It used to be denied that bankers manufacture money out of thin air, but now that fact is often openly admitted by conservative newspapers. For example, a recent financial page article in the New York Times tells just how the miracle is performed:

"Alone among the operators of financial institutions," the article says,'"a commercial banker can create money simply by making a loan", either to the government or to a businessman or other private borrower.

The article cites this example: "When a businessman asks for $50,000, the banker does not dip into the till and take out cash. Instead, he credits the amount of the loan to the businessman's checking account. Then on the bank's books deposits rise."

In effect, the article explains, the bank has added the $50,000 to the country's money supply, and to the amount of money on which the bank makes an interest profit. Yet, no one put that $50,000 into the bank. The bank created the money by lending it.

Only the commercial banks have that money-manufacturing power, the article points out. When a savings bank makes a loan, it lends real money and has that much less money left to lend. The same is true of a "life insurance company', or any other lender except the commercial banks.

The money created by those banks is in the form of "checking account dollars, which comprise 90 percent of the national money supply", says the article. Economists say that the money created in this way is a chief cause of the "inflation" and rising prices which many bankers like to blame on wage raises won by organized labour.

From LABOR of November 14, 1959

It must be pointed out, however, that wage hikes are, in fact, an element contributing to soaring prices in these days. Ed

Control of financial policy is control of the very lifeblood of the entire economic body.

Pope Pius XI

Reporting from New York for the Daily Express (Nov. 23rd 1959) Peter Chambers says that "automation has advanced so far in the United States that 90 per cent of all light bulbs are made by 14 men operating 14 machines." The International Labour Organisation, in their report, also said that two American workers on a single assembly line can turn out 1000 radios a day. But fears that automation will create widespread unemployment are "unfounded" the report said.

The same day's newspaper, on another page, carried a report from Australia of a speech made in Sydney by Professor Linus Pauling, head of the Department of Chemistry of the California Institute of Technology. He said that even if Russia launched a surprise attack, the United States was capable of destroying the Soviet Union "absolutely".

The United States has a stock-pile of 75,000 atomic bombs, and was manufacturing more than 20,000 a year.

Reading the above, it appears that whatever labour-saving may be achieved by the "swings of automation, it can be lost and absorbed by the "roundabouts" of the new atomic bomb industry. Providing the brotherhood of international High Finance so decide and permit, of course. So we get no rest. Or put in other words, the fear of unemployment is "unfounded". The truth is, every advance of invention — even in the making of simple home necessities — automatically provides an increase in the general economic pool of power. This can be centralised in the hands of a few super financiers, as now, who from such a position can impose fear of unemployment, fear of atomic war, and fear of insecurity on the rest of humanity; or alternatively, such power increases can be distributed as they occur, to all individual consumers of goods and services, by way of Social Credit.

The result would be more leisure, more prosperity, and the beginning of a new age of peace and goodwill amongst men.

George Hickling - Social Credit Notes December 1959

'It cannot be beyond the power of man so to use the vast resources of the world as to ensure the material progress of civilization, No diminution in those resources has taken place. On the contrary, discovery, invention and organization have multiplied their possibilities to such an extent that abundance of production has itself created new problems. "

