Basic Income is the talk of the day: 4.24 million entries on Google for “Basic Income” alone, another 439 000 for “Universal Basic Income” and 1.87 million entries for “Social Dividend”.

The basic income of the Ontario Basic Income Pilot Project, where basic income is adjusted to other sources of income, is a “means tested” basic income: An amount of money that will raise a citizen out of poverty, poverty being defined as 70% of the median worker’s salary. If the median wage is $33 000, than the poverty line is established at $23 000 for a citizen living alone.

In this case, the citizen who now has a yearly income of $18 000, would receive a supplement of $5 000 so that his basic income might reach a total of $23 000. Whatever the arguments in favor of or against basic income, the fact remains that Social Security and other types of fixed income do not, at present, suffice in keeping people out of poverty.

A Universal Basic Income, for its part, is a set amount of money sent to every citizen of a country whether they need it or not, whatever their age, whether they are employed or not, etc.

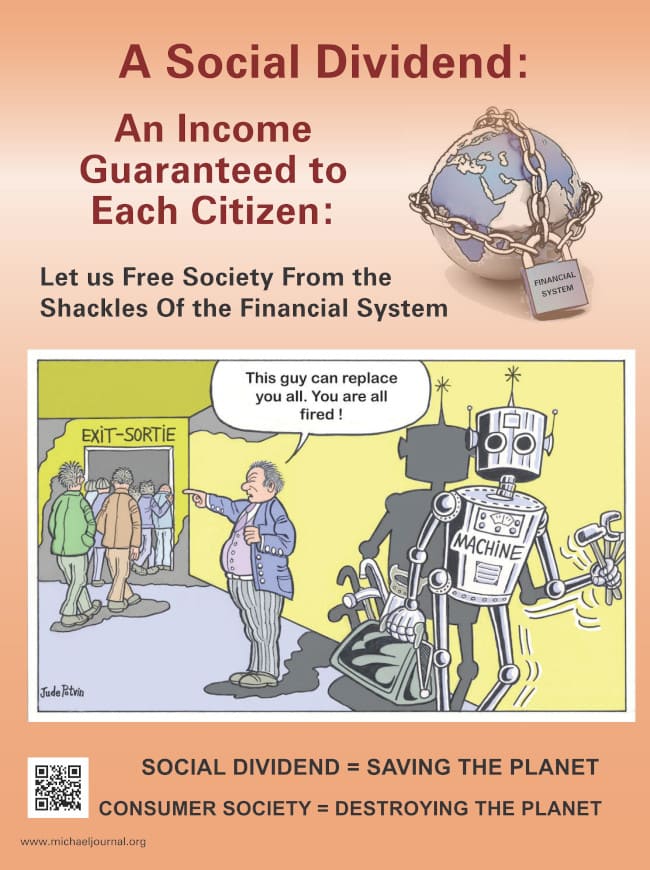

A Social Dividend is more than a basic income, more than a universal basic income. It is the realization that the greater part of production is now being made by machines. Natural resources are a gift of Nature. Technology is passed down from one generation to the next, it is a common good. The two must benefit every single citizen whether employed or not. Social dividends are a basic income “on steroids”, so to speak. Learn more on social dividends by reading: A Social Dividend to All.

Ontario’s Basic Income is a meager supplement of income provided by the Ontario Government, through taxes, ranging from $0 to $23 000 a year. Ontarians are entitled to much more.

If 60% of production is due to progress, as is the case today, than 60% of GDP per capita ought to be distributed in the form of dividends, financed debt-free by the Bank of Canada, by order of the Federal Government.

A basic income, as promoted by the Ontario Basic Income Pilot Project, does not reflect facts. There is a substantial deficit of purchasing power in Ontario: Total GDP of 750 billion dollars, with household incomes of 500 billion dollars. Based on these figures, the Ontario Government could issue some 250 billion dollars to its 14 million citizens: This amounts to $18 000 per person per year or $1 500 per person per month.

The question that remains to be answered is where will the Ontario Government get this much money? The answer to this question can be found in: A Sound and Efficient Financial System

