Foreword

ForewordThe financial system discussed in this booklet is generally known as Social Credit. Its principles were set forth by the Scottish engineer and economist Clifford Hugh Douglas and have not been applied anywhere to date. They were first published in 1918 and since then have been taught throughout the world by followers of Social Credit.

Douglas’ proposals would eliminate all financial problems where no physical limitations on production or distribution exist. His system puts finance in the role of service to the economy.

Douglas developed his proposals without much consideration given to their implementation. He pointed out that methods of implementation would vary according to place and established customs, etc., and could be modified, when necessary, if the principles were respected.

The Social Credit publications, “Michael” and “Vers Demain”, and similar writings have generally refrained from discussing methods for establishing a financial system that conforms with Douglas’ principles.

We believe that our role is foremost to explain what people need to obtain from their economic activities. We also wish to explain the reasons why people are entitled to the benefits which we will describe.

How to implement Douglas’ proposals is a matter for experts rather than one for politicians or for governments. Politicians and governments can tell the experts what is required and the experts will determine how to implement what is expected.

Bearing this in mind, Douglas addressed a meeting of Social Crediters in these words: “The bankers themselves will establish Social Credit — once, of course, they receive the order to do so.”

Douglas suggested that in order to get out of the financial rut in which individuals and governments found themselves during the 1930’s, the government should assemble a few of the country’s leading bankers, lock them up and keep them locked up until they found a remedy to the evils that afflicted the world!

Herein we will discuss how Douglas’ proposals may be implemented. How can a constant equilibrium between prices and purchasing power in the public’s hands be achieved? How can new production be financed, not with savings, but with newly created Credits?

Our goal is simply to demonstrate that it is possible to implement Douglas’ proposals rather than to show that a particular method is the only way. We advocate these methods because they seem to be the most practical and the least confusing. The methods proposed make use of the existing financial system, but free it from the defects that stop it from serving human needs.

