14

Free issue of MICHAEL

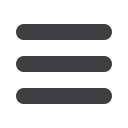

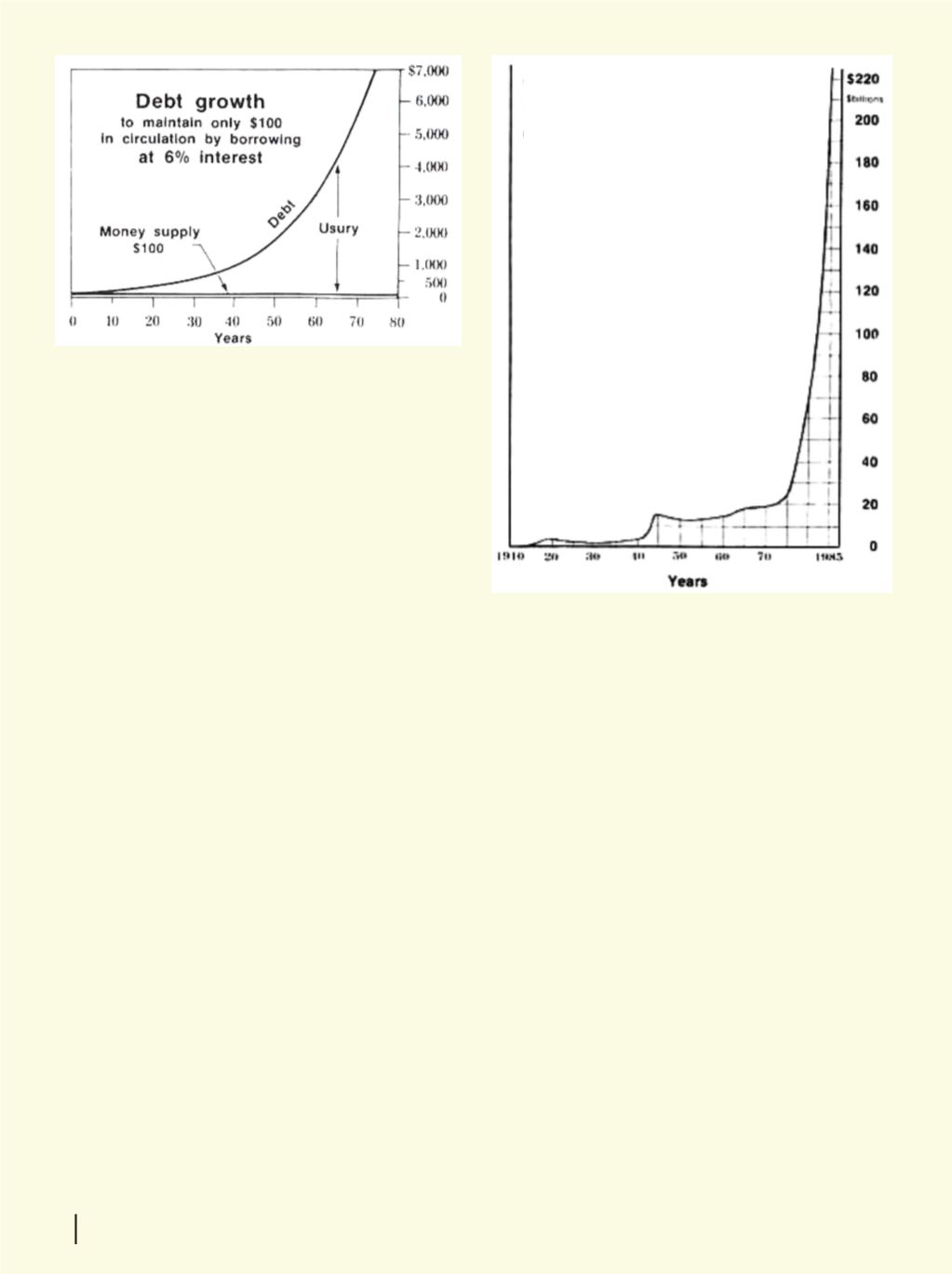

w ww.michaeljournal.o rgThe curve is quite flat at the beginning, but then

becomes steeper as time goes on. The debts of all

countries follow the same pattern, and are increas-

ing in the same way. Let us study, for example, Can-

ada’s public debt.

When Canada was founded in 1867 (the union of

four provinces — Ontario, Quebec, New Brunswick,

and Nova Scotia), the country’s debt was $93 mil-

lion. The first major increase took place during World

War I (1914-18), when Canada’s public debt went up

from $483 million in 1913 to $3 billion in 1920. The

second major increase took place during World War

II (1939-45), when the debt went up from $4 billion in

1942 to $13 billion in 1947. These two increases may

be explained by the fact that the Government had to

borrow large sums of money in order to take part in

these two wars.

But how can be explained the phenomenal in-

crease of these last years, when the debt almost in-

creased ten times, passing from $24 billion in 1975

to $224 billion in 1986, in peacetime (then $575 bil-

lion in 1996), when Canada had no need to borrow

for war ? It is the effect of

compound interest

, like

in the example of the island in

The Money Myth Ex-

ploded

.

Debts of federal governments represent huge

sums, but they are only the peak of the iceberg: If

there are public debts, there are also private debts !

The Federal Government is the biggest single bor-

rower, but not the only borrower in the country:

there are also individuals and companies. In the

United States, in 1992, the public debt was $4 tril-

lion, and the total debt was $16 trillion, with an

existing money supply of only $950 billion. In 2006,

the debt of the U.S. government reached $17 tril-

lion, and the total debt (states, corporations, con-

sumers) was over $100 trillion!

In his November 1993 report, Canada’s Auditor

General calculated that of the $423 billion in net

debt accumulated from Confederation to 1992, only

$37 billion went to make up the shortfall in program

spending. The remaining $386 billion covered what

it has cost to borrow that $37 billion. In other words,

91% of the debt consisted of interest charges, the

Government having spent only $37 billion (8.75% of

the debt) for actual goods and services.)

Fortuantely, more and more people understand

this fraudulent scheme of creating money as a debt.

example, Mr. Gilbert Vik of Cathlamet, Washington,

wrote a few years ago, this very interesting letter:

“For every person in our country, there is

$20,000 of money in existence. Sounds good! But

there is $64,000 of debt ! Apply your $20,000 to the

debt, and that money will cease to exist, leaving

you without any money and $44,000 of debt. Your

options are to forfeit your assets or borrow more

money to attempt to pay. You cannot borrow your-

self out of debt !

“Since the method of money creation is itself

the cause of the ever-increasing debt, it is not pos-

sible to correct the problem using any method that

deals with money after it has been created.

“Working harder will not correct it. Working

longer hours will not correct it. Having a job for

everyone in the family will not correct it. Neither

raising nor lowering wages will correct it. Full em-

ployment will not correct it. Less spending will not

correct it. More spending will not correct it.

(And

the list goes on...)

Canada

Public debt

(in billions of dollars)

1867: S93 million

1913: $483 million

1920: $3 billion

1942: $4 billion

1947: $13 billion

1975: $24 billion

1986: $224 billion

u

w

w .michaeljournal.orgFree issue of MICHAEL