Do goods exist? Do they exist in sufficient quantity to satisfy all of the consumers’ basic needs?

Are we short of anything in our country to satisfy the temporal needs of the citizens? Are we short of food for everybody to eat one’s fill? Are we short of shoes, clothes? Can we not make as much as is required? Are we short of railroads and other means of transportation? Are we short of wood or stones to build good houses for all families? Are we short of builders, manufacturers, or other workers? Are we short of machines?

No, we have all these things, in plenty. Never do the retailers complain that they cannot find enough goods to meet the demand. Grain elevators are bulging. Numerous are the able-bodied men waiting for work. Numerous also are the machines which are at a standstill.

Yet, a great many people suffer! Goods are simply not finding their way into homes.

Of what use is it to tell people that their country is rich, that it exports a lot of goods, that it ranks third or fourth among the world’s exporting countries?

What goes out of the country does not go into the homes of the citizens. What sits idle in the stores does not appear on their tables.

A mother does not feed her children or provide them with shoes and garments by going window-shopping, by reading the advertisements of goods in newspapers, by listening to the description of good products on the radio, or by listening to the sales talk of countless salesmen of all kinds.

Full warehouses, a calamity for the producers while millions of human beings are starving to death

What is lacking is the effective means of laying hands on these goods. You cannot steal them. To get them, you must pay for them: you need money.

There are a lot of good things in our country, but many individuals and families who need these goods lack the right to have them, the permission to get them.

Is there anything lacking but money? What is lacking, apart from the purchasing power to make the products go from stores to homes?

Mankind has gone through periods of food shortage; famines covered big countries, and there was no appropriate means of transportation to bring to these countries the wealth from other sections of the planet. It is no longer the case today. There is an overabundance of everything. It is abundance — no longer scarcity — that creates the problem.

It is not at all necessary to go into detail to demonstrate this fact. There are thousands of cases of voluntary destruction on a large scale "to stabilize markets", by making stocks disappear. Let us give just a few examples:

The Montreal daily "La Presse" of June 7, 1986, reported the case of the potatoes in the Canadian Province of New Brunswick: "Last month… the Federal Government decided to throw away nearly 100,000 tons of potatoes, after having shipped 2,500 dehydrated tons to two African countries. The general mobilization of farmers in New Brunswick, transport companies and volunteers saved nearly 100,000 kilos which were dispatched to soup kitchens and small poorhouses of New Brunswick, Toronto, Ottawa and Montreal. But 90,000 tons, the equivalent of a 10-pound (4.5 kg) potato bag for each Canadian, have been thrown to the garbage…

"The very same week this operation was taking place, 6,000 barrels of 200 pounds (90 kg) of herings were dumped into the Miramichi River in New Brunswick."

Abundance is not confined to Canada; it is the same case in Europe, as was reported in the newspaper in October, 1986, under the title: "World’s starving not consulted":

"Public outrage has erupted over the European Community’s (EC) plan to burn or dump in the ocean the huge surplus mountains of butter, milk powder, beef and wheat piling up across EC nations. A report from the EC’s Brussels headquarters by the European Commission recommends destroying the food, which is rotting and costly to store. US $300 million is said to be the possible saving if dairy products alone were destroyed. The EC already practizes periodic food dumping. Last year it dumped into the sea several hundred tons of deteriorating wheat. Eliminating half of present surpluses is proposed. It is believed that would mean burning 750,000 tons of butter and 500,000 tons of milk powder. Milk quotas haven’t succeeded in draining the EC’s milk lake."

Why all this waste? Why don’t the products join the needs? It is because people have no money. Wealth, goods are laughing in your face, and you starve in front of lofts full to overflowing, if you have got no money. No money, no products: humans starve to death, and products are thrown away.

Look at the cartoon above: Here is a grocer’s store filled with good products in abundance; in front of this store, there is a penniless starving man. Good products are made to be consumed. The grocer displays them to sell them. The consumer would like to purchase them, but he lacks the tickets to purchase them: he has got no money. The result: the good products will not be consumed, and they will rot on the shelves. Yet, everybody would be happier if the situation was different — the grocer would be happy to sell, and the consumer would be happy to buy.

Why is it that something that would make everyone happy cannot take place among human beings?

