this dividend, and to their wages as well.

This is where Social Crediters stand on the issue of progress.

Those who persist in saying that people must be employed to have the right to products found on the market, feel they must create new jobs, whereas progress lays off workers. Since progress cannot be stopped, they try to create new material needs so as to create new jobs. They thus lead us to materialism. Or else, they direct the economy towards war production, and to war itself, which is the most efficient way to destroy production and to keep people busy.

The Social Crediters want to put progress at the service of man, and free man from material worries, thus allowing him to devote himself to human functions other than the mere economic function.

The dividend to each and everyone, aside from being the acknowledgement of the right of all to an income derived from a productive communal capital, is also the most direct method to guarantee every individal will receive his share of earthly goods. This is a fundamental right, held by every man because of man's very nature, as Pope Pius XII reminded us.

(By Louis Even, first published in the February, 1966 issue of the Vers Demain Journal.)

| Previous chapter - Full Income Instead of Full Employment | Next chapter - The Environment |

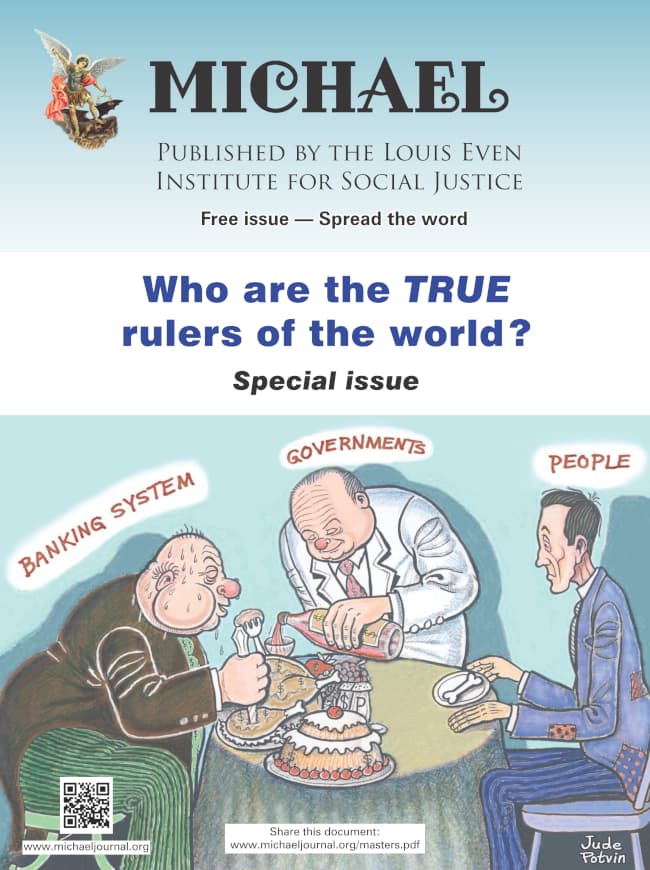

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

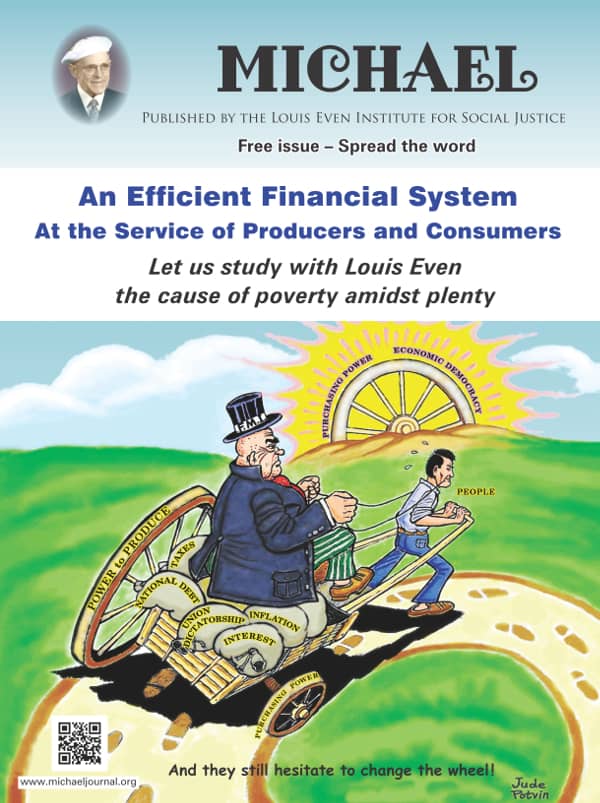

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

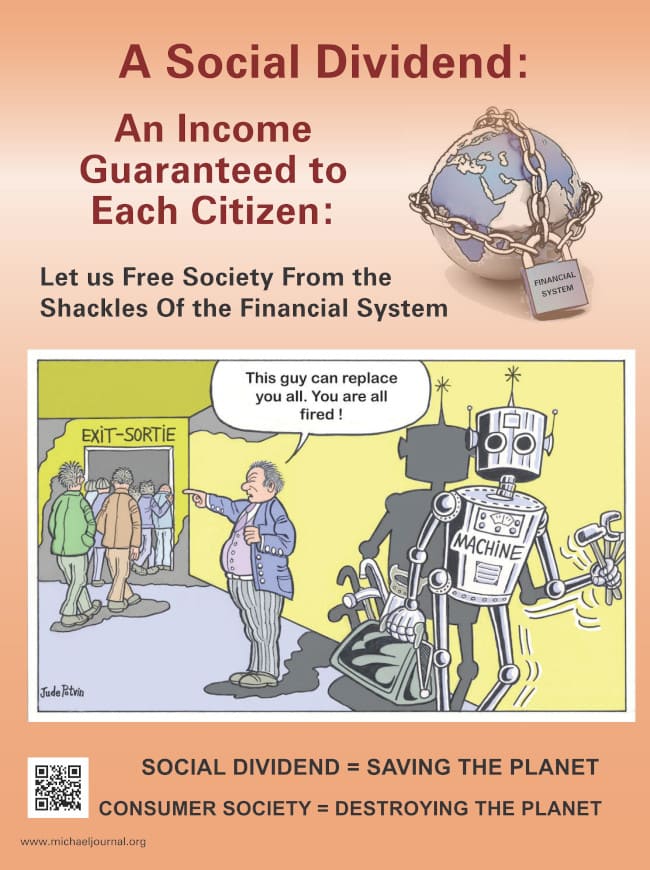

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.