The late King George VI

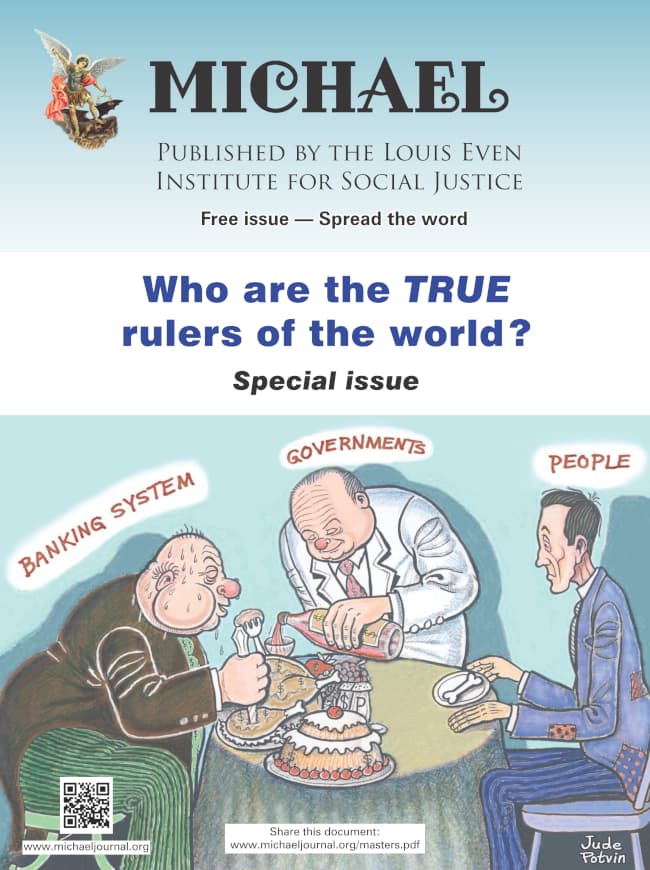

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

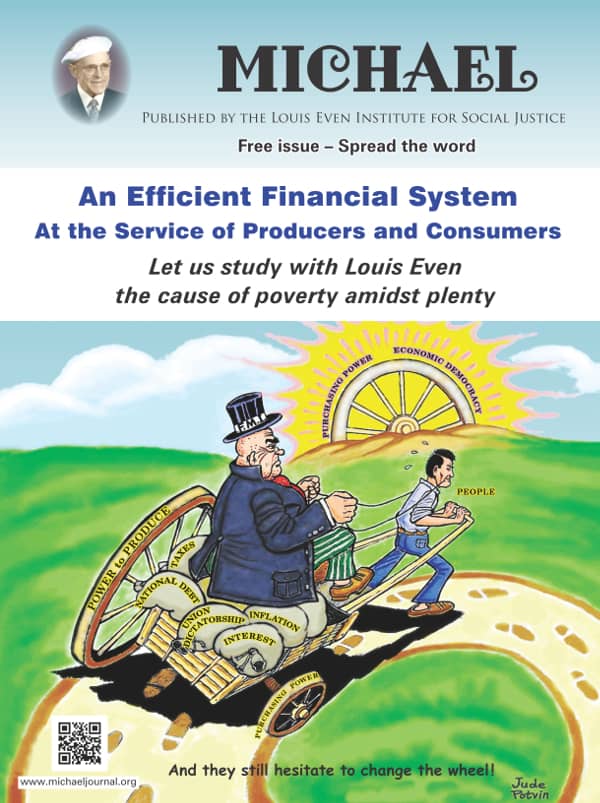

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

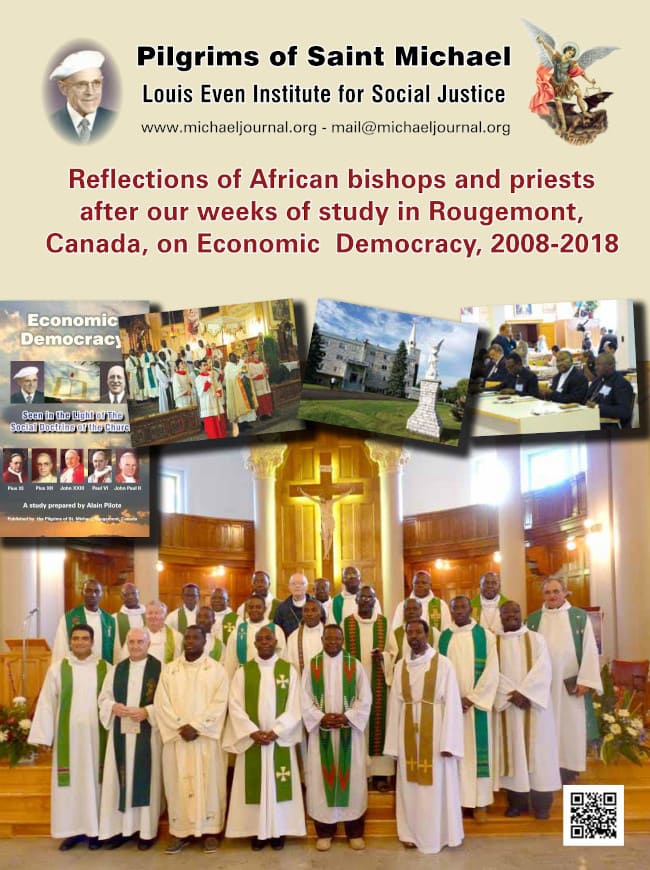

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

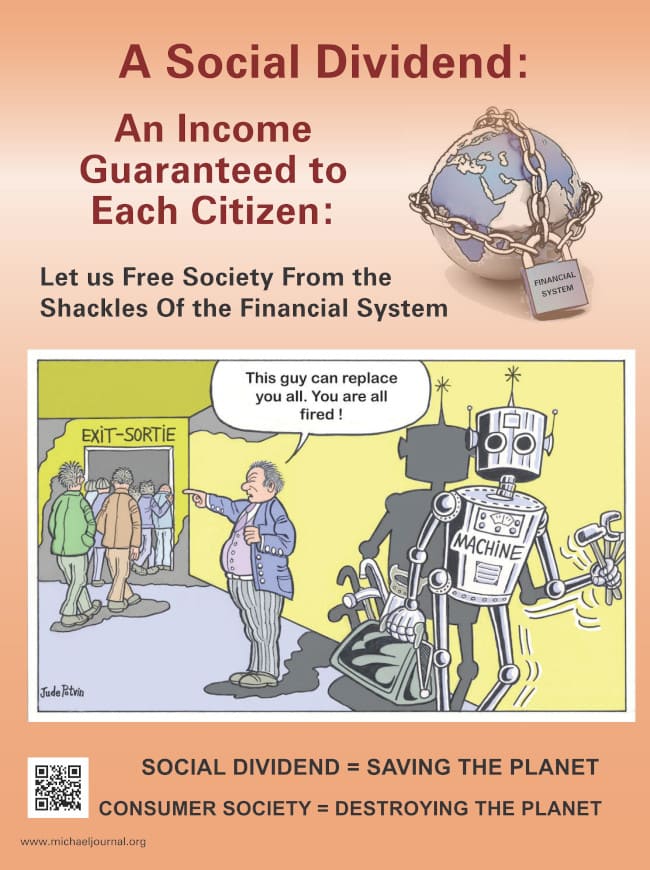

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.