Let us have a look at the monkeys. They see plenty of bananas on the banana trees. Since they need to eat bananas to live, they simply pick the bananas and eat them.

Monkeys never worked out complicated economic systems in their universities. In their heads of monkeys, they never examined the law of supply and demand, nor the difference between socialism and neo-liberalism. They simply saw good things in front of them, and they were smart enough to pick them in order not to starve.

But a monkey is a monkey, and a man is a man. A monkey has no mind, but a man can misuse his mind.

A monkey is led by its instinct, which does not mislead it. Man is led by his mind, which is often misled by pride. In such a case, man quibbles, uses dialectics, but forgets simple and pure reasoning based on common sense.

This foolish situation of a multitude of starving people amidst plenty of food is caused by the greed of those who base their power on the bondage of the masses. You can say also that this foolish situation is supported and maintained by people allegedly learned in economics, who lead minds to the most stupid conclusions, under the pretence of reasoning with science and wisdom.

This whole situation can also be summed up in the form of a joke, although the conclusion is very serious: A group of monkeys in the jungle were arguing whether men were more intelligent than monkeys. Some said "yes"; others said "no". One of the monkeys said: "To be clear in my own mind, I will go to the city of the humans, and find out if they are really smarter than us." All the monkeys agreed that it was a good idea. So the monkey went and saw a penniless man starving in front of a grocery store filled with bananas. The monkey came back to the jungle, and said to the other monkeys: "Don’t worry, men are not smarter than us; they starve to death in front of bananas that rot on the shelves for lack of money."

Conclusion: Let’s be smarter than the monkeys, and let us devise a money system that will allow us to eat the bananas and all the other products that are provided in plenty by God for all His children. This smart money system exists; it is Social Credit.

We have just shown that what is lacking is not products, but money. This does not mean that money itself is wealth. Money is not an earthly good capable of satisfying a temporal need. As we said in the previous lesson, money is a means, the end is the products.

You cannot keep yourself alive by eating money. To get dressed, you cannot sew together dollar bills to make a dress or a pair of stockings. You cannot rest by lying down on money. You cannot cure a sickness by putting money on the seat of the malady. You cannot educate yourself by crowning your head with money.

Money is not real wealth. Real wealth consists of all the useful things which satisfy human needs.

Bread, meat, fish, cotton, wood, coal, a car on a good road, a doctor visiting the sick, the knowledge of a science — these are real wealth.

In our modern world, each individual does not produce all things. People must buy from one another. Money is the symbol or token that you get in return for a thing sold; it is the symbol that you must give in return for a thing that you want from another.

Wealth is the thing; money is the symbol of that thing. The symbol should reflect the thing.

If there are a lot of things for sale in a country, there must be a great deal of money to dispose of them. The more the people and the goods, the more money in circulation that is required, otherwise everything stops.

It is precisely this balance that is lacking today. We have at our disposal almost as great a quantity of goods as we could possibly wish, thanks to applied science, to new discoveries, and to the perfecting of machinery. We even have a lot of people without occupations, who represent a potential source of goods. We have loads of useless, even pernicious, occupations. We have activities of which the sole end is destruction.

Money was created for the purpose of keeping goods moving. Why, then, does it not find its way into the hands of the people in the same measure as the flow of goods from the production line?

Everything, except God, has a beginning. Money is not God, therefore it has a beginning. Money begins somewhere.

Everything, except God, has a beginning. Money is not God, therefore it has a beginning. Money begins somewhere.

We know the origin of such useful commodities as food, clothing, shoes, books. Workers, machines, plus the country’s natural resources, produce the wealth, the goods we need and which we do not lack.

But then where does money begin, the money that we lack in order to buy the goods that are not lacking?

The first idea that we keep alive in our minds, without really realizing it, is that there is one fixed quantity of money, and that it cannot be changed; as if it was the sun, or the rain, or the weather. This idea is utterly wrong; if there is money, it is because it was made somewhere. If there is not more, it is because those who made it did not make more.

Another prevalent belief about the origin of money is that the Government makes it. This is also incorrect. The Government today does not create money, and complains continuously about not having any. If the Government were the source of money, it would not have sat around idly for ten years in front of the lack of money. (And for example, in Canada, there would not be a $500-billion national debt.) The Government takes and borrows, but it does not create money.

