|

|

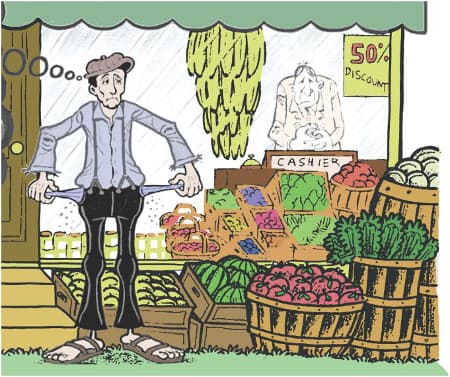

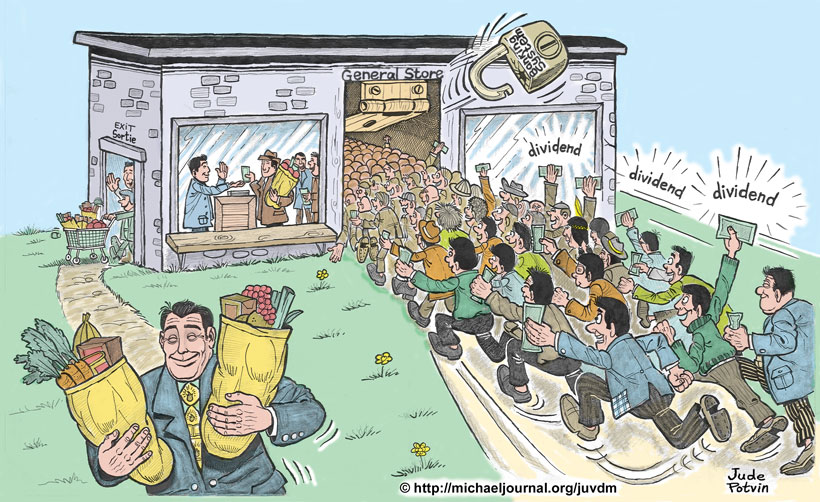

| In a Social Credit system, nobody would be put aside and all, rich or poor, as co-heirs of natural wealth and progress, would receive a dividend. | |

Precisely. It is because all members of society are “co-capitalists” of a real and immensely productive capital that all are entitled to a Dividend.

We have said repeatedly that, at its origin, Financial Credit is the property of society as a whole. This is so because Financial Credit is based on Real Credit which is the country’s productive capacity. In part, this productive capacity is made up by those who take part in production. But it is increasingly made up of other elements that are the property of all individuals.

First of all, natural resources are not made by any man but are a gift from God. This gift must be at the service of all. There are also the inventions created, developed, and shared from one generation to the next. This is the biggest factor of production. Of this progress no man can claim ownership as it is the fruit of many generations.

No doubt some people are needed to set progress in motion and these individuals are entitled to wages and salaries. But a capitalist who does not personally take part in the industry where he made investments is entitled nonetheless to a share of the results because of his invested capital.

Yet, the greater part of the real capital in modern production is the total of the discoveries and accumulated inventions that allow us to obtain more goods with less work. All human beings share in this ever increasing capital and therefore all are entitled to a share in the fruits of production.

The employee is entitled to this Dividend and to his salary. The unemployed person receives no salary, but is entitled to a social Dividend since it is derived from a social capital.

Yes it is. And it is the most direct and concrete means by which every human being is guaranteed his fundamental right to a share of the goods of the earth. Every individual person possesses this inalienable right not as an employee but simply as a human being.

Yes it is. And it is the most direct and concrete means by which every human being is guaranteed his fundamental right to a share of the goods of the earth. Every individual person possesses this inalienable right not as an employee but simply as a human being.

“Every man, as a reason-gifted being, has from nature the fundamental right to make use of the material goods of the earth. Such an individual right can in no way be suppressed, not even by the exercise of other certain and recognized rights over material goods.” (Pius XII radio broadcast, June 1, 1941)

Other rights, such as the right to property, the right of the wage earner, the right of the shareholder, etc., can in no way suppress the right of individuals “to make use of the material goods of the earth.” The Pope duly added: “It is left to human will and to the juridical forms of peoples to regulate more in detail the practical realization of this right.” (Ibid.)

