Society Must Create its Own Money

|

The regular readers of the "Michael" Journal will have noticed that the first claim made by the Social Crediters of the "Michael" Journal, is that the Federal Government, the official representative of society, must take back its power to create money. Once this is done, it will then be possible to implement the other two principles of Social Credit: a monthly dividend to each citizen and a discount on retail prices, to prevent inflation. However, for the new readers, this claim may give rise to a few questions. We will mention here the most frequent ones and give them short answers.

Answers to a few questions

Question: You say that the Government must create the Country's money. Does it not already do so, with the Bank of Canada notes?

Answer: If the Federal Government creates its own money, why is it over $640 billion in debt? The truth is that bank notes and coins come into circulation only when they are lent by private banks, at interest. Moreover, this kind of money (cash) represents less than ten per cent of the money supply in our country. The other kind of money, which represents over 90 per cent of the money supply, is digital or checkbook money, that is to say, figures written on checks or bank accounts.

Question: Why do you want the Government to create money? Isn't the banks' money good enough?

Answer: Chartered banks issue money at interest, in the form of a debt, which creates unpayable debts. For example, let us suppose that the bank lends you $100, at 6 per cent interest. The bank creates $100, but wants you to pay back $106. You can pay back $100, but not $106; the $6 in interest does not exist, since only the bank has the right to create money, and it created $100, not $106.

In fact, when a bank lends you money, it asks you to pay back money that does not exist. The only way to pay back $106, when there is only $100 in existence, is to borrow this $6, also from the bank. And your problem is not solved. It has only gotten worse: You now owe the bank $106, at 6 per cent interest, that is, $112.36. As the years pass, so grows your debt. There is no way to escape this.

Some borrowers, taken individually, can manage to pay back their loans in full — principal and interest — but all the borrowers, taken as a whole, cannot. If some borrowers manage to pay back $106 after having received only $100, it is because they obtain the $6, which is missing, from the money that was put into circulation through the money that was loaned to other borrowers. If some are to succeed in paying back their loans, others must go bankrupt. And it is only a matter of time until all the borrowers, without exception, find it impossible to pay back the banker, whatever the rate of interest on their loans.

It could be said that the best way not to go into debt is not to borrow. But, if no one borrowed money from the banks, there would be no money in circulation. And this money borrowed from the bank cannot remain in circulation indefinitely: It must be returned to the bank when the loan is due... together with the interest, of course.

Unpayable debts

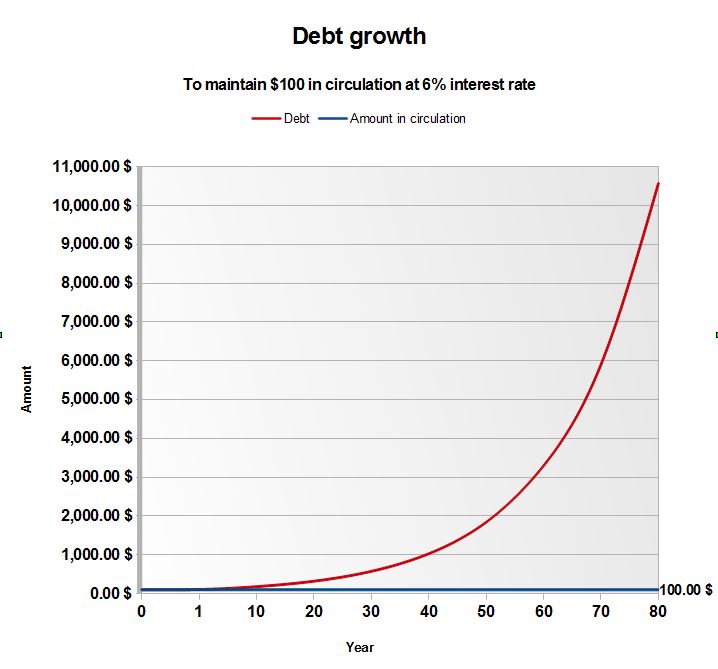

In order to maintain a set amount of money in circulation, year after year, unpayable debts must be incurred. For example, if one wants to maintain $100 in circulation by borrowing at 6% interest, the debt will be $106 after one year, then $112.36 after two years ($106 at 6% interest) and so on. After 70 years, the debt will have reached the sum of $5,907.59 and there will still be only $100 in circulation.

