William Patterson, founder of the Bank of England (1694):

“The Bank hath benefits of interests on all moneys which it creates out of nothing."

R. G. Hawtrey, Assistant Secretary of the Treasury of Great Britain, in a broadcast, March 22, 1932:

“I agree with Douglas that Banks create money, and that trade depression arises from faults in the Banking System in the discharge of that vital function.”.

Reginald McKenna, Chairman of the Midland Bank (one of the Big Five Chartered Banks of England), speaking to the shareholders of the Midland Bank, on January 25, 1924:

“I am afraid the ordinary citizen will not like to be told that the banks can, and do, create money. The amount of money in existence varies only with the action of the banks in increasing and decreasing deposits and bank purchases. Every loan, overdraft, or bank purchase creates a deposit; and every repayment of a loan, overdraft, or bank sale destroys a deposit.”

The Report of the MacMillan Committe (England), 1929, page 34, para. 74:.

"... But the bulk of the deposits arise out of the action of the banks themselves, for by granting loans, allowing money to be drawn on an overdraft, or purchasing securities, a bank creates a credit in its books which is equivalent to a deposit.”

Mariner Eccles, then head of the banking system of the United States (Chairman of the Board of Governors of the Federal Reserve System), giving evidence before a Senate Investigating Committee:

“When the banks take a billion dollars of government bonds as they are offered, they credit the United States Treasury with a billion dollars, and charge their Government Bond Account with a billion dollars; or, they create, by a bookkeeping entry, the money with which they buy the bonds."

The Carter H. Harrison Company, Investment brokers of Chicago, in urging their clients to buy bank stocks, say:

"It is essential only to realize that all banks create, out of nothing, the money they lend, even to the government."

H. D. McLeod, in "The Theory and Practice of Banking":

“The essential and distinctive feature of a bank and a banker is to create and issue credit payable on demand, and this credit is intended to be put into circulation and serve all the purposes of money. A bank, therefore, is not an office for the borrowing and lending of money, it is a manufactory of credit."

In "Branch Banking", issue of July 1938:

“There are enough substantial quotations in existence to prove to the uninitiated that Banks do create credit without restraint and that they create the means of repayment within themselves."

From the Report of the Standing Committee on Banking and Commerce of the Canadian House of Commons (Ottawa), March 8 to June 1, 1938. Evidence given by Graham Towers, Governor of the Bank of Canada, and by Dr. W. C. Clark, then Deputy Minister of Finance for Canada:

"Bank deposits constitute by far the largest portion of our money. It is the Bank deposit itself which constitutes money." (pp. 42-43.)

"Actually the total of Bank deposits runs 4 to 5 times the amount of physical money in existence... It is not correct to say that a bank deposit is 'just as good as money'. A bank deposit, or credit at the bank, actually IS money. It is the major kind of money. It is the kind of money with which 95 per cent. of business is done.” (p. 286.)

Question: “But there is no question about it that Banks create the medium of exchange?" — Answer by Towers: “That is right. That is what they are for... That is the Banking business, just in the same way that a steel plant makes steel.” (p. 287.).

"The manufacturing process consists of making a pen-and-ink or typewritten entry on a card or in a book. That is all.” (p. 76 and p. 238.)

“Each and every time a bank makes a loan: (or purchases securities), new bank credit is created — new deposits — brand new money." (Towers, p. 113 and p. 238.)

"Broadly speaking, all new money comes out of a Bank in the form of loans." (Towers, p. 461.) As loans are debts, then under the present system all money is debt. (p. 459.)

Encyclopedia Britannica, under "Money":

"Banks lend by creating credit; they create the means of payment out of nothing."