That is to say, it is up to the people, through laws and regulations, to choose the methods that will allow each man to exercise his right to a share in earthly goods.

The Dividend would achieve this. No other system has come close to being as efficient, not even the social security laws.

We do well to recognize the right of each individual to basic necessities. No one can deny this. But try to exercise this right in today’s world when you have neither money nor the means with which to produce necessary goods. As well, today, the means of production are increasingly concentrated into fewer hands.

In this modern world the fundamental right to make use of material goods is made impossible without money. Money is, indeed, an agreed upon “permit” to exercise what is a natural right.

The periodic social Dividend is a basic income guaranteed to everyone as a birth right and is an income sufficient to cover at least the basic necessities of life. It is the foremost demand made by Social Credit economics and recognizes the undeniable fact that all human beings are the co-heirs of past generations.

Well, tell a capitalist that he is getting something for nothing when he is paid a dividend as a return on his invested capital! On the contrary, he would claim that an injustice was committed if he was to be refused his dividend.

The same is true of each member of society, as co-capitalist and co-heir of a real capital. This capital is far more essential than the dollar bill or other monetary symbols that have representative value only.

An economy based solely on exchange cannot be a humane economy, given that more than half of the population have nothing to exchange. This is the case for children, mothers at home, the disabled and the sick, the unemployed, older workers and for the able-bodied men who have been replaced by machinery. An economy based strictly on exchanges, an economy of “nothing for nothing” can only be called barbaric. Such an economy sacrifices individuals to rules that are oriented to money instead of to people.

The French Thomist philosopher, Jacques Maritain, speaking on the topic of the distribution of goods as it relates to social justice came to a similar conclusion:

Jacques Maritain Jacques Maritain |

“It is an axiom for the ‘bourgeois’ economy and the mercenary civilization that one has nothing for nothing; an axiom linked to the individualistic conception of ownership. We think that in a system where the conception of ownership outlined here above (with its social function) would be in force, this axiom could not survive. On the contrary, the law of ‘usus communis’ would lead us to lay down that, at least and above all for what concerns the basic, material and spiritual needs of the human being, it is right to get for nothing as many things as possible.

“For the human person to be thus served in his basic necessities is, after all, only the first condition of an economy that does not deserve to be labelled barbarous. The principles of such an economy would lead to a better grasp of the profound sense and the essentially human roots of the idea of heritage in such a way that every human, upon coming into the world, may be able to effectively enjoy in some way the condition of being an heir of the past generations.“ (“Integral Humanism” 1936, p. 205-206)

Absolutely not, since increasing wages only affects the wage earner and gives nothing to the unemployed. Moreover, because all wage increases are added to prices the gap between prices and purchasing power remains.

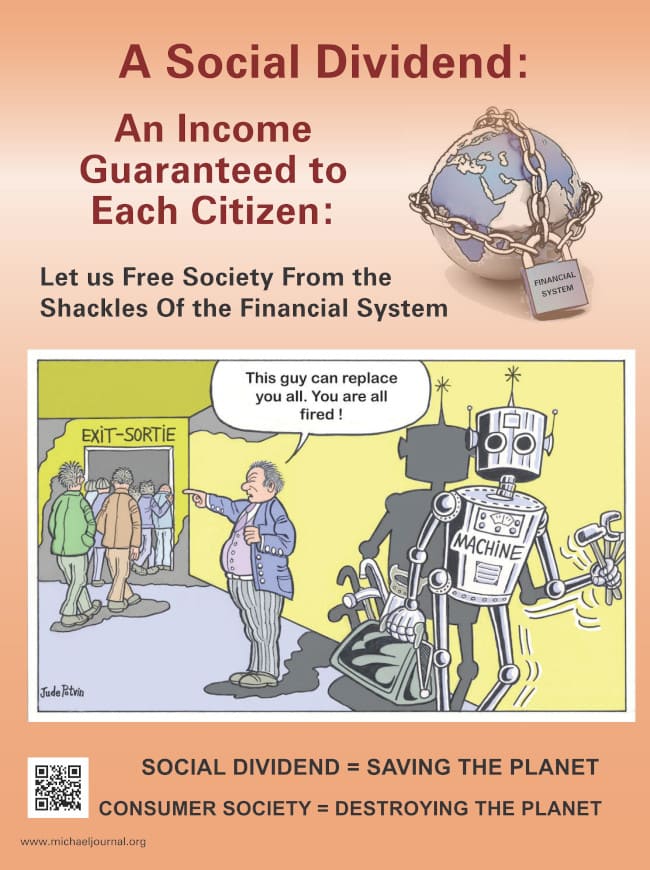

An individual income not linked to employment, such as a social Dividend given to all, is increasingly called for as productivity increases.