$100 debt growth at 6% interest |

||||

| Year | Original borrowed capital | Debt at year end* | Interest due at year end | Money in circulation |

| 1 | $100 | $106.00 | $6.00 | $100 |

| 2 | $100 | $112.35 | $6.36 | $100 |

| 3 | " | $119.10 | $6.74 | " |

| 4 | " | $126.25 | $7.15 | " |

| 5 | " | $133.82 | $7.57 | " |

| 10 | " | $179.08 | $10.14 | " |

| 20 | " | $320.71 | $18.15 | " |

| 30 | " | $574.35 | $32.51 | " |

| 40 | " | $1,028.57 | $58.22 | " |

| 50 | " | $1,842.02 | $104.26 | " |

| 60 | $100 | $3,298.77 | $186.72 | $100 |

| 70 | $100 | $5,907.59 | $334.39 | $100 |

| * includes interest due | ||||

In the case of public debts, the bankers are satisfied with only the interest on the debt being paid. Are they doing us a favor? No, it only delays the financial impasse by a few years: After a while, even the interest on the debt becomes unpayable. In the case of the $100 borrowed at 6%, the interest owed on the debt will reach $104.26 after a lapse of 50 years, which is more than the $100 in circulation.

It is no wonder that the national debts of civilized countries should reach astronomical proportions. For example, Canada’s national debt, which was $24 billion in 1975, is now over $640 billion, in 2017 (1). So as to satisfy the bankers, the Government must slash all of its other expenditures, except for the servicing of the debt. Will the Government wait until 100% of all taxes are needed to service the debt before changing the system, or would it rather let the people starve?

The national debt is only the tip of the iceberg: there are also provincial, municipal, corporate and private debts!

The Government has the power

Question: Does the Government have the power to create money? Would this money be as good as that of the banks?

Answer: The Government has indeed the power to do so, since it is the Federal Government that gave the chartered banks this power. That the Government should refuse to itself a privilege it has granted to the banks, is pure idiocy! The first duty of any sovereign government is to issue its own currency. Today, all countries have unjustly handed over this power to private corporations, the chartered banks. Great Britain was the first nation to do so, back in 1694. In both Canada and the United States, the right to create money was forsaken in 1913.

It is not the banker who gives money its value. Money draws its value from the country’s production. Bankers produce absolutely nothing; they only create the figures that allow the nation to make use of its own production capacity, of its own wealth. Without the production made by the citizens of a country, the bankers’ figures are worthless. The Government can create these figures, which represent society’s production, just as banks do, without resorting to the banks and without going into debt. Why should a government pay interest to private banks for the use of money it owns, money that it could itself issue, without going through the banks, without interest, without debt?

Graham Towers, Governor of the Bank of Canada from 1935 to 1954, upon testifying before the House of Commons Standing Committee on Banking and Commerce, in the spring of 1939 (2), was asked the question:

"Will you tell me why a government with power to create money should give that power away to a private monopoly and then borrow that which parliament can create itself back at interest to the point of national bankruptcy?"

Towers answered: "If parliament wants to change the form of operating the banking system, then certainly that is within the power of parliament."

As a matter of fact, the power of the Federal Government to create the money of our country is clearly stated in the Constitution (Section 91 of the British North America Act, paragraphs 14 through 20).

No danger of inflation

Question: Might the Government misuse this power and issue too much money, which would result in runaway inflation? Is it not preferable to leave this power to the bankers, in order to shield it from the whims of politicians?

Answer: The money issued by Government would be no more inflationary than the money created by the banks: it would be the same figures, based on the country’s same production. The only difference is that the Government would not have to go into debt, nor to pay interest, in order to obtain these figures.

On the contrary, the first cause of inflation is precisely the money that is created as a debt by the banks: inflation means that prices are increasing. The obligation, laid upon corporations and governments, to bring back to the banks more money than the banks have created, forces corporations to increase their prices and governments to increase their taxes.

How does the Bank of Canada fight inflation? Precisely by raising interest rates, the same interest that causes inflation! The Premiers of several provinces have likened this to “extinguishing a fire by throwing gas at it”.

