Because it does not attain its goal.

The goal of a financial system is to finance the production and distribution of goods that satisfy needs.

If the financial system succeeds then the goal is achieved, if it doesn’t succeed the goal is not achieved. In doing anything else the goal is missed.

Because there are public and private goods that are required by the population and that can readily be made but are not because the financial system will not finance their production.

Moreover, there are goods offered to a population that need them, but some individuals or families cannot obtain these goods because the system does not finance their consumption. These facts can not be denied.

Through Means of Payment in the form of coins, paper money or cheques drawn on bank accounts.

These Means of Payment can be termed Cash Credits because everyone accepts them. The word ‘credit’ implies confidence. One equally accepts four quarters, a one-dollar bank note or a one-dollar cheque drawn on any bank where the cheque’s signer has a bank account. With any of these three Means of Payment a producer can pay for labour or materials for the value of one dollar and customers can purchase consumer goods for the value of one dollar.

Financial Credit draws its value from Real Credit, that is to say, from the country’s productive capacity. Money, regardless of the form, has value only because the country’s production can supply goods equal to that value. This productive capacity can be called Real Credit. It is a country’s Real Credit, its productive capacity, which causes a person to believe he can earn a living in that country.

Real Credit is the property of society. There is no doubt that individual and group efforts have contributed to it. But without natural resources, which are a gift from Providence and not the result of individual competence, without organized society which allows for the division of labour, and without public services such as schools, roads, transportation systems, etc., the global productive capacity would be considerably less.

This is why we speak of national production and a national economy. These terms do not mean state controlled production. It is in this global productive capacity that each citizen finds a basis for the confidence he has that his material needs will be satisfied. This is what led Pope Pius XII to say in his 1941 Pentecost Sunday radio broadcast:

“The national economy, the fruit from the activities of men who work together in the national community, tends toward no other thing than to secure, without interruption, the material conditions in which the individual life of the citizens will be able to fully develop.”

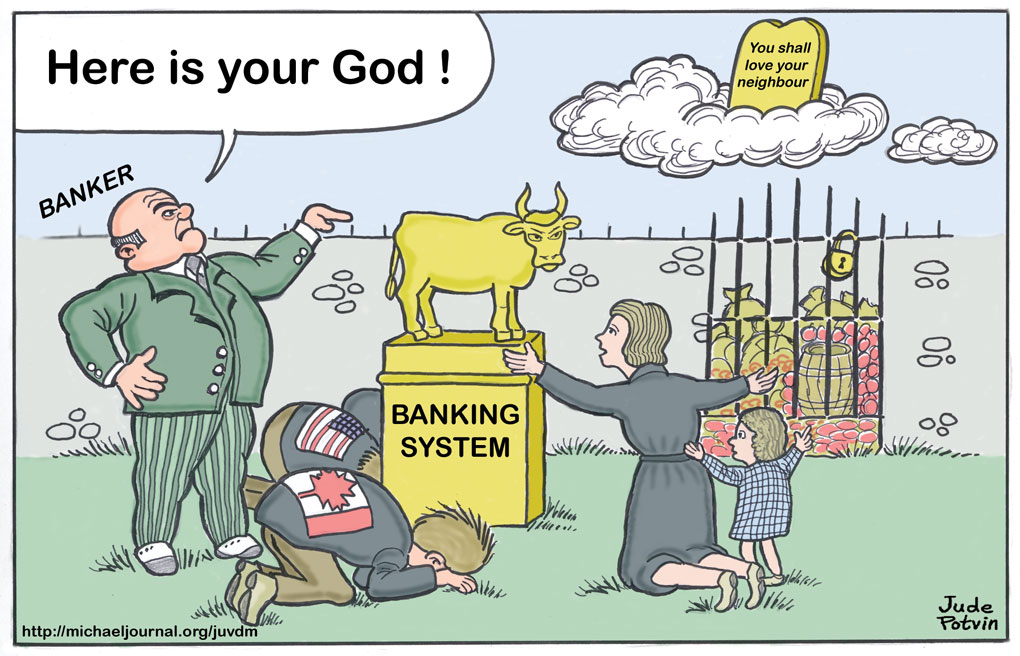

At its source, Financial Credit, like Real Credit from which it draws its value, belongs to all. It is a communal good from which all members of the community must benefit in one way or another.