For those who say “we must work for a wage”, we ask how will production be distributed when we have full automation? We are not there yet, but automation is advancing at an increasing speed. The distribution of purchasing power must reflect this reality.

Not only is raising wages in order to increase purchasing power not a solution it is also an injustice. If wages are a reward for labour they would normally decrease as the amount of work decreases. All wage increases are a theft of the people’s Dividend. Douglas said: “The dividend shall progressively displace the wage and salary”.

Much could be said about a Dividend to all. It is a question that startles those who have never examined their faulty economic ideas.

And what value is there in the objection of those who persist in seeing “unearned” money as being immoral? Do they see as immoral the bequeathing of an inheritance of a father to his child who has never contributed to create this inheritance? Do they see as immoral the dividends paid to millionaires who have never produced any real wealth? Do they see anything immoral in the lavish salaries of civil servants who do absolutely nothing for the people who pay these salaries with their taxes? And how many more questions of this nature could be asked of those who are against the Dividend?

This is happening now. Those who are employed by production receive salaries, but capitalists receive dividends on their capital, even if they don’t participate in production. If the capitalist is also an employee he receives an income in two ways: through money linked to his job and through money linked solely to the dollars he has invested.

The same would apply under a Social Credit system except that all citizens, simply for being members of society and being the co-owners of progress, would receive a periodic Dividend.

The same question now causes friction between capitalists and workers. The capitalists say: “Without our money there would be no jobs and therefore no production.” The workers say: “Without work there would be no products.” In fact, both capital and labour are production factors, and it is usually agreed that the greater share of the money distributed must go to the workers who are also in greater numbers.

Under a Social Credit system, it is the capitalists, all citizens, who would be in greater numbers. In Canada, there are approximately 12 million wage earners, out of 30 million Canadians [in 1964]. There are therefore 12 million workers and 30 million capitalists.

Moreover production is due increasingly to the real capital that belongs to the 30 million people rather than to the work done by the 12 million workers. If purchasing power was made to reflect with precision the part of production that is the result of progress, which is a common capital, and the part that results from the efforts of those who take part in production the total amount given as social Dividends would have to be much greater than the total amount given as wages and salaries.

Do not jump to unfounded conclusions. It is incorrect to say that the individual who is not working would get more money than the one who is employed. Both would have a Dividend and one would have a Dividend plus a salary.

The incentive created by a salary would still exist. With time the wage earner would come to understand the need for a Dividend as his sense of society grew.

A Dividend, based upon the dominant part played by the real communal capital as a modern factor of production, would therefore be a generous amount.

A dividend, based upon the dominant part that the real communal capital plays as a modern factor of production, would therefore constitute a generous amount.

We can understand that the transition from a low-carb food plan to high energy food might require some adjustments. One does not go from hospital food to a normal diet without first making similar adjustments.

Wisdom requires that the amount of the Dividend be increased gradually.

The Dividend must first be applied. We must fully embrace an economy of “plenty”, of Dividends to all, leaving behind an economy of scarcity where income is limited to employment.

Douglas states in the third proposal which would be in conformity with the facts:

«The distribution of cash credits to individuals shall be progressively less dependent upon employment. That is to say that the dividend shall progressively displace the wage and salary, as productive capacity increases per man-hour. »

This means that an increasing portion of purchasing power would come from Dividends and a decreasing portion would come from employment.

In his 1933 outline for Scotland, Douglas considered that a Dividend given to every man, woman, and child would comprise one percent of the country’s total assets. In his words:

«The dividend thus obtained might be expected to exceed three hundred pounds per annum per family. »

In Canadian dollars this amounts to $1,450 per year or $121.50 per month. This breaks down to a $25.00 Dividend per month for every man, woman, and child in Scotland.