Now, we will explain where money begins and ends. Those who control the birth and death of money also regulate its volume. If they make much money and destroy little, there is more. If the destruction of money goes faster than its creation, its quantity decreases.

Our standard of living, in a country where money is lacking, is not regulated by the volume of goods produced, but by the amount of money at our disposal to buy these goods. So those who control the volume of money, control our standard of living. "Those who control money and credit have become the masters of our lives... No one dare breathe against their will." (Pope Pius XI, Encyclical Letter Quadragesimo Anno).

Money is whatever serves to pay, to buy; whatever is accepted in exchange for goods and services.

The material substance of which money is made is of no importance. In the past, money has at times been made of shells, shark teeth, leather, wood, iron, silver, gold, copper, paper, etc.

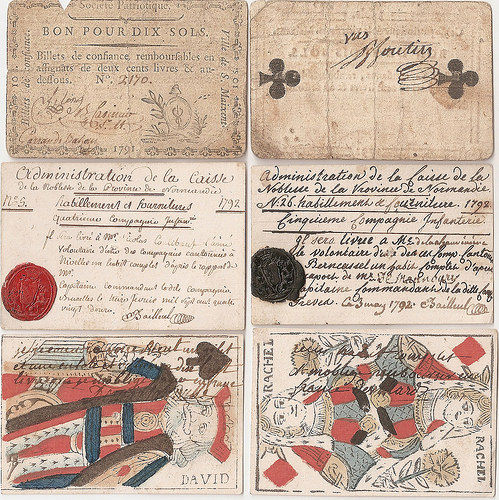

Examples of money in the past

|

Playing-card money was used as currency from 1685 to 1719 in New France, present-day Quebec and Eastern Canada. The Intendant, Jacques de Meulles, was the head of government in New France. In 1685, he had run out of gold and silver coins to pay his employees, mostly soldiers. Faced with this problem, he thought up a creative solution. He wrote "promises to pay" on the backs of playing cards and signed them. He then ordered everyone in New France to accept these emergency notes in payment. source: http//www.currencymuseum.ca/eng/learning/digit.php |

|

Salt was used as currency in Abyssini (now Ethiopia) until the 1920s. In some areas, salt was so rare it was worth its weight in gold. In fact, because salt is so essential for preserving food and maintaining health, the ancient Romans paid their soldiers a "salarium" — a portion of their pay used to buy salt. Thus, the English word "salary" — fixed pay for regular work — come from the Latin word "salarium." |

|

In the 1800s, the Chinese authorities used tea bricks to pay the Mongolian troops in their service. Tea bricks were used for making payments, but they could be used to brew tea as well. Tea is a favourite drink in most Asian countries. For this reason, tea bricks were a popular form of currency for a long time. In the 1870s, a camel could be bought for 120 to 150 tea bricks, a sheep for 12 to 15 bricks, a pipe for 2 to 5 bricks. |

These notes were used in the Chinese Empire, in what is now Eastern China, from 1368 to 1450 during the Ming Dynasty. The Chinese invented paper about 200 AD and were also the first to use paper money, introducing it over a thousand years ago. They called this money "fei-ch'ien" which means "flying money." This refers to its ease of transportation. This note represented 1 kwan (a string of 1,000 won that weighed 3.5kg). It was much easier to leave the actual coins in a safe place and then use a printed piec of paper to represent them. These notes were used in the Chinese Empire, in what is now Eastern China, from 1368 to 1450 during the Ming Dynasty. The Chinese invented paper about 200 AD and were also the first to use paper money, introducing it over a thousand years ago. They called this money "fei-ch'ien" which means "flying money." This refers to its ease of transportation. This note represented 1 kwan (a string of 1,000 won that weighed 3.5kg). It was much easier to leave the actual coins in a safe place and then use a printed piec of paper to represent them. |

There are at present two kinds of money in Canada: one we call pocket money, made of metal or paper; and the other we shall call book money, made of figures in a ledger. Pocket money is the least important; book money is the most important (over 95%).

Book money is the bank account. Business operates through bank accounts. Whether pocket money circulates or not depends on the state of business. But business does not depend upon pocket money; it is kept going by the bank accounts of businessmen.