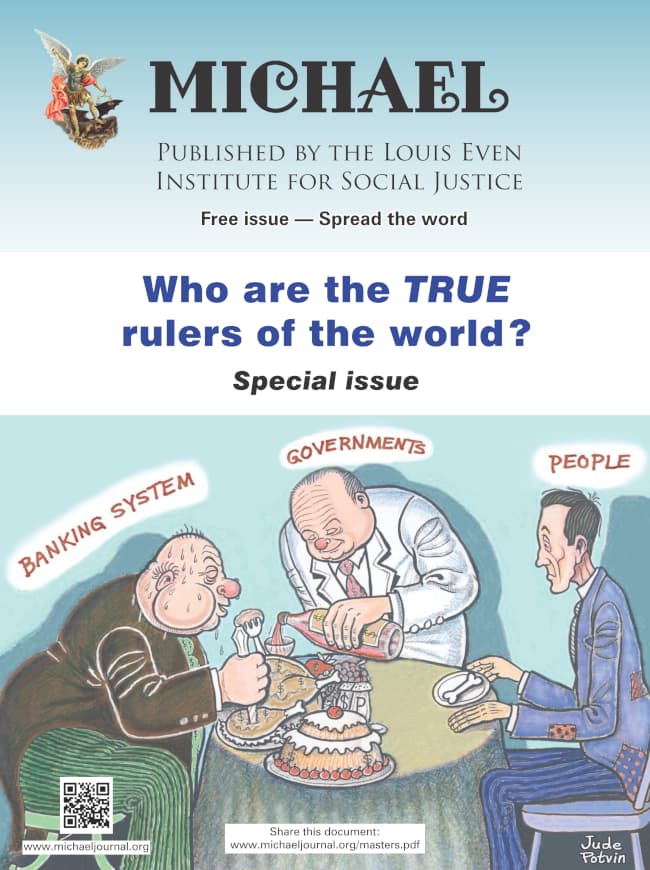

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

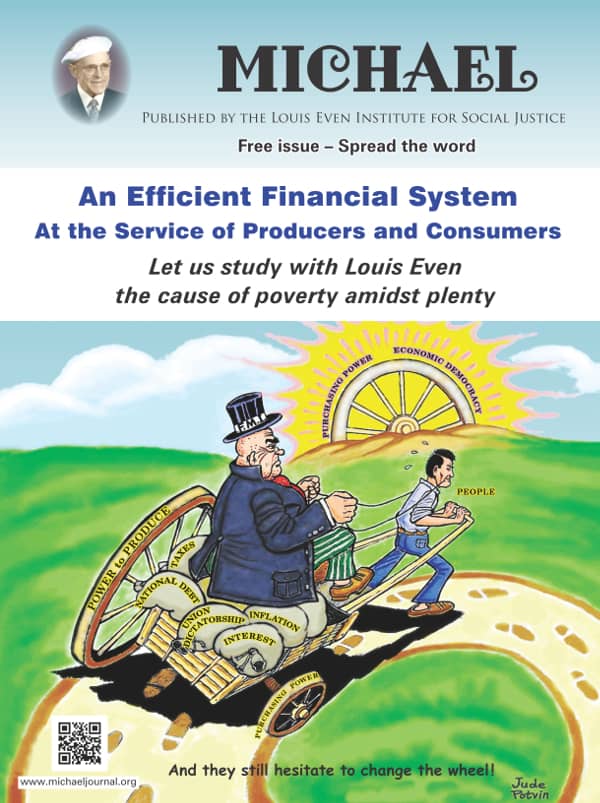

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

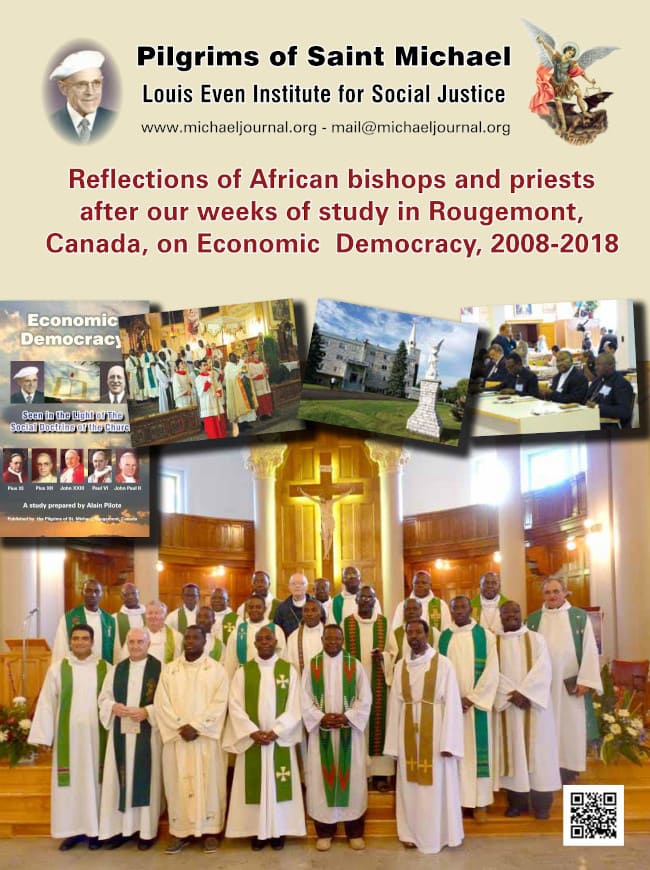

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

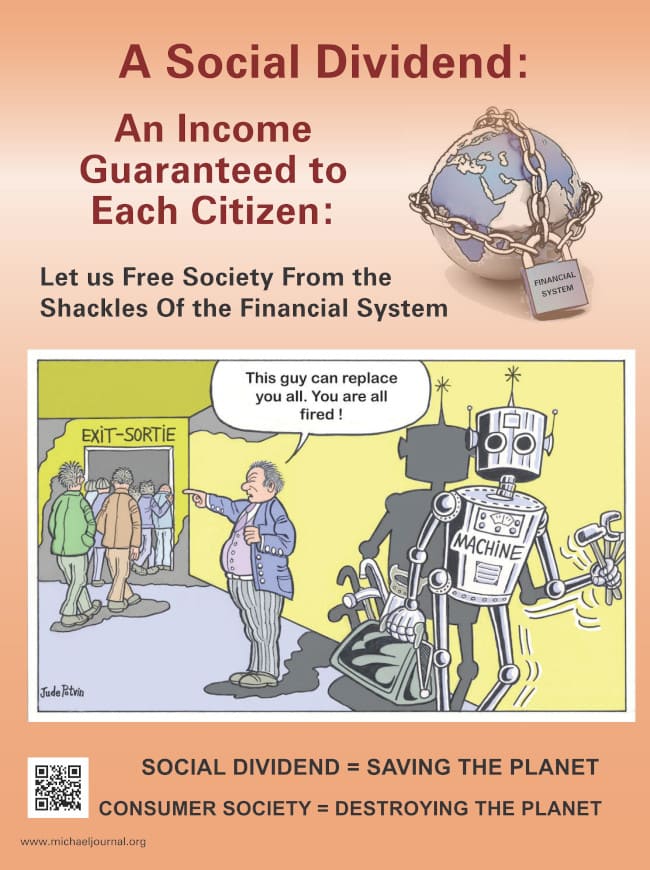

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.