Douglas wrote this in 1933. Traslated into Cdn dollars, this would mean an annual amount of $1,450 per family, that is to say, $121.50 a month; or (with an average of five people to a family), a $25.00 monthly dividend to every man, woman, and child in Scotland.

If this amount was thought to be reasonable in 1933, it should be at least $50 a month in 1964 as the cost of living has doubled in the last twenty years. As well, the productive capacity has also increased meaning there are more products to be distributed.

This was, in Douglas’ mind, an initial Dividend, which should increase as the productive capacity per man-hour increased. [Ed. Note: The $50 cited above for 1964, equal to $1,200 in 2017, is a very conservative estimate. 60% of GDP per capita would be closer to reality, that is: 60% of $50,000 = $30,000 per capita per year, or $2,500 per month for every man, woman and child in the country.]

Considering Canada’s productive capacity the periodic Dividend should guarantee now and in the future the money needed to satisfy all of the citizen’s normal needs. This would simplify and decrease the bureaucracy of the social security system making the government more efficient. Social involvement and personal responsibility would flourish.

An example will help us understand: Let us suppose that over the period of one year a workforce of 100,000 men had an output of 100,000 production units. And the following year twice as many workers, that is 200,000 men, had twice the output of 200,000 production units. The productive capacity per man-hour would be exactly the same for both cases.

But if in the second year we obtained a two-fold output of 200,000 production units with a workforce of 100,000 men, then the productive capacity per man-hour would have doubled.

Or, if in the second year we obtained the same output as during the first year, i.e. 100,000 units, but with half the workforce of 50,000 men, then the productive capacity per man-hour would also have doubled.

The productive capacity per man-hour increases each year in all industrialized countries. One can lower the number of employees or lower the number of working hours without reducing total production. With the same number of work hours production will increase.

This increase is not the result of a greater effort made by each worker but comes from advances made by the use of mechanical and technical tools. We are all co-heirs and co-owners of this progress. We should benefit from this increase by receiving a larger monthly Dividend.

Not necessarily although there are reasons that could justify this under a Social Credit system. But by leaving wages at their present level any increase in the monthly Dividend as the country’s productive capacity increases would lower the ratio of total wages to total purchasing power.

The ratio of total wages to total purchasing power must be taken into consideration in a system that wants to be consistent with economic realities.

A factory employing 100 men at 40 hours a week (4,000 man-hours) producing 8,000 units, yields 2 units per man-hour.

By adding automated machinery, 70 men working 30 hours (2,100 man-hours) will produce 10,500 units.

Here, 2,100 man-hours, rather than 4,000, increased production to 10,500 units, giving an output of 5 units per man-hour instead of the 2 units we had before.

Productivity that went from 2 units to 5 units per man-hour is certainly not the fruit of more labour. It was due to advanced techniques and to progress which is a communal capital that grows with each generation and which is increasingly productive.

This increase in productivity should benefit the owners of this communal capital, namely everyone. To this social capital, must be associated a social Dividend.

We see that 3 production units out of 5 are due to technical advancements and modernization of the above factory. It is fair to reward the producers, employers and employees with 2/5 of the production. The whole community, producers and non producers alike, should have a share in a Dividend that corresponds to the remaining 3/5 of the production.

This is only an example to make us understand Douglas’ proposal which says that as the output increases per man-hour the percentage of purchasing power distributed in Dividends must increase and the percentage in wages and salaries must decrease.

If this proposal by Douglas had been adopted 40 years ago, in 1924, the economic situation would have evolved quite differently from what we have witnessed. Instead of wage increases to workers who have less employment, we would have seen increasing Dividends issued to all, including workers, their wives and their children.

There would have been less inflation as every person would be provided with enough purchasing power. As well, production would correspond to the community’s needs.

If purely financial obstacles had been removed, the quantity of goods made and distributed would have been greater, limited only by the physical capacity to produce or by the saturation of consumption.

The wage earners would have lost nothing. Like the capitalists they would have received more Dividends than wages.

In the way that would be considered the most practical and required the least bureaucracy. The preferred way is the one requiring the least number of changes in how the Means of Payment are transferred.

Family Allowances are paid monthly to mothers for their underage children. Old Age Security payments and other similar allowances for the blind and disabled are also paid monthly to each eligible person and the same can be done for the monthly Dividend.