In the same way that “real credit” is a social credit, financial credit, by its very nature, is also a social credit. It belongs to all the members of society.

The use of this common good must not be subjected to conditions that hinder the productive capacity or divert production from its proper goal. This goal is to fulfill private and public human needs in the order of their urgency. Basic needs are to be satisfied first before the extravagant needs of a minority and before the grandiose projects of public administrators.

This can be accomplished through a financial system that guarantees to each individual a share of the community’s Financial Credit. This share needs to be large enough to allow each individual to obtain whatever is necessary to satisfy basic needs from his country’s production.

Such a financial system would dictate nothing. Production would organize itself according to the requirements established by consumers for private goods. Similarly, it would organize itself according to requirements established by public administrations regarding public works. On the one hand, the financial system would serve to express the will of consumers, and on the other hand it would be used by producers to mobilize the country’s productive capacity in order to meet those consumers’ requirements.

For this we need a financial system that reflects reality. This financial system would not contradict facts and would be sustainable. It would distribute needed goods and serve man.

Yes. Its broad outlines were developed by Clifford Hugh Douglas, the master and genius who introduced the world to what is known as Social Credit. Douglas summarized in three proposals the basic principles of a system needed to meet these goals and that would be flexible enough to adjust itself to the economy in all its stages regardless of the degree of mechanization, or automation.