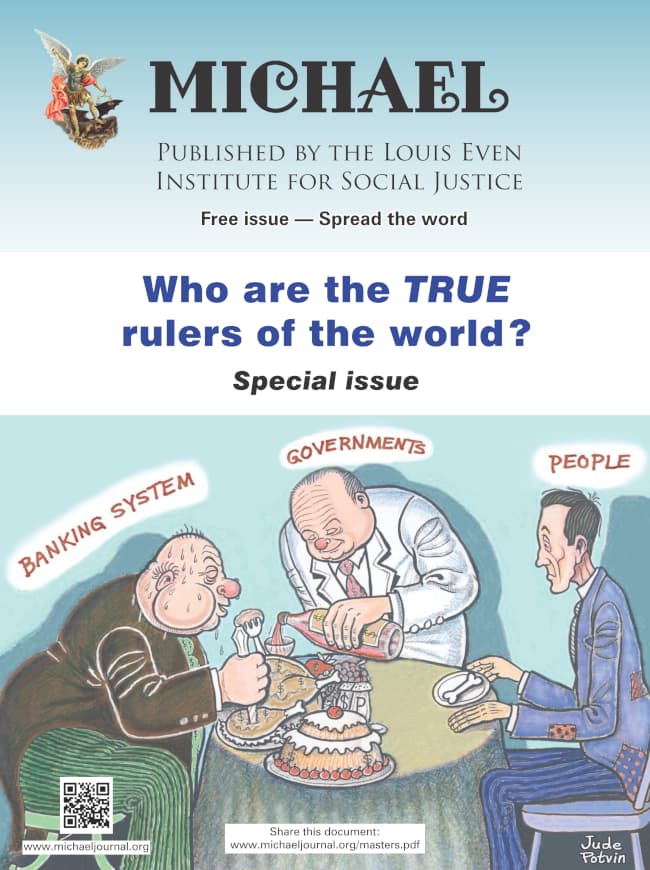

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

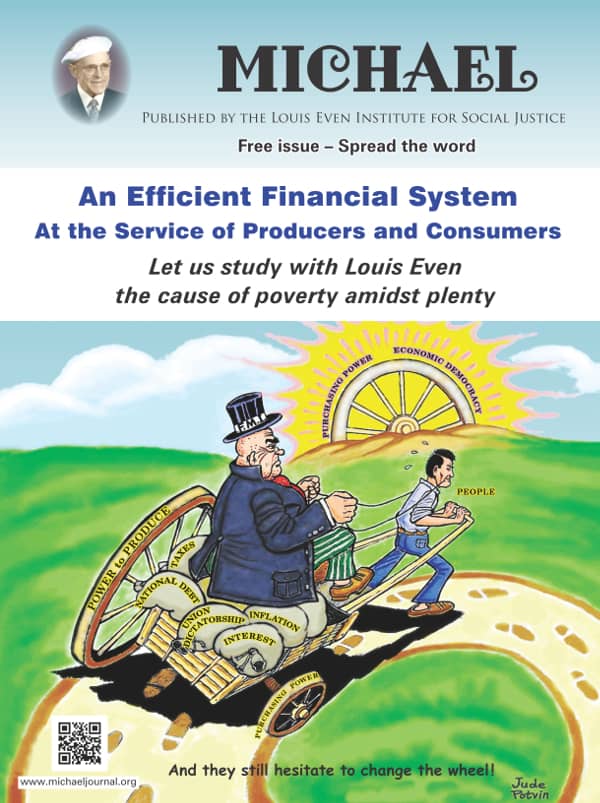

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

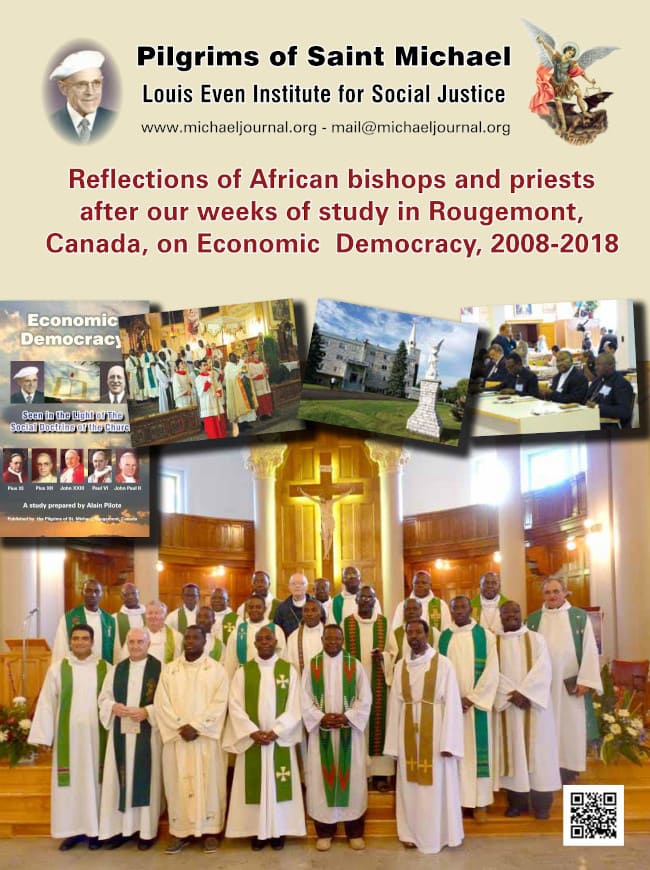

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.