We can also resort to the commercial banks. Each citizen would be registered at a local bank. Each month, the commercial bank would simply credit each account with the amount determined for the monthly Dividend. Here again, commercial banks would obtain interest free credits from the Central Bank and deposit a monthly Dividend in each of the accounts in their jurisdiction. Commercial banks would be paid by the Central Bank to render this service.

Another way the monthly Dividend could be paid would be by using the postal service. This is the method that Douglas advocated in his scheme for Scotland: “The dividend shall be paid monthly by a draft on the Scottish Government credit, through the post office.”

Using today’s computers, banks can easily find a fast, safe, accurate and efficient way to distribute a monthly Dividend to each individual. It would undoubtedly be easier to distribute a Dividend to a co-capitalist than it is to collect taxes from a citizen.

It would be an increase of money in the consumer’s wallet, and I do not believe that the people who will benefit from this will complain. It is not when your income is raised that one is hurt. Have you ever heard anyone complain about an increase in income? It is when prices go up that everyone complains.

Cost prices would not be affected as social Dividends are not paid by either retailers or manufacturers. Salaries, stocks and shares given to money brokers are, in fact, issued by industry. The Dividend is not included in the cost price. It would be issued by the Central Bank, the property of the people.

In today’s system, restrictions are in place where none are needed. None exist where some are needed. Increases of consumer money could give rise to an unwarranted increase in retail prices. But in a Social Credit system, prices are determined by true cost accounting and the sales price is kept in check by the Price Adjustment mechanism.

Yes, whatever the amount of production, there is always a substantial part of it that was made thanks to real communal capital. It is only the case where production stops that the basis for the Dividend would disappear. In this case, the basis for wages and salaries would also disappear since there would be no production.

Of course, when production is low the total purchasing power must be low to be consistent with reality. In such a case, both Dividends and salaries can understandably be lower than during a period when production is plentiful. One can only distribute products when they exist.

Some Social Crediters have mistakenly presented the Dividend as the distribution of the increase in annual production only. This growth can justify an increase in the Dividend as we have seen. Whatever the amount of production, there is always a part owed to social capital, and therefore there is a portion of production that always justifies a social Dividend.

Others have said that the Dividend would distribute the money lacking in purchasing power needed to become equivalent to retail prices. This is not correct either. The Dividend certainly contributes to filling the gap between prices and purchasing power, but this is not its purpose. And even if there was no gap between prices and purchasing power, each citizen would still be entitled to a Dividend for the reasons cited above.

To guarantee a Dividend is one of the functions of a sound financial system, as stated in Douglas’ third proposal. To establish or maintain the equilibrium between the sum of prices and purchasing power is another function [Douglas’ first proposal]. The Social Credit method accomplishes both functions, through simple accounting operations to Financial Credit which, we must remember, reflects the country’s Real Credit.