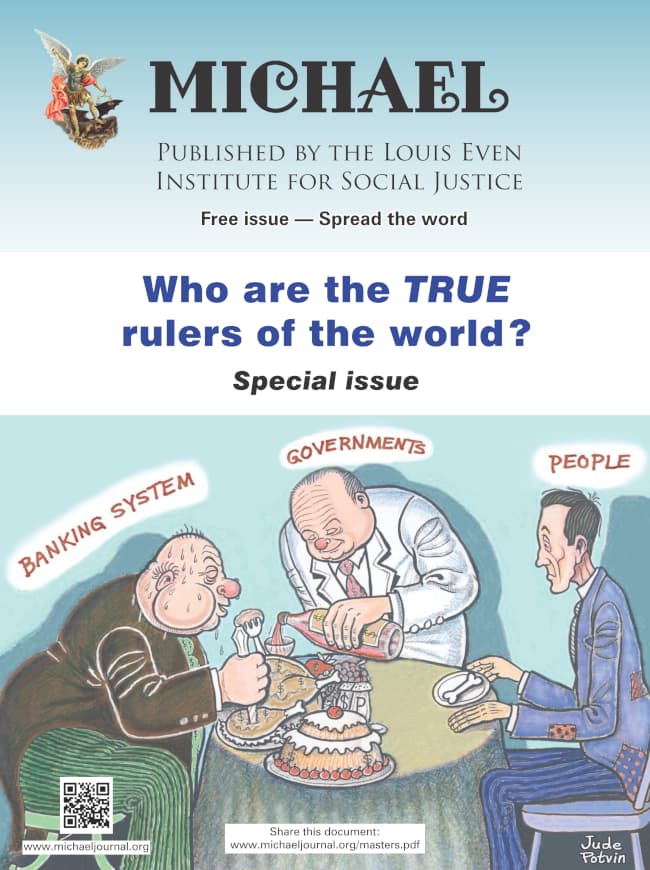

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

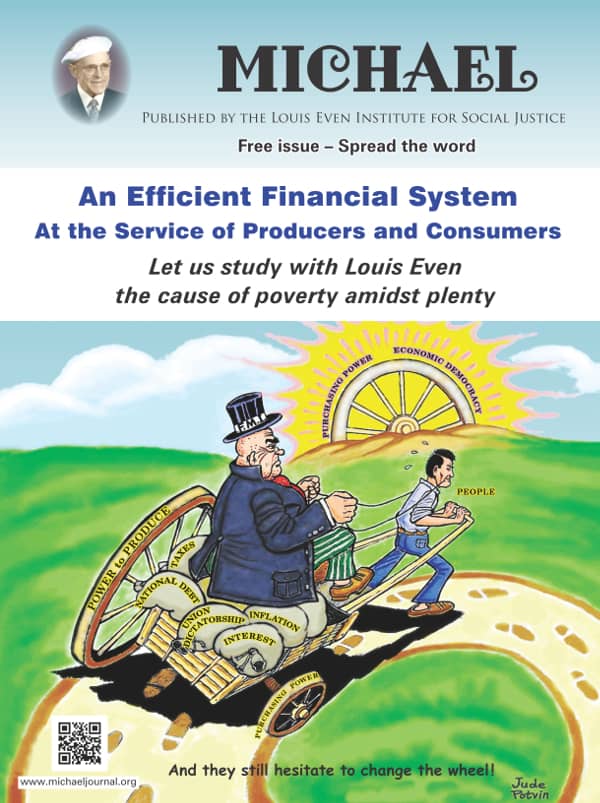

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

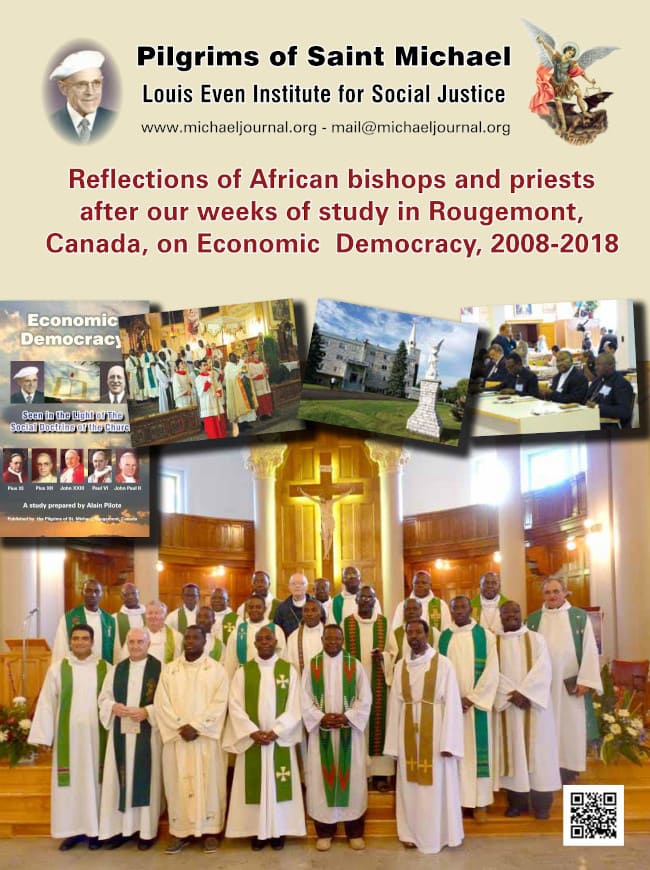

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

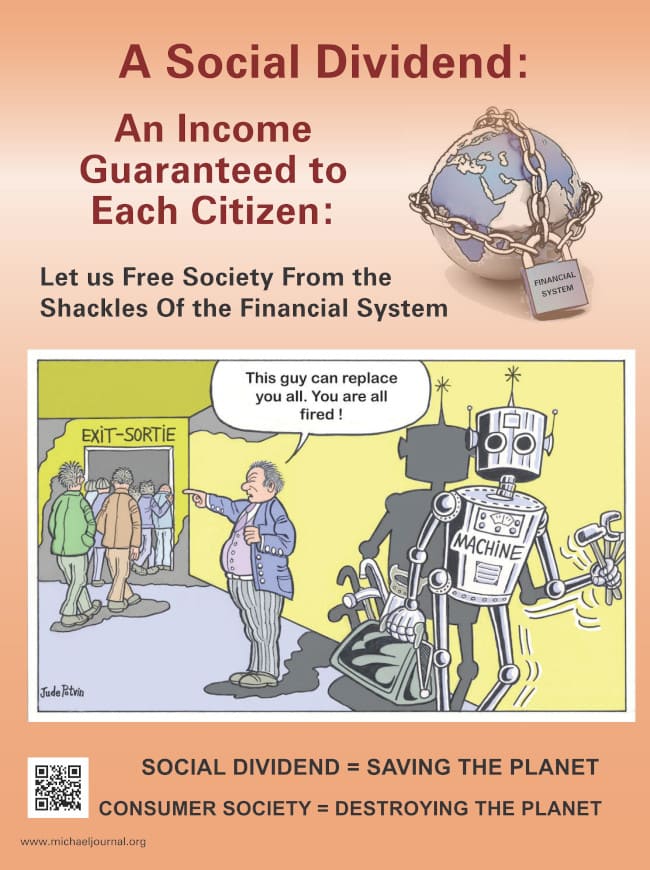

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.