Read the leaflet online or download it

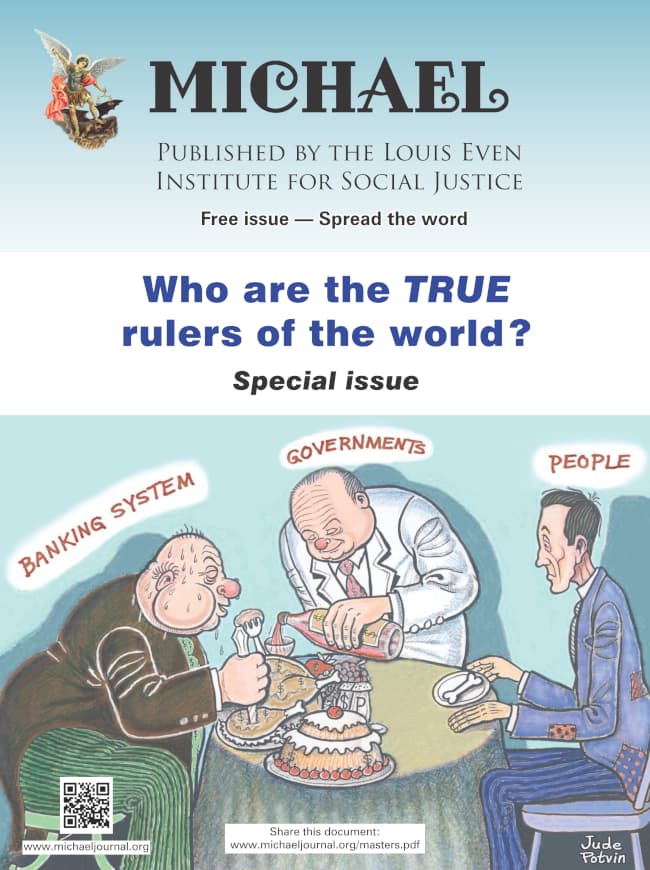

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

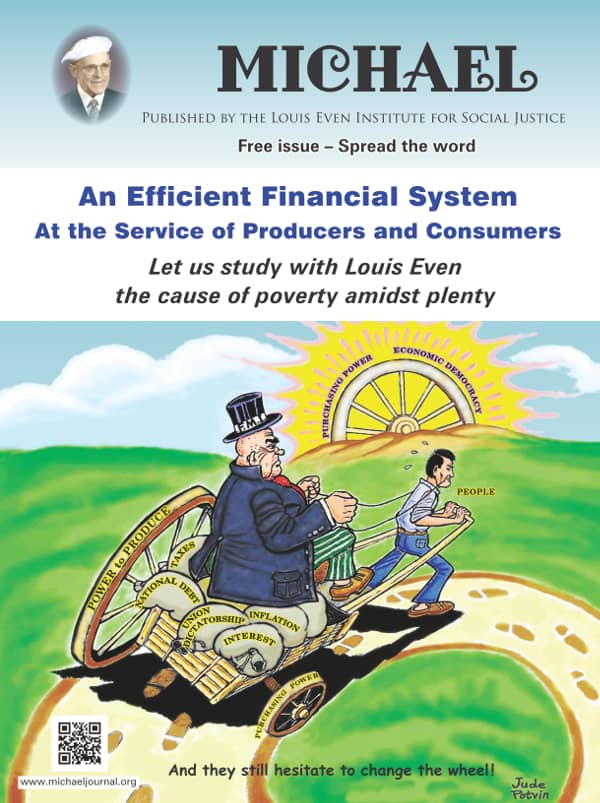

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

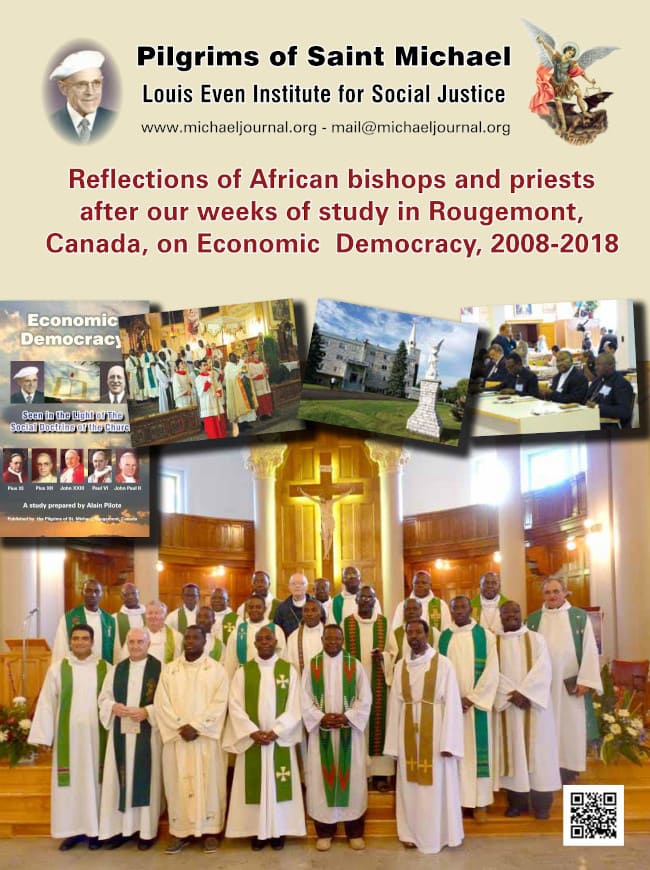

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

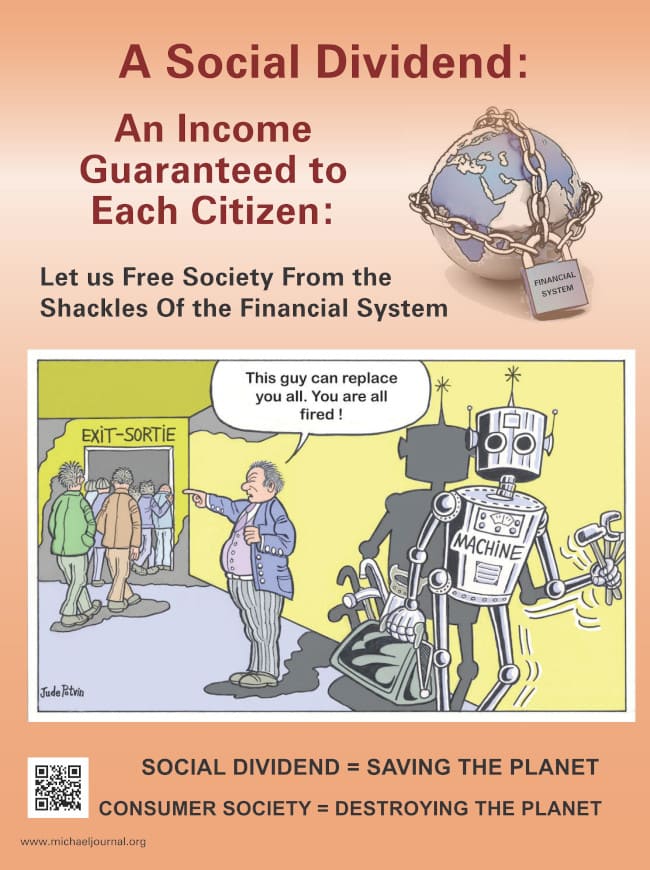

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.