Previous chapter - Circulation of Money |

Next chapter - Taxes under Social Credit |

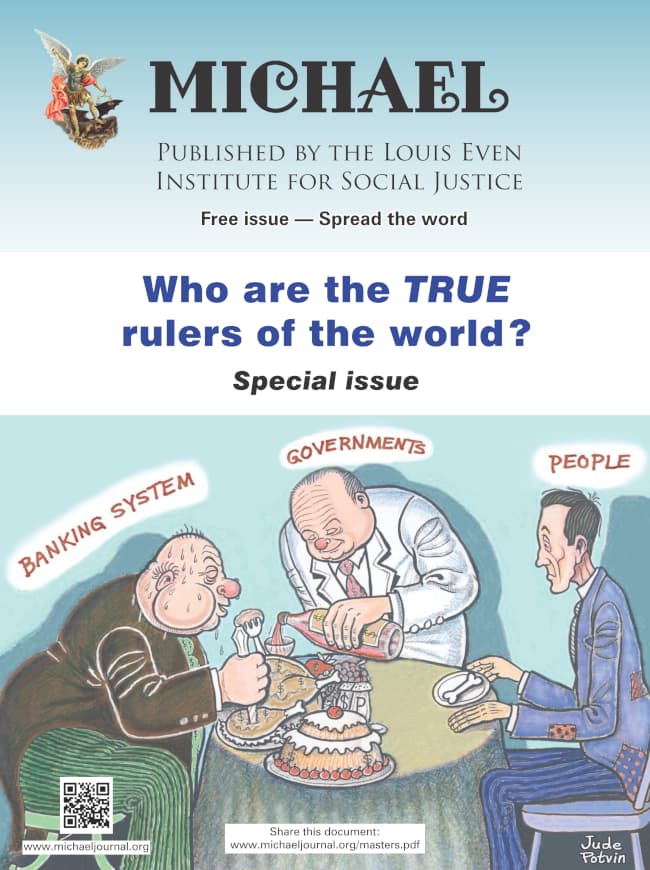

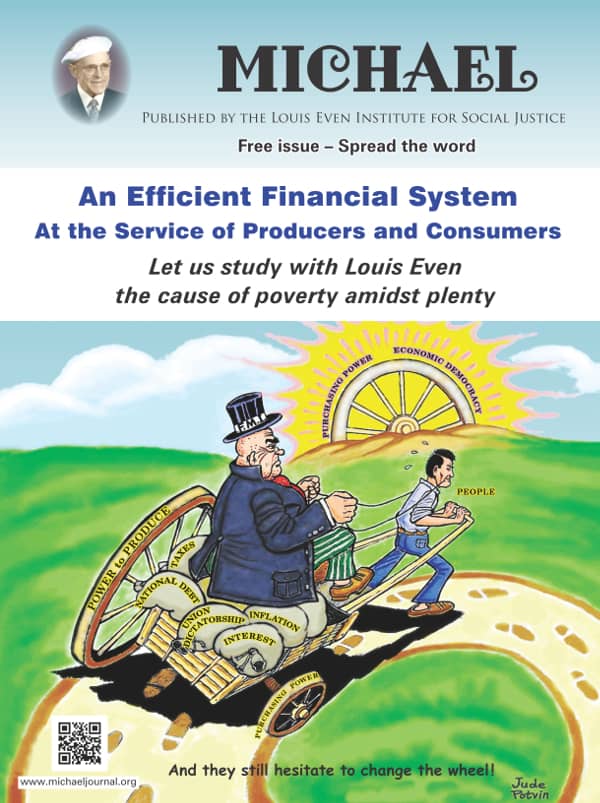

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

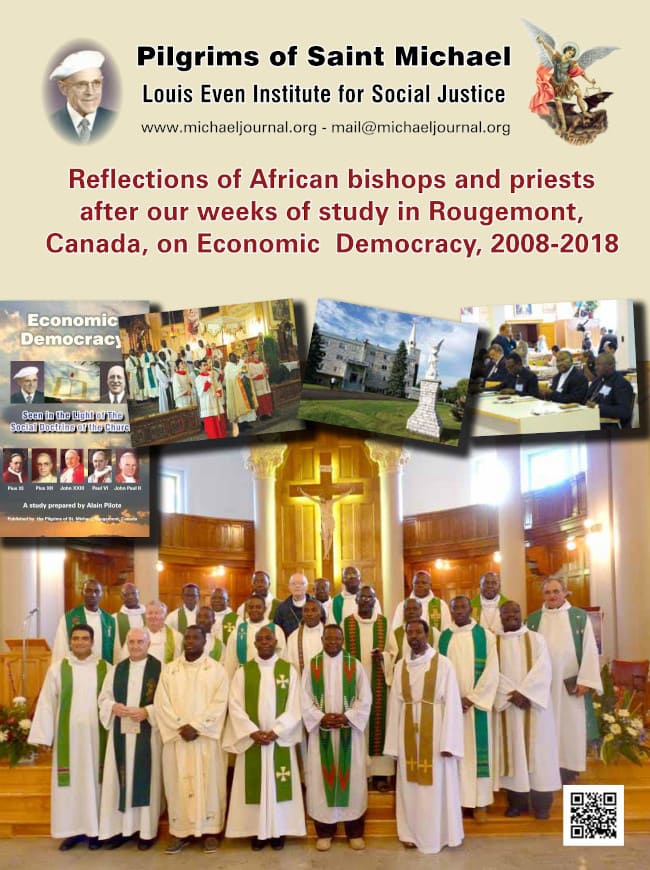

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.