John Ruiz Dempsey BSCr, LL.B, a criminologist and forensic litigation specialist filed a class action suit on behalf of the People of Canada alleging that financial institutions are engaged in illegal creation of money.

The complaint filed Friday April 15, 2005 in the Supreme Court of British Columbia at New Westminster, alleges that all financial institutions who are in the business of lending money have engaged in a deliberate scheme to defraud the borrowers by lending non-existent money which are illegally created by the financial institutions out of "thin air."

The suit which is the first of its kind ever filed in Canada which could involve millions of Canadians alleges that the contracts entered into between the People ("the borrowers") and the financial institutions were void or voidable and have no force and effect due to anticipated breach and for non-disclosure of material facts.

Dempsey says the transactions constitute counterfeiting and money laundering in that the source of money, if money was indeed advanced by the defendants and deposited into the borrowers' accounts, could not be traced, nor could it be explained or accounted for.

The suit names Envision Credit Union ("Envision"), a credit union; Laurentian Bank of Canada ("Laurentian Bank"), Royal Bank of Canada ("Royal Bank"), Canadian Imperial Bank of Commerce ("CIBC"), Bank of Montreal ("BOM"), TD Canada Trust ("Canada Trust") and Canadian Payment Association ("CPA") as civil conspirators.

The plaintiff in the lawsuit is seeking recovery of money and property that was lost by way of confiscation through illegal "debt" collection and foreclosure. The Plaintiff is also seeking for the return of the equities which rightfully belong to the People of Canada, now being held by the defendant financial institutions as constructive trustees without color of right.

At all material times, these defendant banks and all of them have no legal standing to lend any money to borrowers, because:

1) these banks and credit unions did not have the money to lend, and therefore they did not have any capacity to enter into a binding contract;

2) the defendants did not have any cash reserve, they are not legally permitted to lend their depositor's or member's money without expressed written authorization from the depositors, and:

3) the defendants have no tangible assets of their own to lend and all their "assets" are "paper assets" which are mainly in the form of "receivables" created by them out of "thin air," derived out of loans whereas the monies loaned out were also created out of thin air.

Other than bookkeeping and computer entries, no money or substance of any value was loaned by the defendants to the Plaintiff. In all of the loan transactions entered into between the plaintiff and the Defendants, the financial institutions did not bring any equity to any of the transaction.

The complaint alleges that the loan transactions are fraudulent because no value was ever imparted by the defendants to the Plaintiff; these defendants did not risk anything, nor lost anything and never would have lost anything under any circumstances and therefore no lien has been perfected according to law and equity against the plaintiff.

The foreclosure proceedings which comes as a result of the borrower defaulting on such fraudulent loans were carried out in bad faith by the defendant banks and credit unions, and as such, these foreclosures were in every respect unlawful acts of conversion and unlawful seizure of property without due process of law which always results in the unjust enrichment of the defendants.

The suit alleges that the defendants utilize fraudulent banking practices whereby they deceive customers into believing that they are actually receiving "credit" or money when in fact no actual money is being loaned to their customers. However, the complaint describes a practice whereby there is realistically no money other than ledger or computer entries being loaned to the borrowers.

See the complete article here: https://www.ignboards.com/threads/canada-class-action-accuses-banks-of-illegal-creation-of-money.250259714/