Book money is the bank account. Business operates through bank accounts. Whether pocket money circulates or not depends on the state of business. But business does not depend upon pocket money; it is kept going by the bank accounts of businessmen.

With a bank account, payments or purchases are made without using metal nor paper money. Buying is done only with figures.

Let us suppose I have a bank account of $40,000. I buy a car worth $10,000. I make my payment by writing a cheque. The car dealer endorses the cheque, and deposits it at his bank.

The banker then makes changes in two accounts: first, that of the car dealer, which he increases by $10,000; then mine, which he decreases by $10,000. The car dealer had $500,000 — he now has $510,000 written in his bank account. I had $40,000 in mine — my bank account now shows $30,000.

Paper money did not move in the country because of this deal. I simply gave some figures to the car dealer. I paid with figures.

More than nine-tenths of all business is done this way. It is book money, the money made of figures, which is modern money; it is the most abundant money; its volume is ten times that of paper and metal money. It is a superior type of money, since it gives wings to the other. It is the safest kind of money, the one that no one can steal.

Book money, like the other type of money, has a beginning. Since book money is a bank account, it comes into existence when a bank account is opened without money decreasing anywhere, neither in another bank account nor in anyone’s pocket.

The amount in a bank account can be increased in two ways: by saving and by borrowing. There are other ways, but they can be classified under borrowing.

The savings account is a transformation of money. I bring along some pocket money to the banker; he increases my account by this amount. I no longer have that pocket money; I have book money at my disposal. I can get back pocket money by decreasing the amount of book money in my account. It is a simple transformation of money.

But since we are trying to find out how money comes into existence, the savings account, being a simple transformation of money, is of no interest to us here.

The borrowing (or loan) account is the account lent by the banker to a borrower. Let us suppose I am a businessman. I want to set up a new factory. All I need is money. I go to a bank and borrow $100,000 under security. The banker makes me sign a promise to pay back the amount with interest. Then he lends me the $100,000.

The borrowing (or loan) account is the account lent by the banker to a borrower. Let us suppose I am a businessman. I want to set up a new factory. All I need is money. I go to a bank and borrow $100,000 under security. The banker makes me sign a promise to pay back the amount with interest. Then he lends me the $100,000.

Is he going to hand me the $100,000 in paper money? I do not want it. First, it is too risky. Furthermore, I am a businessman who buys things at different and widely far-flung places, through the medium of cheques. What I want is a bank account of $100,000 which will make it easier for me to carry on business.

The banker will therefore lend me an account of $100,000. He will credit my account with $100,000, just as if I had brought that amount to the bank. But I did not bring it; I came to get it.

Is it a savings account, set up by me? No, it is a borrowing account made by the banker himself, for me.

This account of $100,000 was made, not by me, but by the banker. How did he make it? Did the amount of money in the bank decrease when the banker lent me $100,000? Well, let us ask the banker:

This account of $100,000 was made, not by me, but by the banker. How did he make it? Did the amount of money in the bank decrease when the banker lent me $100,000? Well, let us ask the banker:

— Mr. Banker, have you any less money in your vault after having lent me $100,000?

— I haven’t gone into my vault.

— Have other people’s accounts been reduced?

— They remain exactly as they were.

— Then what was decreased in the bank?

— Nothing was decreased.

— Yet my account has been increased. From where did the money you lent me come?

— It didn’t come from anywhere.

— Where was it when I came into the bank?

— It didn’t exist.

— And now that it is in my account, it exists. So we can say that it was created.

— Certainly.

— Who created it, and how?

— I did, with my pen and a drop of ink when I inscribed $100,000 to your credit, at your request.

— Then you create money?

— The banks create book money, the money of figures. That’s the modern money that puts into circulation the other type of money by keeping business on the move.

The banker manufactures money, ledger money, when he lends accounts to borrowers, individuals, or governments. When I leave the bank, there will exist in this country a new source of cheques, one that did not exist before. The total amount of all accounts in the country was increased by $100,000. With this new money, I will pay the workers, buy materials and machinery — in short, build my new factory. Who, then, creates money? — The bankers!

| Previous chapter - The end of economics: To make goods join those who need them | Next chapter - Banks create money as a debt |