Of course, should the Canadian Government decide to create or print money any which way, without any limits, according to the whims of the men in office, and out of relation to products that exist, there would be inflation and money would lose its value. But this is not what Social Crediters are promoting.

Accurate bookkeeping

What the Social Crediters advocate, when they speak of money being created by society, is that money be brought back to its proper function, which is of being a figure that represents products; this is in fact nothing more than simple bookkeeping. And since money is nothing but a bookkeeping system, all that needs to be done is to establish accurate bookkeeping:

The Government would appoint a commission of accountants, an independent organism called the "National Credit Office" (in Canada, the Bank of Canada could play this role if it were ordered to do so by the Government). This National Credit Office would be given the task to establish accurate accounting, where money would be nothing but the reflection, the exact financial expression of economic realities: production would be expressed as assets and consumption as liabilities. Since one cannot consume more than has been produced, the liabilities could never exceed the assets. Deficits and debts would no longer be possible.

In practice, this is how it would work: New money would be issued by the National Credit Office as new products are made and it would be withdrawn from circulation as these products are consumed (purchased). (Louis Even’s booklet, A Sound and Efficient Financial System, explains this mechanism in detail.) The possibility of there being more money than products would disappear: A constant equilibrium would be maintained between money and products; money would keep its same value; inflation would no longer be possible.

Money would not be issued according to the whims of Government or of the accountants, since the commission of accountants of the National Credit Office would only act according to facts; according to what Canadians have produced and what they have consumed. The volume of money in circulation would not be dictated by the Government or party in office; money would be issued in keeping with the statistics of production and consumption, the result of the free activities of producers and consumers.

|

|

|

“Bank notes and coins come into circulation only when they are lent by private banks, at interest.” |

The best way to prevent prices from going up, is to lower them. Social Credit also provides a mechanism that lowers retail prices, called the "compensated discount". This discount on retail prices would allow consumers to purchase all of the products that are available for sale, and to do so with the money they have at their disposal. The lowering of retail prices (a discount) by a measured percentage, would allow the means of payment in the hands of consumers to be equal to the prices that are attached to products. The discount would later be refunded to the retailers by the National Credit Office.

No more financial problems

If the Government issued its own money, in accordance to the needs of society, it would then be able to finance the country’s production debt-free. It would no longer have to borrow money from foreign or domestic institutions. The only taxes collected from the people would be used to pay for the services they receive. Public developments would only be paid for once, after interests had become a thing of the past.

Upon discussing a new project, Governments would no longer ask: "Do we have the money?" but instead, they would ask: "Do we have the materials and the workers?" If such is the case, new money would be issued to finance this new production. People could then live according to their true means, their physical means, according to their production capacity. All that is physically possible would be made financially possible. Financial problems would disappear. The only limit remaining would be the nation’s productive capacity. Governments could finance all the developments and social programs requested by the population, so long as they are physically feasible.

The education of the people

Question: If all that you have said above is true; that a social money system, whereby money is created by a public organism on behalf of society, is so beneficial, why is it that the Government does not implement it right away?

Answer: Constitutionally speaking, there is nothing that prevents the Government from doing so immediately, since it already has the right to issue its own currency. It is the nation’s sovereign government that must be responsible for the country’s monetary policy, and not private corporations whose objective is, in no way the pursuit of the common good, but their own profit. On July 21, 1961, Louis Rasminski, who was Governor of the Bank of Canada from 1961 to 1973, wrote what follows to the Government:

"If the Government disapproves of the monetary policy being carried out by the Bank (of Canada), it has the right and the responsibility to direct the Bank as to the policy which the Bank is to carry out... and the Bank should have the duty to comply with these instructions."

Governments, despite their often idiotic statements, are perfectly aware of the iniquity by which private companies are allowed to create money, but they dare not challenge this power, for want of support by the population.

The only thing that is missing is the education of the people, to show them the falseness, the absurdity, the injustice of the present financial system and the existence of a remedy such as Social Credit. The "Michael" Journal stands alone in denouncing the present system and in offering the Social Credit solution. The population must therefore study the "Michael" Journal. To that end, everyone must become a subscriber to the “Michael” Journal and ask friends and relatives to do likewise.

- See debtclock.ca

- Minutes of The Proceedings and Evidence Respecting the Bank of Canada, Committee on Banking and Commerce, 1939, page 394.