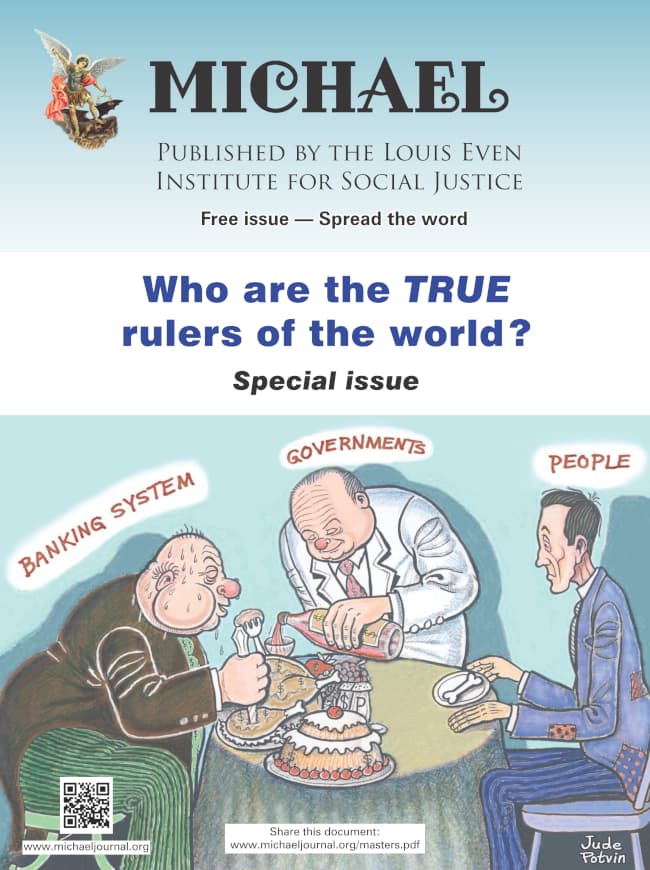

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

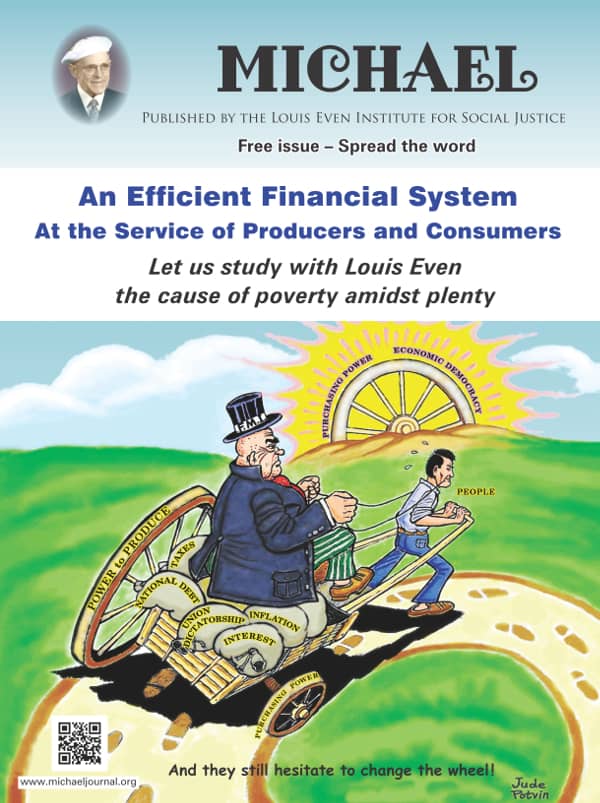

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

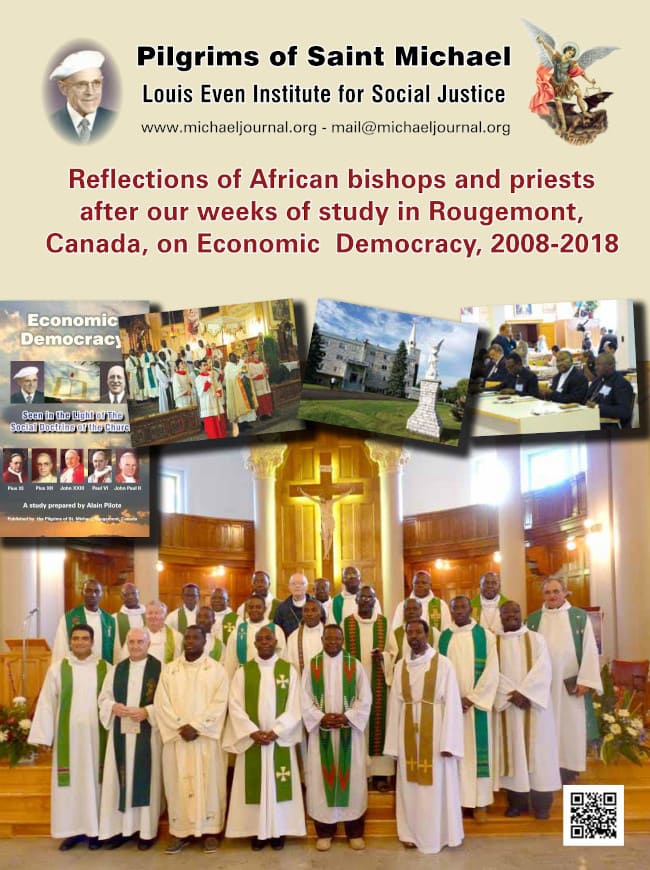

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

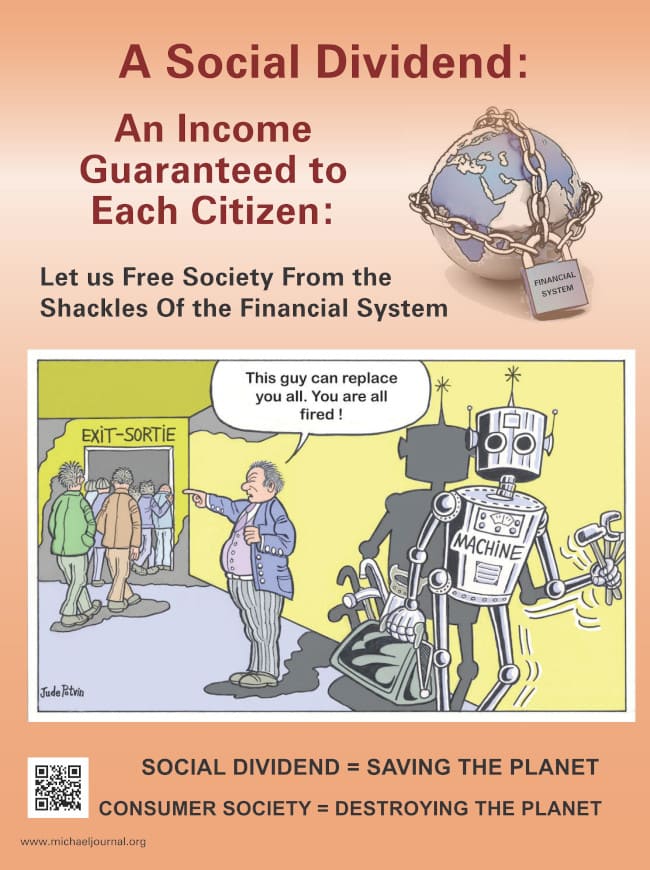

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.

Comments (1)

Adelchi Di Palma

506 8603 8769 WhatsApp. I am in Brantford On for a short time but will be going back to Costa Rica soon.

reply